Florida Real Estate Weekly Snapshot June 8, 2020

June 15, 2020

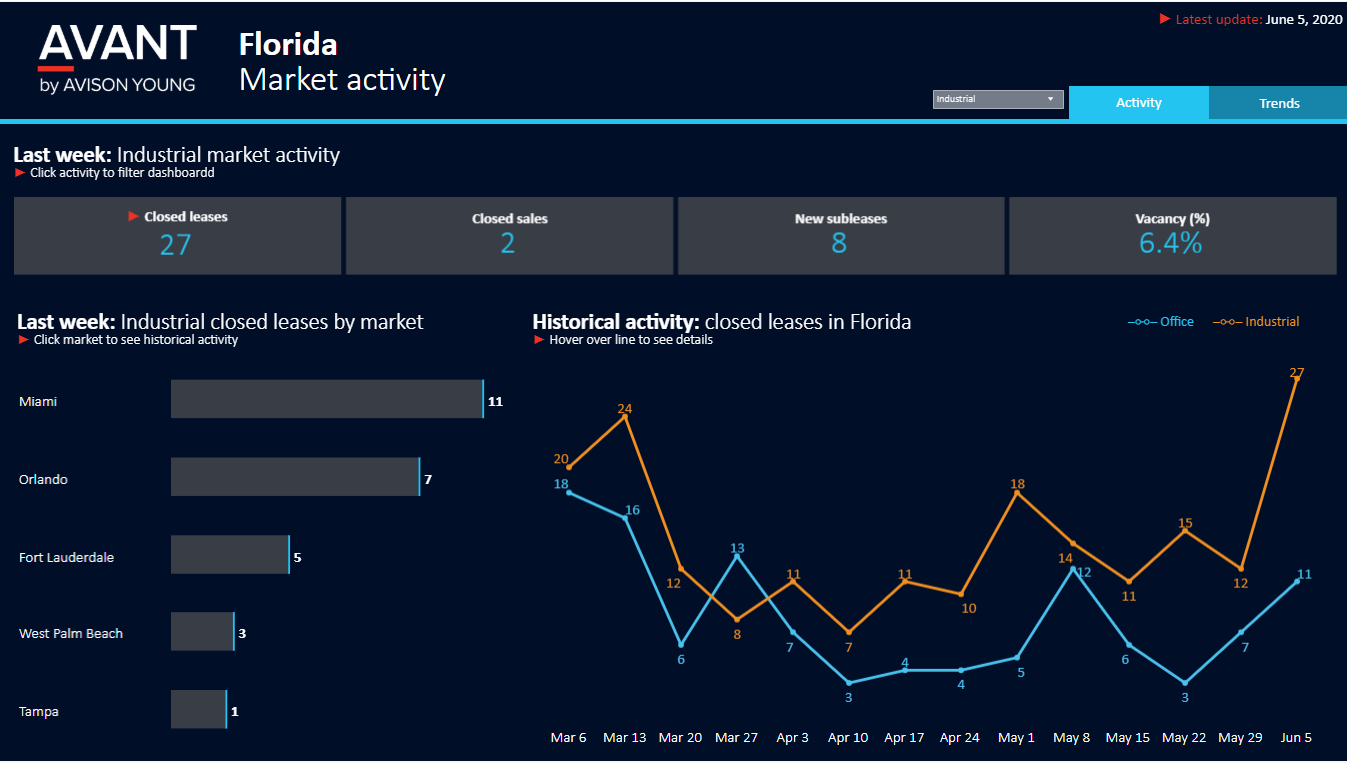

The industrial sector continues to exhibit strength during the pandemic. There has been a particular increase in activity along the I-4 corridor between Tampa and Orlando. At the end of May, HCA Healthcare signed a massive lease for 713,000 sf at a newly completed speculative development in Lakeland. Home Depot is also planning its third warehouse on 65 acres in Hillsborough County.

The University/Research Park submarket in Orlando continues to see steady activity due in large part to the defense and technology presence in the area. In the overall market, some lease deals that were put on hold are starting to resurface as the economy continues to re-open, and the Orlando Economic Partnership has had 29 new leads for business in the last two months.

The Related Group announced it has scrapped plans to build a condo project and instead is seeking to building a 160,000-sf office project in Miami Beach called One Island Park. The prominent developer cited increased demand from businesses in the Northeast and elsewhere as the reason for the pivot in development plans.

Over the last few weeks, lenders have been primarily focused on existing client relationships, but are now becoming more active and are cautiously entertaining new relationships to make new deals. Interest rates are ranging from 3-4% and non-recourse lenders are offering up to 65% maximum Loan-to-Value (LTV) for stabilized properties.

