The Avison Young Greenville office provides commercial real estate services to property owners, investors and occupiers

The experienced team of commercial real estate advisors that make up Avison Young Greenville are here to meet your company’s real estate needs, regardless of your business line. We offer a full suite of CRE services in all major industry sectors – office, industrial, retail, mixed-use, development, and investment – ensuring that your specific real estate requirements are expertly managed.

Avison Young is a global real estate advisor built to create real economic, social, and environmental value, powered by – and for, people. We believe there is a vital role for our sector in creating healthy, productive workplaces for employees; cities that are centers of prosperity for its citizens and; built spaces and places that create a net benefit to the economy, the environment and the community. Our people organize around our clients’ opportunities and work as colleagues to focus on their success.

Greenville commercial real estate services

Avison Young’s brokerage team in Greenville has consistently completed major leasing and investment sales transactions across all asset types. We’ve worked on the behalf of tenants, landlords, investors, vendors and buyers alike, including many large national and international corporate clients.

Whether you are an owner, investor, occupier or developer, we deliver results aligned with your strategic business objectives. Our Greenville commercial real estate advisors are here to support your initiatives, add value, and build a competitive advantage for your organization.

Find Greenville properties for sale or lease

Search Avison Young’s Greenville commercial real estate listings for sale and lease to find the right commercial property for you. Our investment and leasing opportunities include office, industrial, warehouse, retail, multifamily and hospitality properties. We also offer specialized spaces for healthcare, automotive, self-storage and more.

Greenville commercial real estate news

-

Ashley Jackrel named REALTOR® of the YearApril 24, 2024

Ashley Jackrel named REALTOR® of the YearApril 24, 2024 -

Avison Young celebrates Women of Influence, class of 2024April 18, 2024

Avison Young celebrates Women of Influence, class of 2024April 18, 2024 -

.jpg/ef28df96-d38d-5ba8-8fcb-5a9aa6753ebf?t=1713375377600) Avison Young announces $44.5 million sale of Natomas Corporate Center, a Class A Office Property in SacramentoApril 17, 2024

Avison Young announces $44.5 million sale of Natomas Corporate Center, a Class A Office Property in SacramentoApril 17, 2024 -

Avison Young taps Lisa Jesmer as Florida Market LeaderApril 1, 2024

Avison Young taps Lisa Jesmer as Florida Market LeaderApril 1, 2024

Greenville commercial real estate case studies

-

Industrial Building

2605 Anderson Road, Greenville, SC+/- 108,750 sf (leased during the pandemic)

Industrial

Hudson Valley Management -

Multifamily building

40 Bee Street, Charleston, SC 29403+/- 59,903 sf, 64 units

Multi-family

The Fisher Companies -

Industrial Redevelopment

17 Haywood Drive, Greenville, SC100,000 sf

Industrial Redevelopment

Advanced Automation, Inc. (Doerfer Corporation) and Professional Party Rentals -

Industrial Redevelopment

4900 Prospectus Drive, Durham, NC125,000 sf

Capital Markets

Harrod Construction, Kestrel Heights Charter Elementary School and Kestrel Heights Charter

Greenville commercial real estate insights

The Greenville/Spartanburg office and industrial markets continue to experience major growth as companies relocate to the Upstate from all over the globe because of its central location relative to Charlotte, Atlanta, and the Charleston port.

View Greenville office market report (Q1 2024)

View Industrial submarket trends for S. Greenville County (Q4 2023)

View Upstate investment market report

-

.png/b181efb6-6bce-52a3-aee5-12bd70caee55?t=1707939412100) Downtown Greenville’s visitation increases 70% over past three years

