Back-to-school spending surge stresses supply chain

The back-to-school season is upon us, complete with masks (or no masks), iPads and social distancing at recess. In the last few decades, supply chains have become more globalized and more complex, and this summer we’re again in the midst of a new dynamic as prices for all goods are going up, shortages are occurring and many items that are needed are sometimes in short supply. This dynamic is no different when it comes to back-to-school items for our nation’s children, which we explore in this issue.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

As if we didn’t have enough variant anxiety in mid-2021, now students are returning to schools and colleges for the fall, and supply chain disruptions are creating an uneven trajectory during one of retail’s coveted shopping seasons. Retailers are experiencing a record-setting surge in consumer spending, yet many shelves are empty as retailers and warehouse operators struggle to move high-demand items through the pipeline.

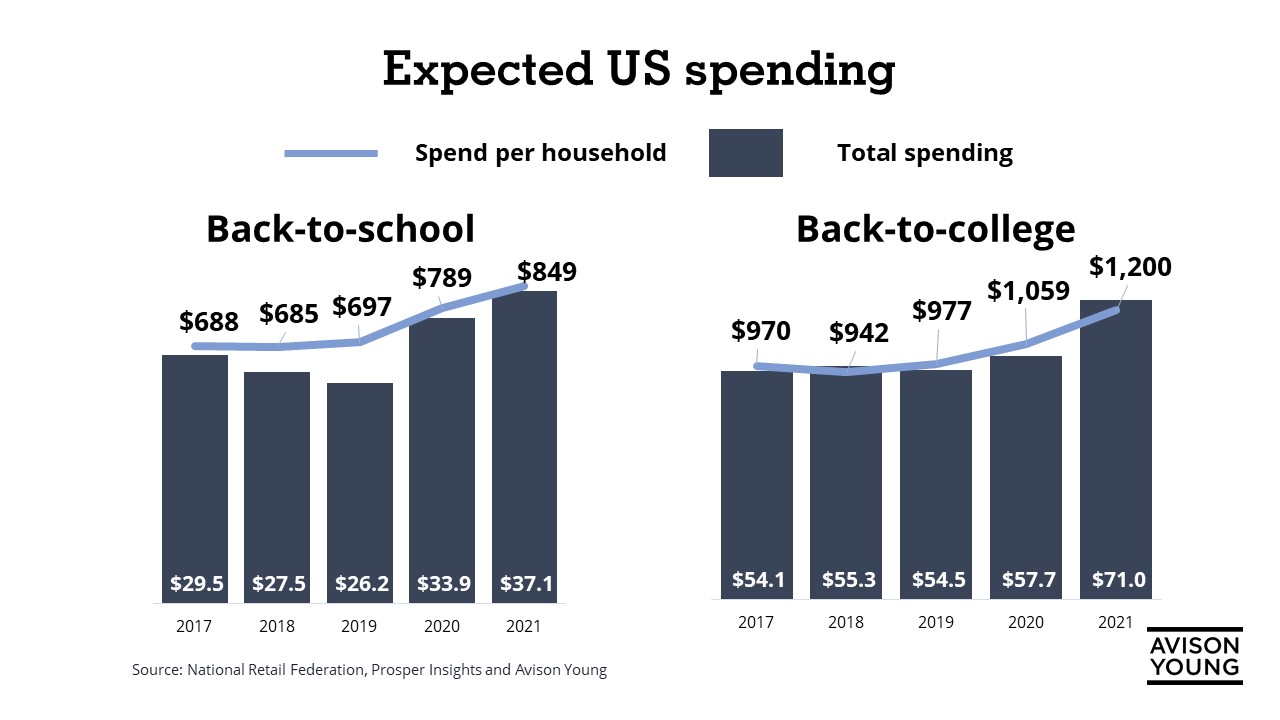

On a positive note, back-to-school sales are projected to reach $37.1 billion this season, an increase from $33.9 billion in 2020. College-related purchases are projected to reach $71 billion, up from $67.7 billion in 2020, according to the National Retail Federation (NRF). This equates to an average $848.90 per family for K-12 schools and $1,200 for higher education. Some industry experts are now questioning whether consumer spending will reach those levels, however, given continued disruption amid surges in the spread of the COVID-19 Delta variant and higher inflation crimps pocket books and wallets.

There are reported product shortages across multiple retail categories. Sneaker production was halted among several Vietnamese suppliers due to the spread of COVID-19, for example. The global chip shortage -- fueled by strong demand for in-home electronics during the early days of the pandemic -- continues to impact the delivery of computers and other consumer items.

