We provide commercial real estate services including leasing, sales, project management, construction management and valuation in Northern and Central New Jersey

Avison Young New Jersey offers a full suite of commercial real estate services to best meet the needs of our clients in and around the greater area. As one of the premier CRE firms in the area, Avison Young has commercial real estate advisors located in Morristown and Iselin. Our mix of around-the-corner knowledge and multinational expertise allows us the ability to provide you with top-tier, uniquely personal service regardless of your market or location.

Avison Young is a global real estate advisor built to create real economic, social, and environmental value, powered by – and for, people. We believe there is a vital role for our sector in creating healthy, productive workplaces for employees; cities that are centers of prosperity for its citizens and; built spaces and places that create a net benefit to the economy, the environment and the community. Our people organize around our clients’ opportunities and work as colleagues to focus on their success.

New Jersey commercial real estate services

Avison Young’s brokerage team in New Jersey has consistently completed major leasing and sales transactions across all asset types. We’ve worked on the behalf of tenants, landlords, investors, vendors and buyers alike, including many large national and international corporate clients.

Whether you are an owner, investor, occupier or developer, we deliver results aligned with your strategic business objectives. Our New Jersey commercial real estate advisors are here to support your initiatives, add value, and build a competitive advantage for your organization.

Find New Jersey properties for sale or lease

Search Avison Young’s New Jersey commercial real estate listings for sale and lease to find the right commercial property for you. Our investment and leasing opportunities include office, industrial, warehouse, retail, multifamily and hospitality properties. We also offer specialized spaces for healthcare, automotive, self-storage and more.

New Jersey commercial real estate news

-

Avison Young arranges industrial sale in Newark for The Commencement GroupApril 17, 2024

Avison Young arranges industrial sale in Newark for The Commencement GroupApril 17, 2024 -

.jpeg/114fee4e-754d-0381-fb71-eea81c645f8b?t=1712774996910) Avison Young arranges industrial property lease for Kamps Pallets in North Brunswick, NJApril 10, 2024

Avison Young arranges industrial property lease for Kamps Pallets in North Brunswick, NJApril 10, 2024 -

Avison Young arranges full-building lease for Velocity MedTech in Totowa, NJJanuary 30, 2024

Avison Young arranges full-building lease for Velocity MedTech in Totowa, NJJanuary 30, 2024 -

Avison Young brings 132,930-sf industrial property to full occupancyJanuary 24, 2024

Avison Young brings 132,930-sf industrial property to full occupancyJanuary 24, 2024

New Jersey commercial real estate insights

Reopening efforts, higher vaccination rates, and additional market dynamics show a promising future for the New Jersey office and industrial market.

