We provide commercial real estate services including leasing, investment sales, project management and property management in Charleston

Avison Young’s Charleston office has become one of the area’s premier client-focused, full-service providers of commercial real estate. Our experienced team of commercial real estate advisors cover all major industry sectors, including office, industrial, retail, mixed-use, development, and investment. In utilizing our company’s no-silo approach to partnership, we provide reliable, efficient services for owners and investors alike, as well as for users and occupants.

Avison Young is grounded on a unique foundation of partnership. Our Principals are both the owners and configure and re-shape our team and expertise around your business demands, ensuring that your commercial real estate needs will always be met.

Our services include:

Charleston commercial real estate services

Avison Young’s brokerage team in Charleston has consistently completed major leasing and investment sales transactions across all asset types. We’ve worked on the behalf of tenants, landlords, investors, vendors and buyers alike, including many large national and international corporate clients.

Whether you are an owner, investor, occupier or developer, we deliver results aligned with your strategic business objectives. Our Charleston commercial real estate advisors are here to support your initiatives, add value, and build a competitive advantage for your organization.

Find Charleston properties for sale or lease

Search Avison Young’s Charleston commercial real estate listings for sale and lease to find the right commercial property for you. Our investment and leasing opportunities include office, industrial, warehouse, retail, multifamily and hospitality properties. We also offer specialized spaces for healthcare, automotive, self-storage and more.

Charleston commercial real estate news

-

Avison Young tapped to market mixed-use trophy property in historic Charleston, SCFebruary 5, 2024

Avison Young tapped to market mixed-use trophy property in historic Charleston, SCFebruary 5, 2024 -

Avison Young represents Charleston-based LSV manufacturer in market expansion into the MidwestJanuary 24, 2024

Avison Young represents Charleston-based LSV manufacturer in market expansion into the MidwestJanuary 24, 2024 -

.jpg/bc914a9d-0fcf-936d-2313-90d8bd454fee?t=1704297666562) Chase Gray joins Avison Young as Associate in CharlestonJanuary 3, 2024

Chase Gray joins Avison Young as Associate in CharlestonJanuary 3, 2024 -

.jpg/c2d6999f-42b6-0ed6-d984-66f15aa7aede?t=1704163159242) Ashley Jackrel, Michael Bone, promoted to Senior Vice PresidentJanuary 2, 2024

Ashley Jackrel, Michael Bone, promoted to Senior Vice PresidentJanuary 2, 2024

Charleston commercial real estate insights

Workers returning to the office, new companies relocating to the area, and additional market dynamics show a promising future for the Charleston office, multifamily, and industrial markets.

View Charleston office market report (Q1 2024)

View Charleston industrial market report (Q1 2024)

View Charleston multifamily market report (Q4 2023)