Downtown Greenville’s visitation increases 70% over past three years -

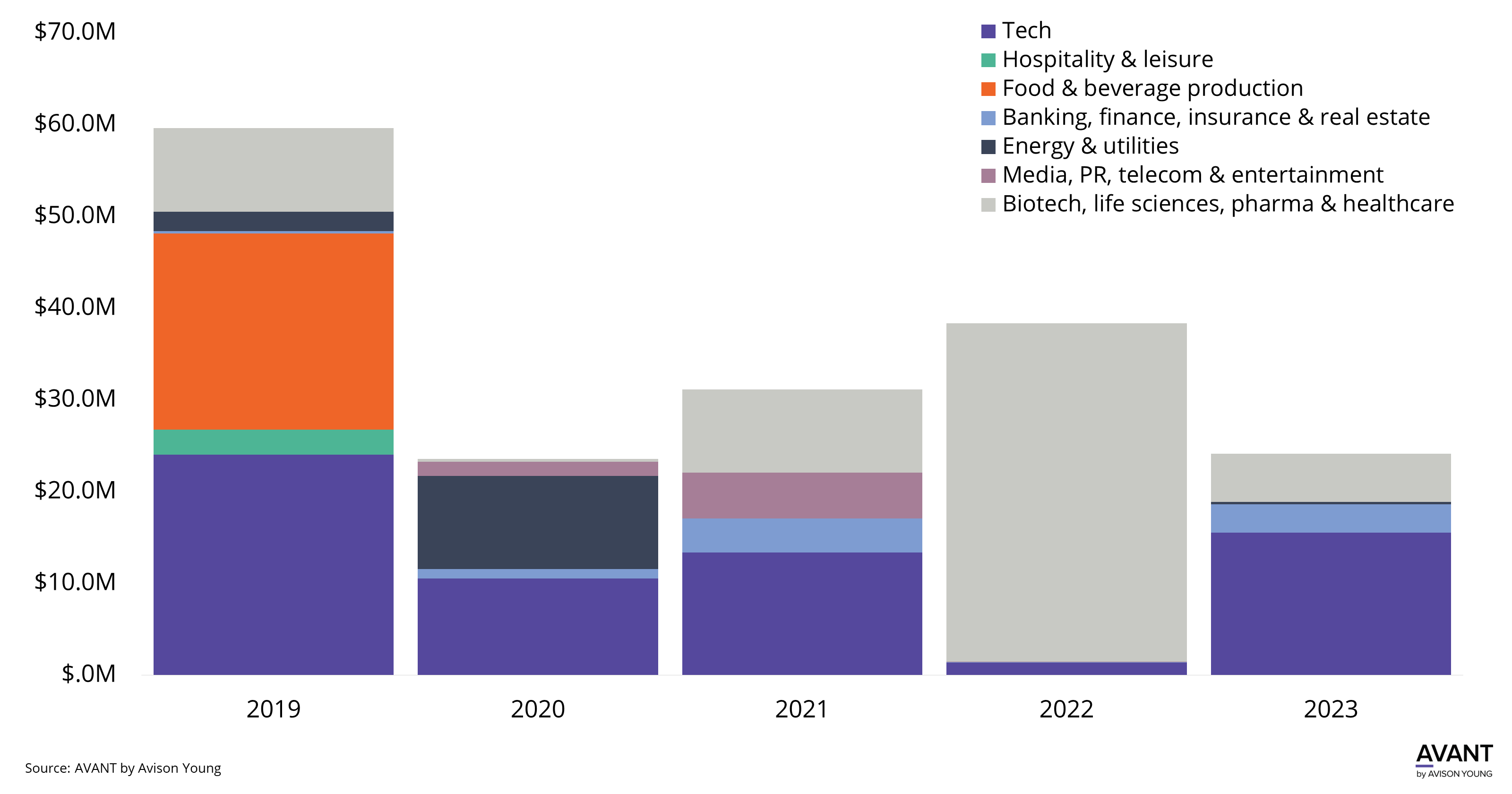

Tech industry gaining investor interest in the South Carolina Upstate, surpassing biotech and life sciences

Tech industry gaining investor interest in the South Carolina Upstate, surpassing biotech and life sciences -

Ports across the state expected to positively affect Greenville’s industrial sectors in 2024

Ports across the state expected to positively affect Greenville’s industrial sectors in 2024 -