-

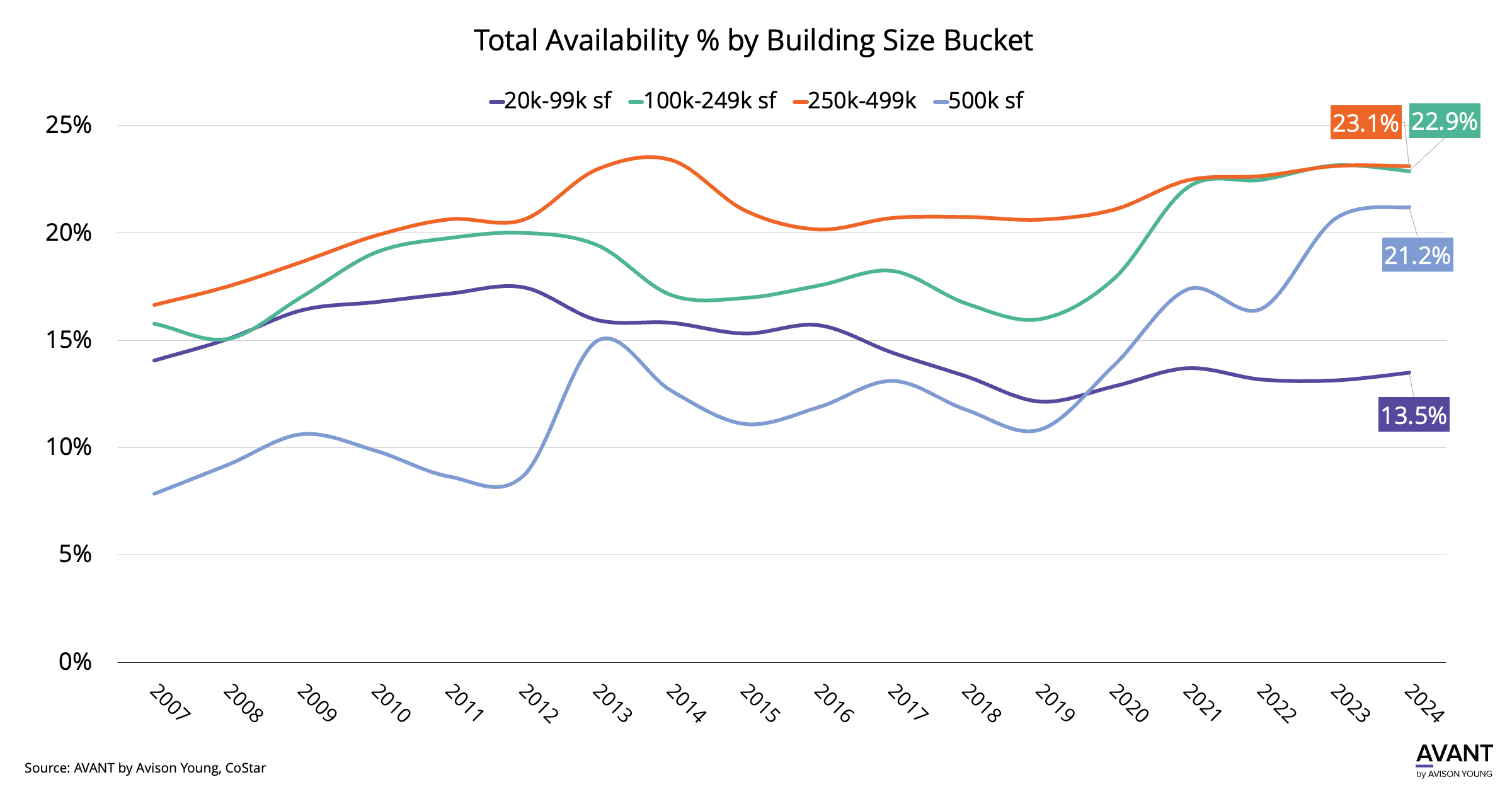

New Jersey office occupiers continue to seek smaller footprints

New Jersey office occupiers continue to seek smaller footprints -

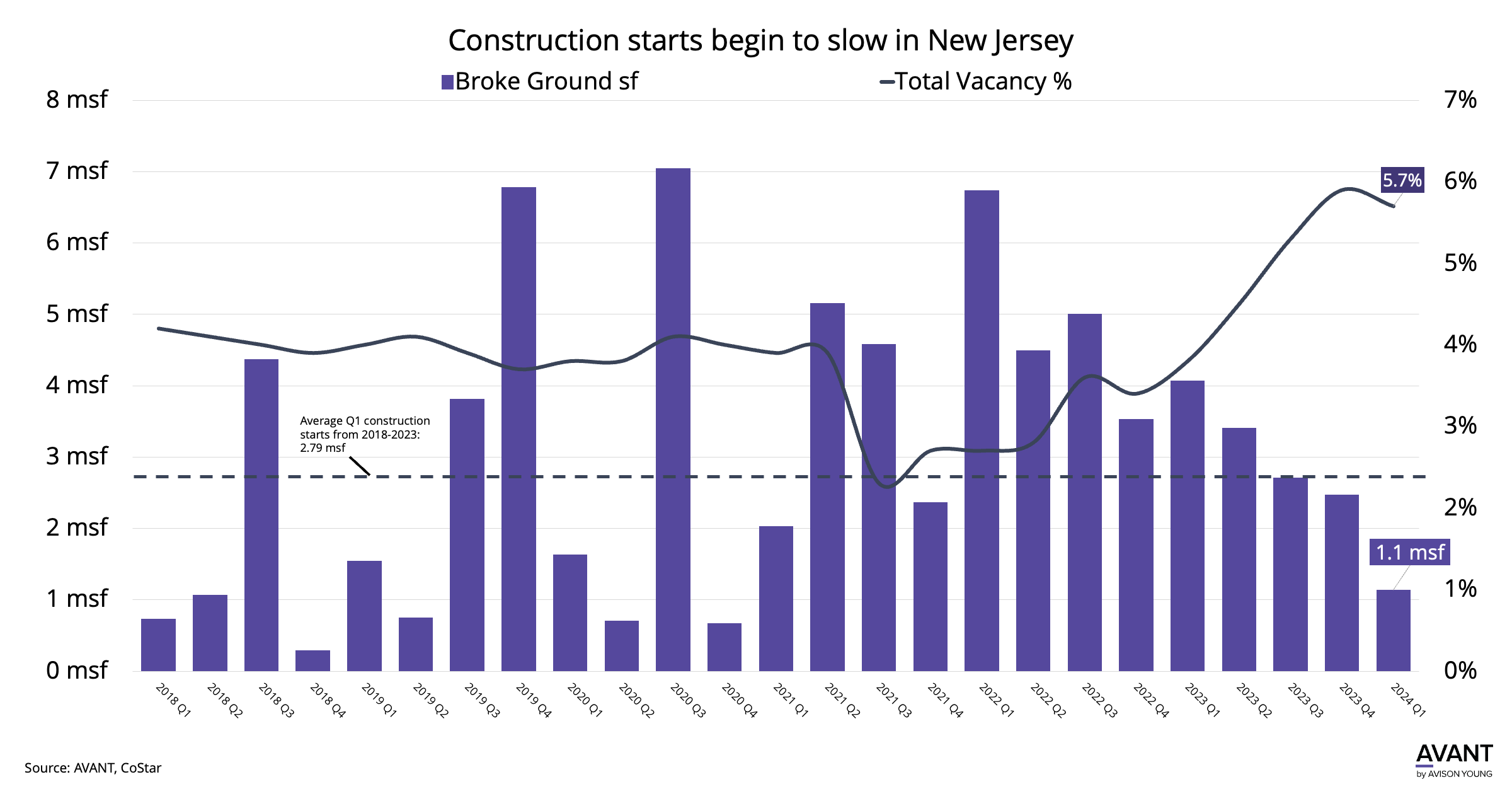