-

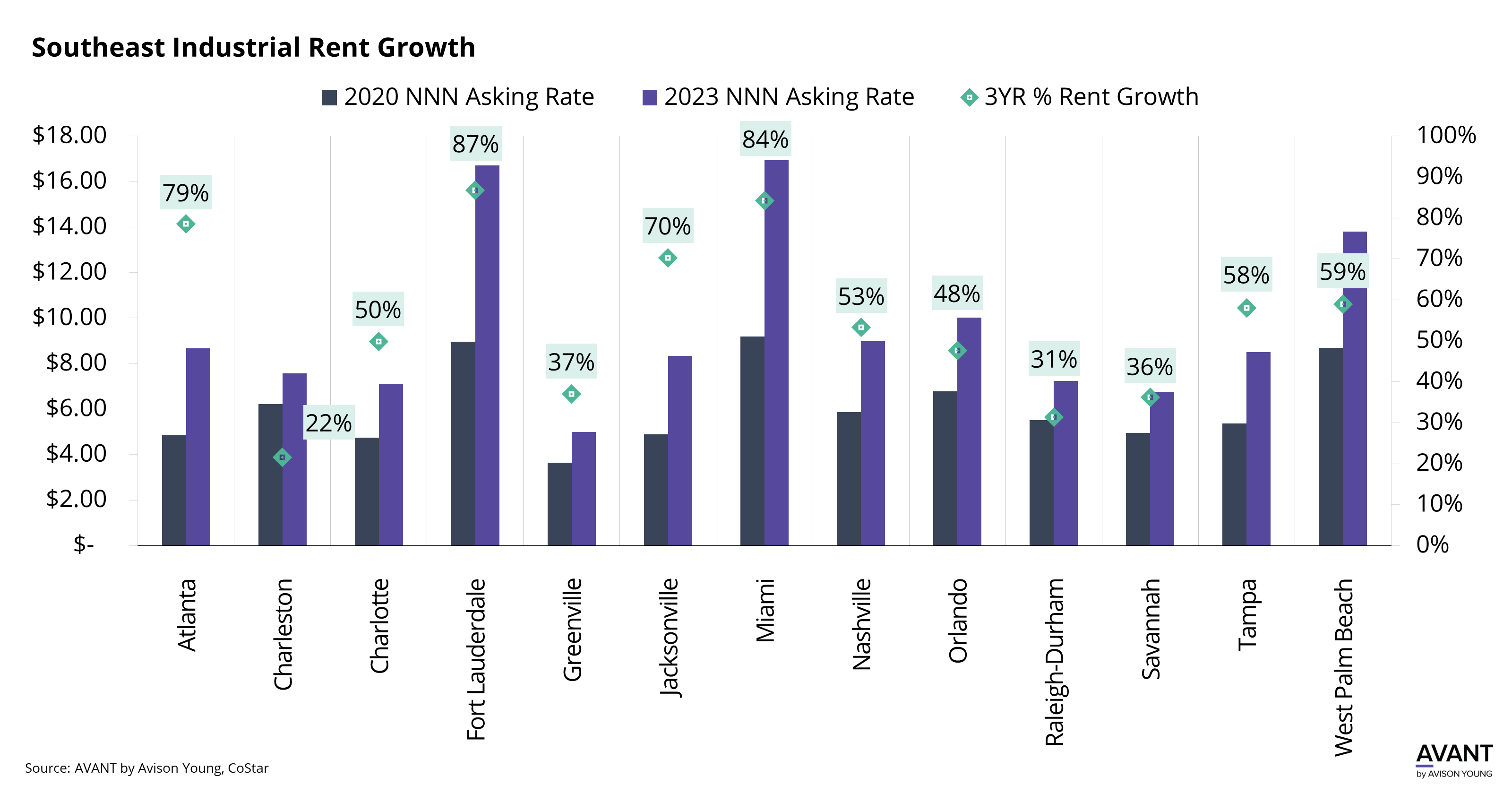

Is Charleston the most affordable industrial market in the Southeast?

