Lighting up 2022 with continued positive prospects

The calendar may have changed, but industrial real estate investment fundamentals have not

As we move into the New Year, there is a tendency to focus on industry predictions for any signs of change in expectations for capital flow, pricing levels, cap rates and an assortment of other barometers. In our ongoing review of a variety of indicators, we recap what’s ahead for 2022. There is plenty of good news (with a few cautionary notes) to share.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Q4 recap and what’s ahead for 2022?

The last two years were ones for the record books, as the pandemic helped push e-commerce to new levels and added fuel to a massive and ongoing expansion in industrial leasing, construction and investment. A look at 2021 shows significant investment flow in the industrial sector as well as record levels of fundraising for commercial real estate overall. By all accounts, that strong activity is expected continue.

According to Preqin, private equity real estate investors raised a record $287.8 billion in 2021 for commercial property acquisitions. This is an 11% increase from 2020 and a 57% increase from 2019. Funds in the market are at record levels, totaling 1,284 and targeting $365 billion in capital as of the third quarter of 2021. A significant portion of the dry powder is likely to flow into the industrial sector, given investors’ voracious appetite for assets that are tied to e-commerce and modern bulk logistics facilities.

While it’s tempting to turn the calendar to a new year and question whether investors should adjust their strategies, an analysis of current market fundamentals and demand drivers points to that old adage of “lather, rinse and repeat.” The industrial sector has certainly been working very well over the past several years (with a few speed bumps!), and a look at investor sentiment and pipeline activity points to more of the same for 2022 and beyond.

Among the fundamentals shaping this outlook are tenant demand and rent growth, which remain robust. Developers continue to chase demand with new product and, despite disruption from supply constraints, labor issues and materials pricing, they are expected to deliver a massive amount of new space again in 2022. Delivery of new industrial product averaged more than 300 million square feet per year between 2018 and 2021 and there is an additional 300 million square feet of new product in the pipeline in major U.S. markets, according to Avison Young research. This activity will continue to grow in areas with large population centers and growing pools of new residents.

Private equity draws billions in dry powder

One factor highlighting investor confidence is the amount of capital flowing into the market. Pitchbook estimates that the dry powder earmarked for the commercial real estate industry has grown to more than $800 billion across U.S. private equity firms. In many instances, firms are bringing in more commitments than they can place. Among the notable fund raising reported in the fourth quarter of 2021 was Bain Capital Real Estate’s closing of a $3 billion fund (with a potential to reach $9 billion with leverage). The fund will invest in industrial, life sciences and other sectors.

A look at fundraising totals from Texas firms in the latter part of 2021 shows Crow Holdings closing its largest fund ($2.3 billion), having raised all of it during the pandemic. The fund is focused on industrial and multifamily investment and development. Sole Source Capital closed its second fund, which targets lower-middle market companies in the industrial sector, at $555 million. The fund was originally targeted to close with $400 million.

Some of the fundraising is focused on specialized sectors that have taken on more importance in recent years. Lineage Logistics announced a $1.7 billion equity raise to fuel supply chain innovation and growth. The commitment is seen as a strong sign for the industrial sector overall and particularly for the temperature-controlled warehouse sector. The funds will be used to strengthen the REIT’s balance sheet, support facility expansions, and fuel investments in leading technologies. This comes on the heels of the company’s recent expansion at the Port of Savannah, a key growth port in a high demand geographic area.

Investors are also busy putting these funds to work, as a few recent transactions highlight. KKR, for example, recently announced the acquisition of a 1.5 million-square-foot distribution campus in Allentown, PA from seller GLP Capital Partners. In New York, RXR Realty and LBA Logistics acquired more than 760,000 square feet of industrial space in Gowanus. The eight-building portfolio sold for $123 million and provides the firms with access to waterfront land in an active investment and development area of Brooklyn.

Supply chain outlook

A 2022 outlook story would not be complete without a look at how the supply chain is faring after two years of volatility due to pandemic-related factory closures, labor issues and other headwinds. Industrial real estate and logistics location strategy is of course interwoven and enmeshed in these trends. Of course, supply chain disruption has been well documented throughout the pandemic and continues to be on the radar for the industry as well as the general consumer.

There are several longer-term initiatives that will help reduce congestion over a multi-year spectrum, including the Biden administration’s Infrastructure Investments and Jobs Act that earmarked $17 billion for port infrastructure and modernization. There also are modernization programs underway at several ports around the country. In the short term, many businesses are taking steps to rethink their logistics and inventory management programs to help improve supply chain conditions. These efforts have created a greater need for “safety stock” that companies can have on hand in U.S. warehouses. These efforts to onshore additional goods should continue to support warehouse inventory growth into 2022.

Two years into the pandemic, the industrial sector continues to support strong tenant demand and solid investment returns. Capital flow is strong and demand drivers are pointing to another solid year. The best advice? Lather, rinse and repeat.

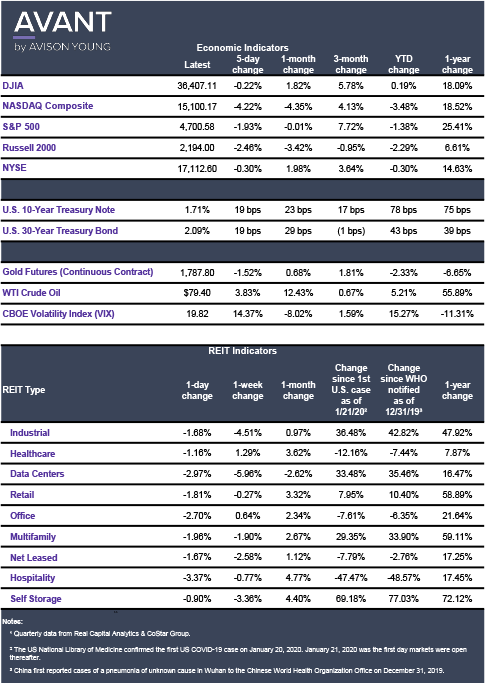

Click the image for Economic Indicators

Sources: Avison Young research, Bloomberg, Dallas Business Journal, Preqin