New Jersey industrial construction starts grind to a near halt

New Jersey industrial construction starts grind to a near halt -

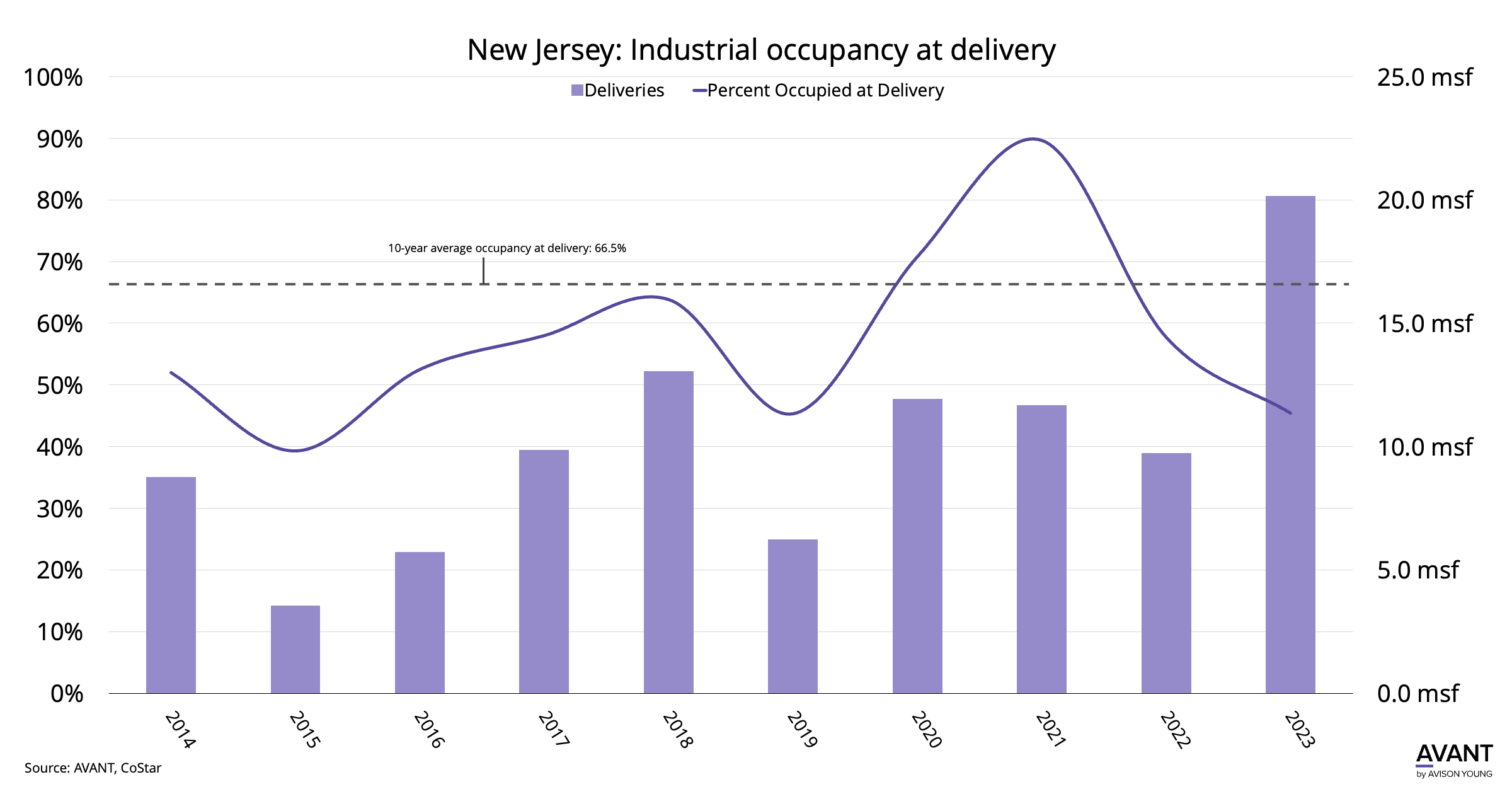

In 2023, preleasing activity in the New Jersey industrial market experienced a decline

