Significant dry powder creates offsetting investment opportunities in a volatile market

This week's announcement of a major interest rate hike points to the volatility and turmoil we are all seeing in the economy. Anticipation of the impact on deal flows, velocity, capitalization, liquidity and potential underwriting were already beginning to manifest. In this issue, we take a look at how this new interest rate environment will impact the capital markets space -- and what to expect in the months ahead, especially if there are contemplated further rate increases.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Interest rates rise as economic uncertainty continues

High gas and food prices, falling consumer sentiment, freight instability, volatility in the stock market and overall inflation running at a 40-year high have -- in aggregate -- left both consumers and real estate investors with a greater sense of anxiety. The capital markets environment has become much more complex in 2022, as a confluence of economic headwinds are beginning to push back against strong demand and deep capital allocations. And, with Wednesday's decision by the Federal Reserve to raise interest rates another 75 basis points (bps) -- the highest increase since 1994 -- the situation just became more challenging.

It was a bold step taken by the Fed -- and it will likely be followed by a few more 50 or 75 bps increases in 2022 as it tries to cool an overheated economy. This follows a 50 bps increase in May after that month’s disappointing inflation report showed inflation rising from 8.3% to 8.6%, instead of leveling off or retreating.

While the economic news is troubling, there are several offsetting factors that could bode well for commercial real estate, particularly in the industrial sector. Tenant demand remains robust and vacancy rates are still at or near long-term historical lows in many U.S. markets, factors that have been contributing to significant construction activity in recent years. By some estimates, there is $150 billion dollars in dry powder already allocated in the private equity sector for commercial real estate. Additionally, well-funded corporate tenants may see increasing real estate costs as a minor blip on the screen compared to their other capital expenditures.

What will change?

Here's a view of the interest rate landscape and what changes to watch for in the coming months. As the cost of capital increases, borrowers will be carefully scrutinizing values and whether a specific deal can be justified, given the added costs. The buyer pool has decreased in many markets, depending on fundamentals and dynamics of the deals. Underwriting assumptions have been experiencing adjustments in many cases, given the volatility in the markets in 2022, changes in the debt market, and overall risk assessments.