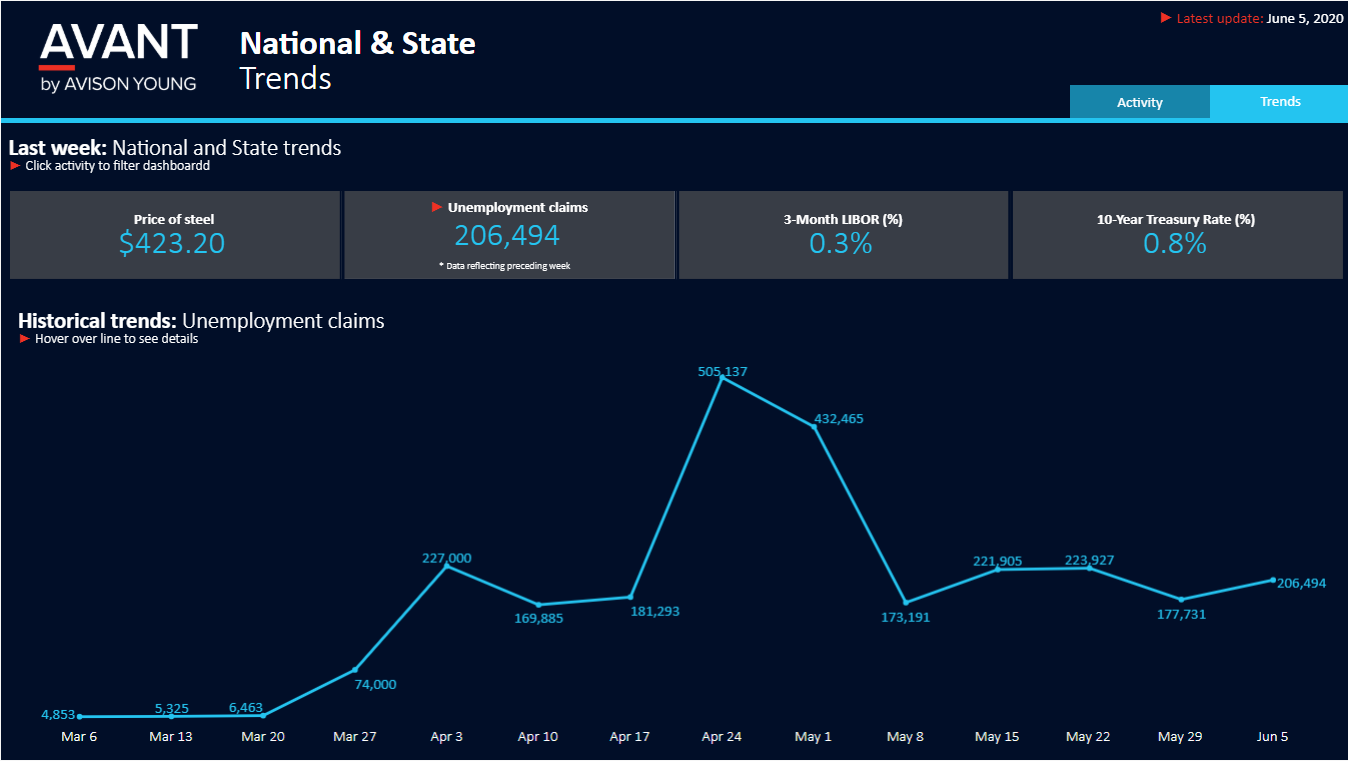

The cost of construction has remained relatively flat during the pandemic as construction was deemed an “essential service” in Florida and many projects that were already underway continued to move forward. Some commodities have reduced in price, particularly oil related products like paint, sealers, asphalt, and roofing materials. The price of steel jumped to its highest level in five months, trading at a weekly average of $423 USD per ton, as the gradual lifting of lockdown restrictions in some larger economies and a rebound in manufacturing in China boosted expectations of higher demand.

Retail vacancy is starting to increase likely because occupancies were previously being artificially supported by PPP & SBA funding. With national brands like JCPenney and Tuesday Morning announcing store closings, there will be opportunity for new retail and value concepts to backfill junior and big-box space. Some restaurants are also converting their stores into a quick-service-restaurant (QSR) model or incorporating it into their growth strategy.

U.S. hotel occupancies rose for the seventh week in a row according to the latest figures released by hotel data firm STR. National occupancy rates rose to 36.6% during the last week of May after falling below 30% for all of April. In Miami, occupancy rates rose to 32.8%, a significant increase from the 19.6% recorded in mid-March.

The year-over-year change in weekly travel spending for the week ending May 30th was -81% in Florida at -$1.67 billion, a slight improvement from the -83% one week prior. The year-over-year change in weekly state tax revenue was -$49 million.

According to a report released on Friday by the Bureau of Labor Statistics, the U.S. added 2.5 million jobs during May and the unemployment rate declined to 13.3%, down from 14.7% recorded in April. The data comes as a relief to economists who had forecasted a 7.5 million jobs loss in May and an increase of the unemployment rate to a near-record 19%.