In 2023, preleasing activity in the New Jersey industrial market experienced a decline -

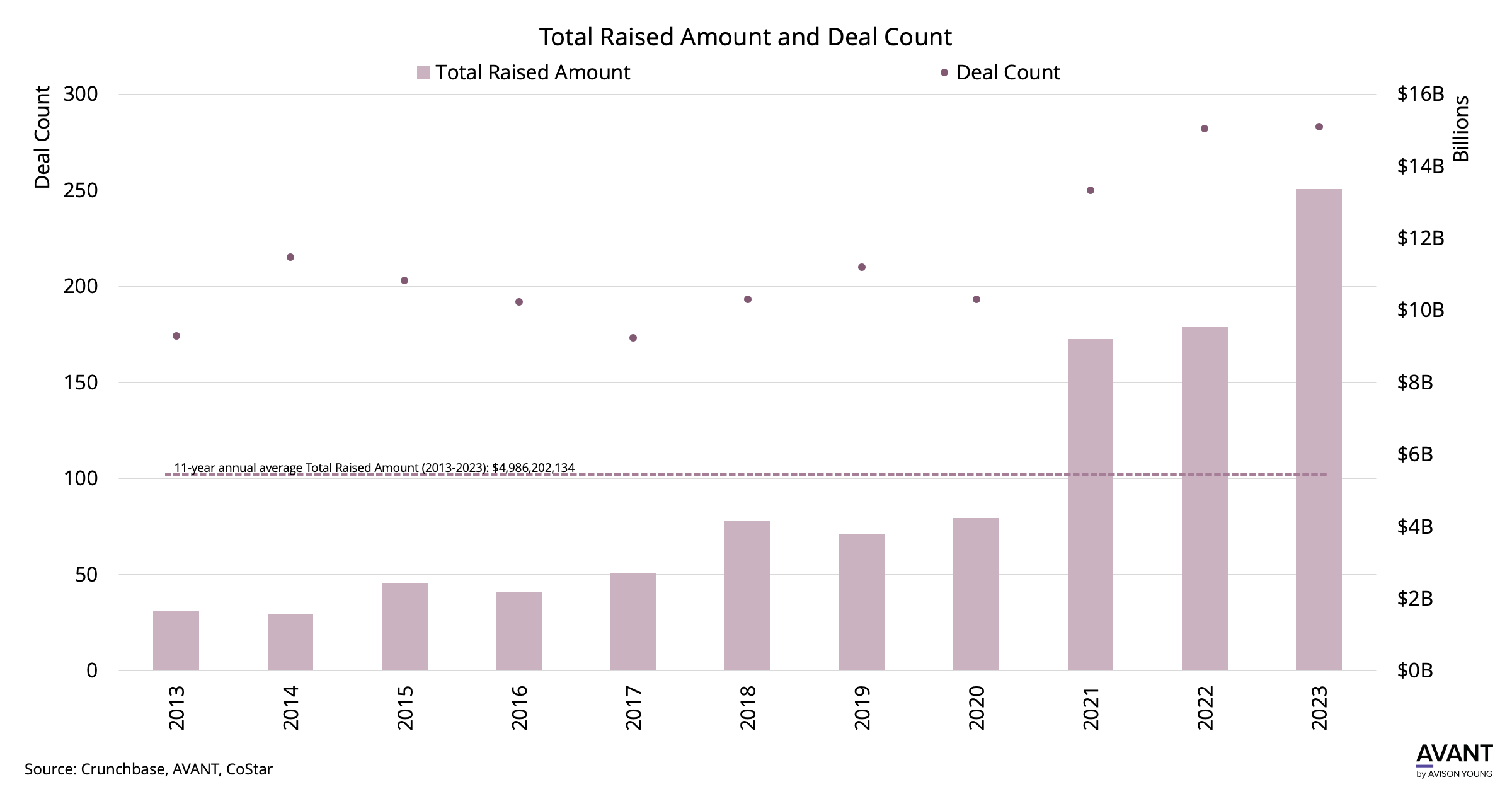

New Jersey witnesses a 30% surge in venture capital and private equity funding in 2023

New Jersey witnesses a 30% surge in venture capital and private equity funding in 2023

New Jersey commercial real estate consultants

Morristown

Contact a commercial real estate advisor in New Jersey

Our commercial real estate brokers and advisors leverage data-driven intelligence paired with deep New Jersey knowledge. Connect with us to discuss how we can help you drive more value from your assets.