Is Charleston the most affordable industrial market in the Southeast? -

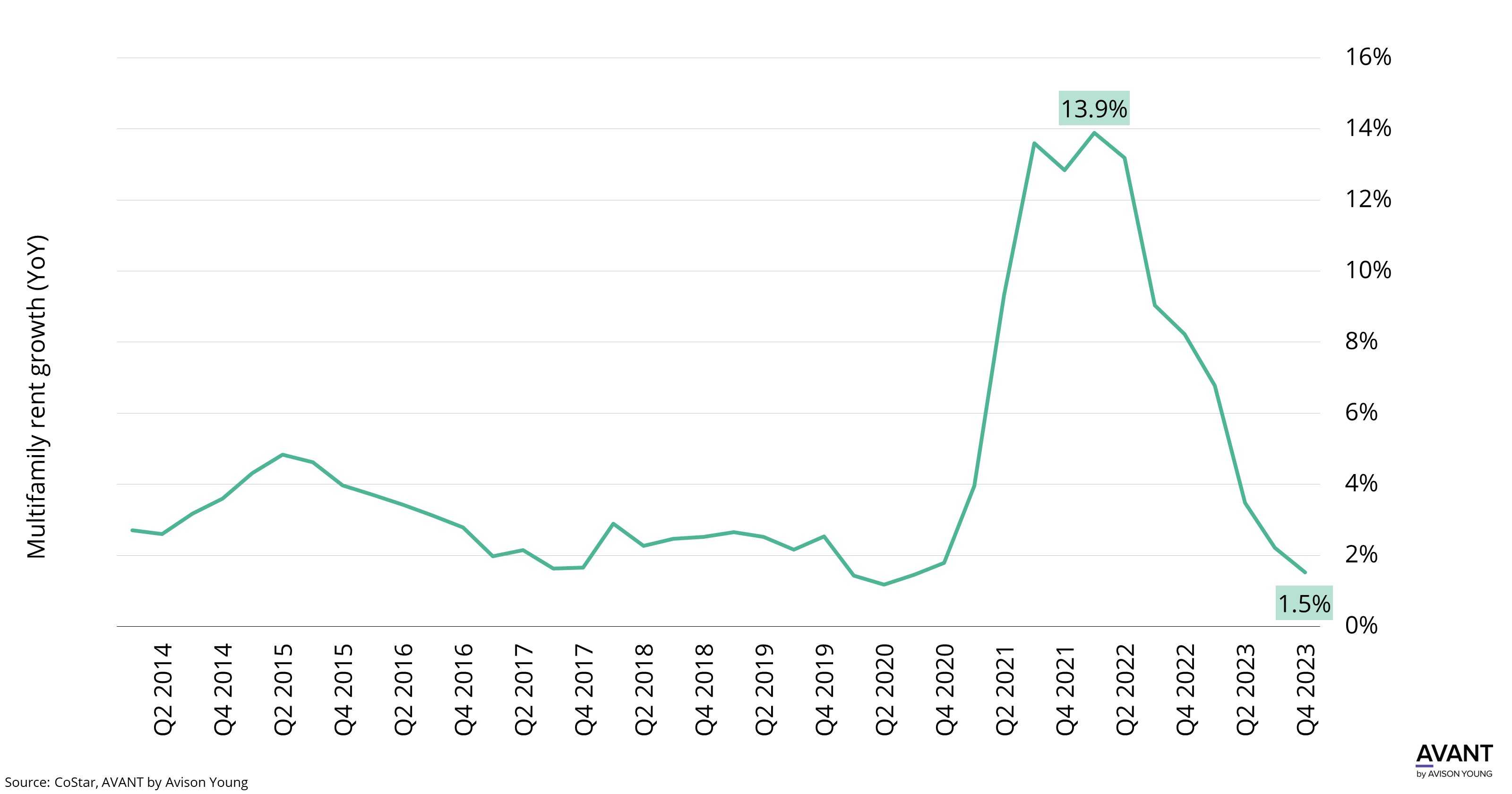

Is there relief in sight for Charleston’s multifamily occupiers?