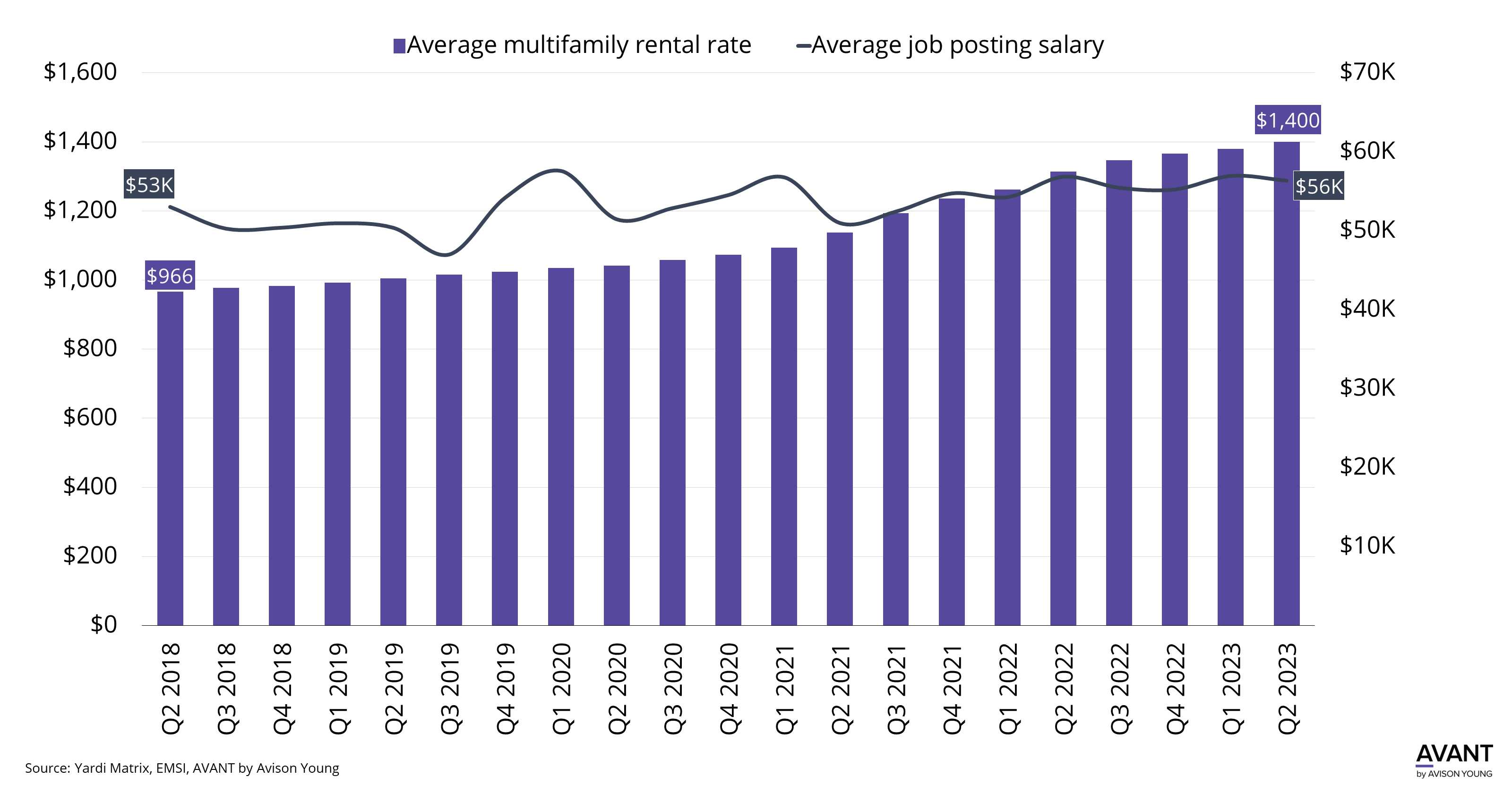

Greenville's rising multifamily rental rates outpace salary growth

Greenville's rising multifamily rental rates outpace salary growth

Greenville commercial real estate consultants

Greenville office

Contact a commercial real estate advisor in Greenville

Our commercial real estate brokers and advisors leverage data-driven intelligence paired with deep Greenville knowledge. Connect with us to discuss how we can help you drive more value from your assets.