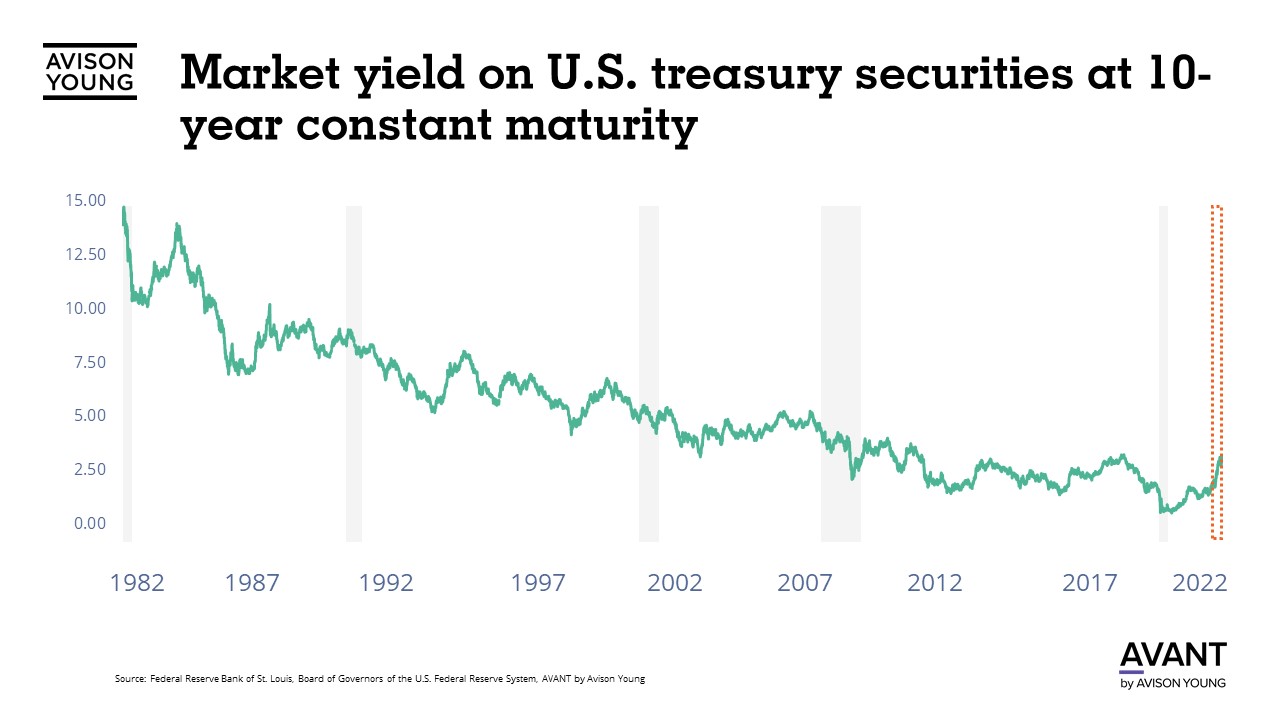

Some borrowers can expect higher interest rates cap costs and high swap spreads, as lenders are already factoring in rate increases into their projections and considering the impacts on deal leverage and LTV values. If this trend continues, rates could return more toward the mean, where it hasn't been in 20 years. This will make recently originated assumable debt more valuable to a new buyer.

Conversely, many sellers are facing new pricing adjustments due to borrowers having additional costs to overcome. Even before this week's interest rate hike, some sellers had already begun to re-examine their pricing to look at what is realistic in today's market. Their decisions will be guided by time horizon, rent flow and many other factors. In this environment, sellers are also taking a closer look at the marketability of the assets, including location, tenancy and property conditions.

Assets that might have sold quickly a few years ago may continue to garner notable attention -- or take longer to sell. This situation further accentuates the need for skilled representation from capital market experts who have longevity in the space, deep buyer and debt & equity relationships, and the ability to help navigate through once run-of-the-mill offerings and transactions that are now becoming more fluid and more complex.

While the buyer pool for industrial remains very competitive and includes many global capital sources, some buyers with more limited funding or lower risk tolerance may shift to the sidelines until the interest rate environment stabilizes. Additionally, some deals will be squeezed out of the market as the spread between cap rates and interest rates narrows. Investors with significant financial backing who have more leverage to secure favorable rates are more likely to continue to remain active over the next 12 to 18 months.

Overall, sales volumes could potentially decline in 2022 across most sectors, but with industrial and multifamily poised to see the lowest declines given their recent strength and solid leasing fundamentals. According to Bisnow, commercial property sales totaled $39.4 billion in April, based on data from MSCI Real Assets. This is a 16% decrease from a year ago and comes after 13 consecutive months of increases. That one-month snapshot shows office, industrial and senior housing led the decline, while sales of retail and multifamily continued to rise. There may also be a race to close with some transactions, as investors with near-term closings try to get ahead of additional rate increases, creating a short-term, artificial “pop” in activity.

There are broad tailwinds in the development sector as well, given the strong tenant demand, low vacancies and undersupply in many markets. The cost of capital and the rising construction costs could put a damper on some projects, however. Many equity partners will forge ahead with projects as long as the demand persists and rents continue to rise.

Markets to watch

During times of economic upheaval, many investors may focus on a “return to core” strategy as a hedge against uncertainty. Industrial assets in top tier markets such as New York, New Jersey, Los Angeles, the Inland Empire, Dallas and Chicago will continue to attract buyers due to their locational and demographic advantages, as well as their perceived stability from institutional capital.

Similarly, growing population centers, such as Phoenix, Nashville and Charlotte are expected to maintain a steady flow of investment activity due to the long-term population fundamentals and favorable business environments supporting those markets.

Conclusion

This "new normal" of economic uncertainty is having a notable impact on the commercial real estate sector, as investors adjust to the volatility and try to plan their strategies. As some investors retreat and re-adjust their buying decisions, others are working to close deals to stay ahead of additional rate increases. The overall picture is challenging, however, as the cost of funds increases.

While this is not a textbook example for a strong investment environment, there are signs that commercial real estate is, for now, holding its own in these turbulent times and uncertainty around a potential recession. Overall, the next 12 to 18 months will be a true test of how much volatility investors are willing to accept.

Click the image for Economic Indicators.

Sources: Bisnow, CNBC, The Wall Street Journal