Is there relief in sight for Charleston’s multifamily occupiers? -

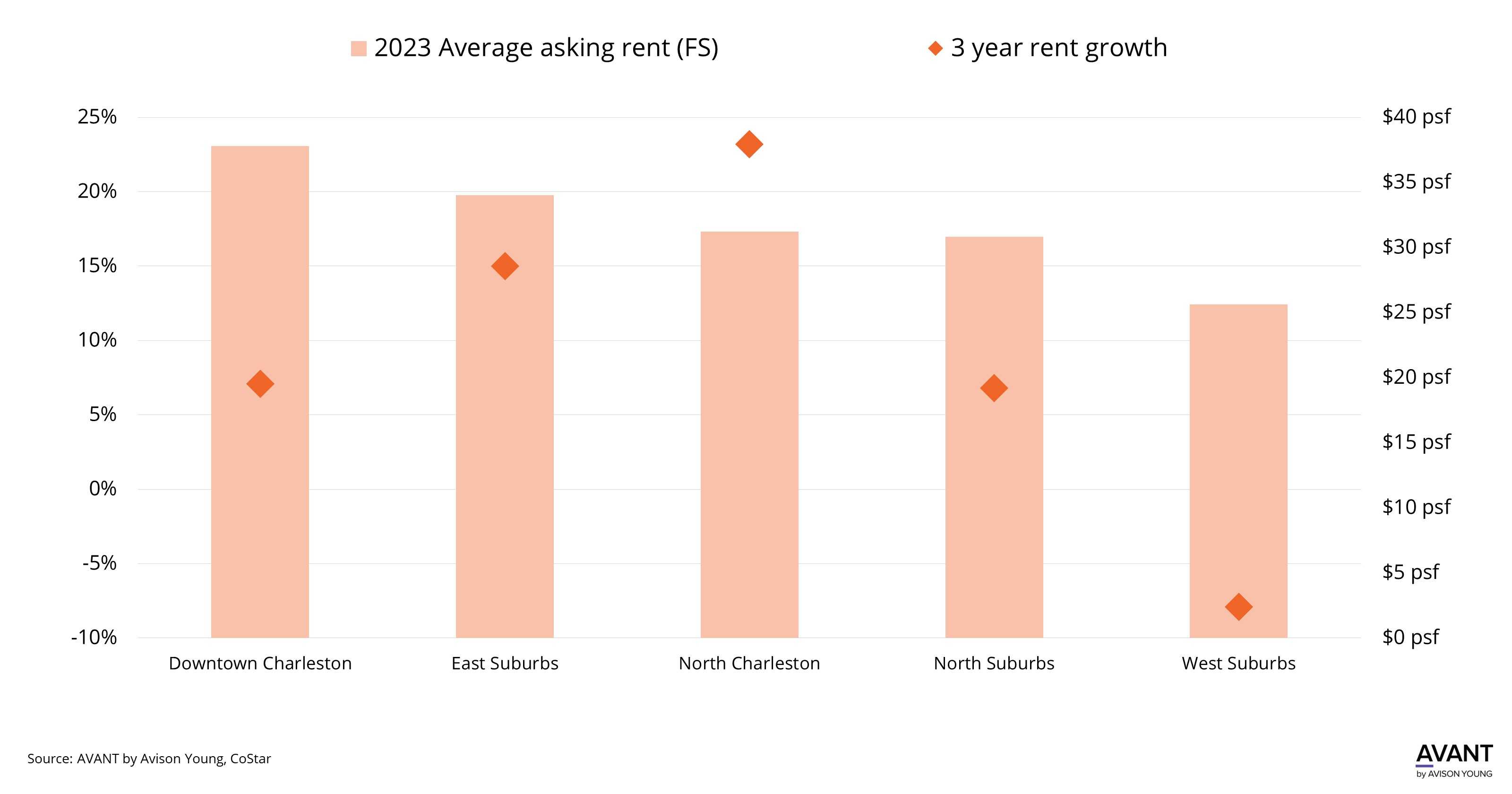

North Charleston office submarket shows promising growth for 2024

North Charleston office submarket shows promising growth for 2024 -

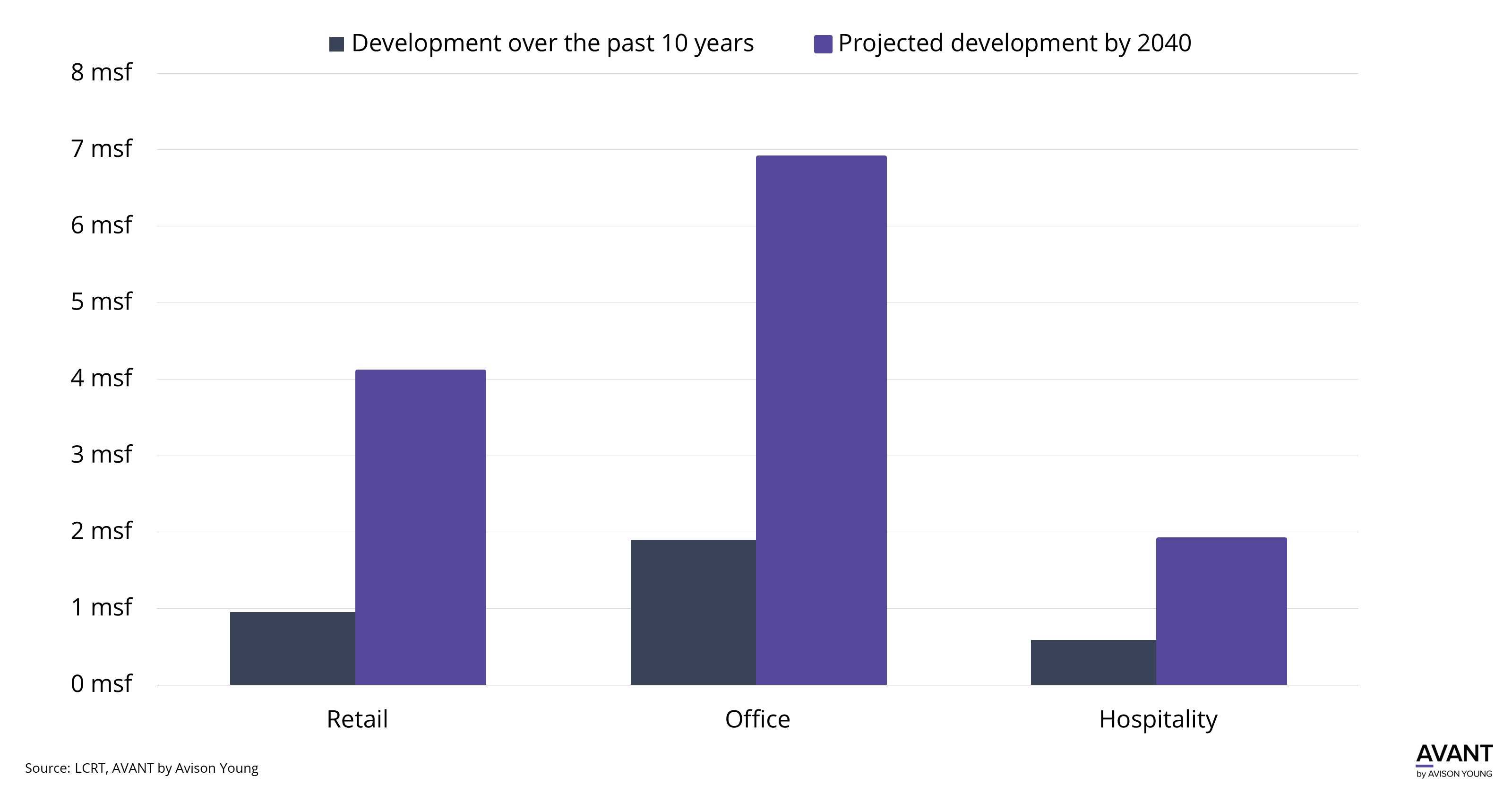

Lowcountry Rapid Transit projected to increase commercial development - approximately 13 msf of new retail, office and hospitality spaces expected

Lowcountry Rapid Transit projected to increase commercial development - approximately 13 msf of new retail, office and hospitality spaces expected

Charleston commercial real estate consultants

Contact a commercial real estate advisor in Charleston

Our commercial real estate brokers and advisors leverage data-driven intelligence paired with deep Charleston knowledge. Connect with us to discuss how we can help you drive more value from your assets.