This activity is also leading to 10% to 15% price increases on some merchandise. Among the items in hot demand -- and low supply -- are apparel, backpacks, stationary and laptops. Consumers are also faced with fewer choices, particularly for those who have waited to jump into the shopping frenzy.

While consumer spending has surged in recent months, there are signs of a tipping point. According to CNBC, a recent industry survey showed that shoppers are getting more anxious about visiting stores due to the resurgence in COVID-19 cases. Will this push more shopping online and fuel further industrial activity?

Key markets for industrial activity

The industrial sector continues to see robust demand for warehouse and distribution space, particularly in and not surprisingly adjacent to population hubs and major markets such as the Inland Empire, New York, New Jersey, Chicago and Miami, among others. The need for close-in, last mile logistics and distribution facilities near large population centers is growing, as e-commerce now accounts for nearly 16% of overall retail sales.

According to Avison Young research, the Inland Empire has a 3% vacancy rate for industrial space, a 20-year record low, as of Q2 2021. Port traffic has increased by 44% compared to the same period last year and overall leasing activity has been strong throughout the pandemic. Net absorption reached 15.3 million square feet in the first half of the year and is expected to outpace annual totals for the past decade.

Miami has a 4.4% vacancy rate as thriving port activity and robust industrial fundamentals continue to spur space demand. Third-party logistics and parcel delivery companies are working overtime to help minimize supply chain disruptions.

In Chicago, overall leasing activity has sustained throughout the pandemic and net absorption is keeping pace with new deliveries. As seen in many markets, developers are racing to keep up as there are currently 15 properties larger than 750,000 sf under construction. Building on continued growth since 2015, base rents have increased by more than 10% since the start of COVID-19. This positive growth has continued to spur an investment rush for industrial properties across the Chicagoland area. -- as well as in many other industrial markets.

Port congestion continues to impact product flow

Amidst this strong industrial activity is the continual presence of supply chain challenges, particularly across U.S. and global port markets. It has become a familiar sight to see ships anchored off of the coast of California waiting to be allowed entry to the ports. There is similar congestion along the East Coast, off shore of the Port of New York and New Jersey. An uneven flow of goods has also contributed to a shortage of the cargo containers needed to move products from port to port and ultimately into consumers’ hands.

Despite efforts to plan ahead and future-proof their operations, many businesses are experiencing notable struggles due to port congestion, product and labor shortages, and other factors. Many retailers adjusted their spring buying schedules to bring in inventory earlier, for example. This is good news for the industrial sector, with seasonal warehouse demand occurring earlier than usual for back-to-school and the upcoming holiday season.

Some retailers are adding inventory in the U.S. with a “just-in-case” approach to guard against supply chain disruption. Depending on the business, this can lead to a 5% to 10% increase in space utilization.

As the industrial market continues to grapple with supply chain disruption and ongoing product and labor shortages, many are now looking beyond the back-to-school season and onto the critical holiday shopping season. How will large market players such as Amazon, Target, Walmart and others work around these obstacles to keep merchandise flowing? How will industrial space demand and investment activity fare over the next 12 to 18 months? Look for periodic updates on these issues as the Avison Young capital markets team continues to monitor these important issues impacting the global investment community.

Sources: CNBC, Deloitte, Freightwaves, National Retail Federation, Supply & Demand Chain Executive, USA Today

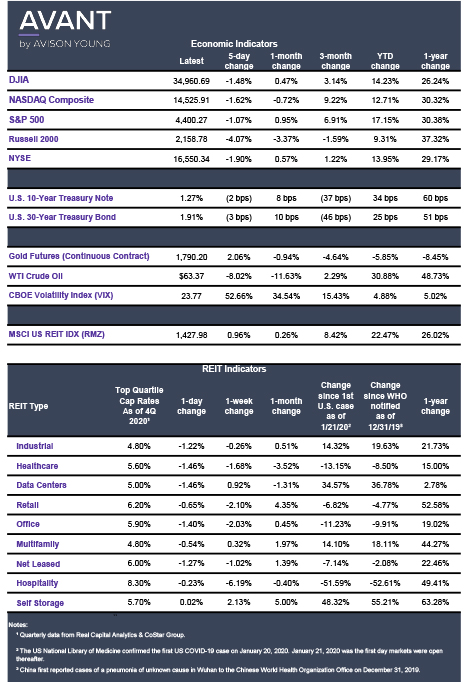

Click the image for Economic Indicators