2023 NorCal Broker Sentiment Survey

Avison Young Brokers in Northern California are closely monitoring the commercial real estate market, economy and ongoing recovery. We’ve conducted a survey among our internal brokerage team, yielding some intriguing insights and sentiments regarding various market-related topics.

Market predictions

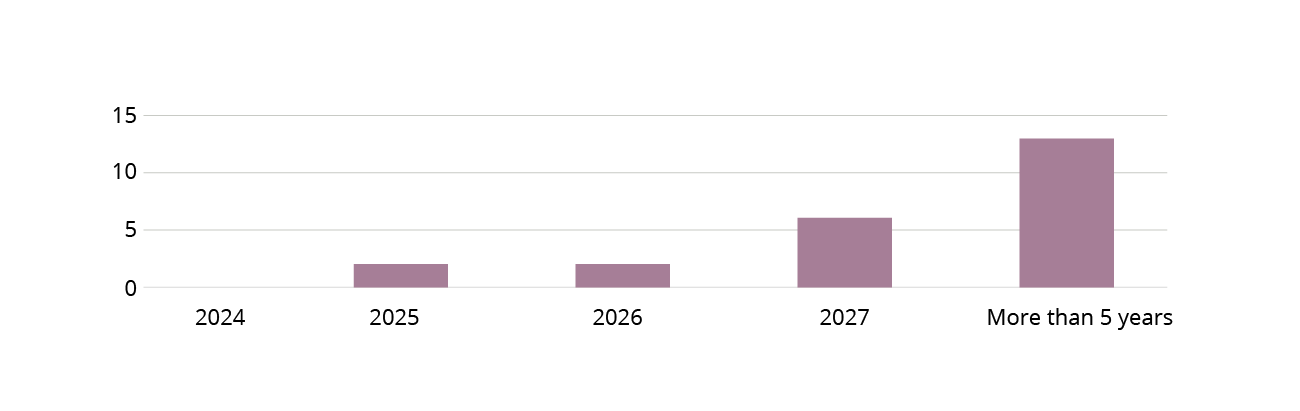

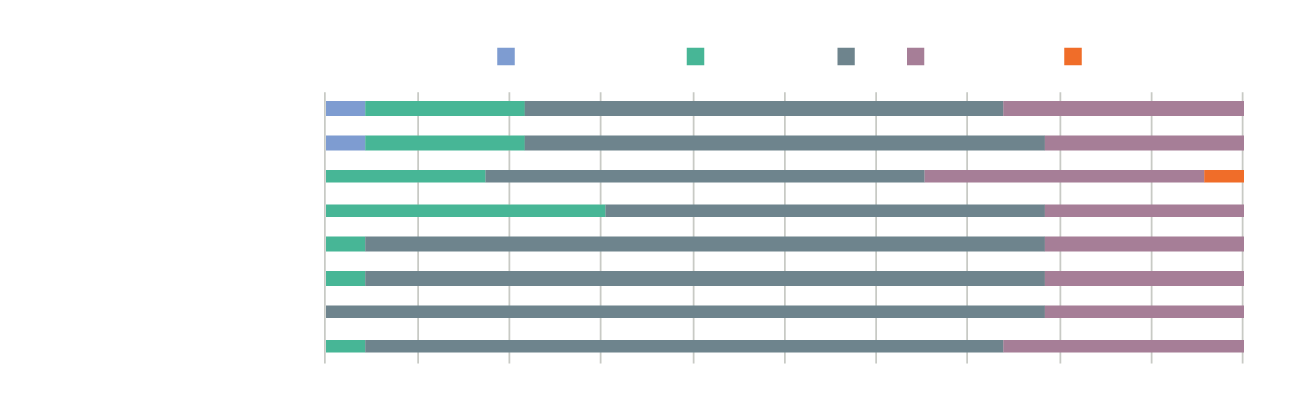

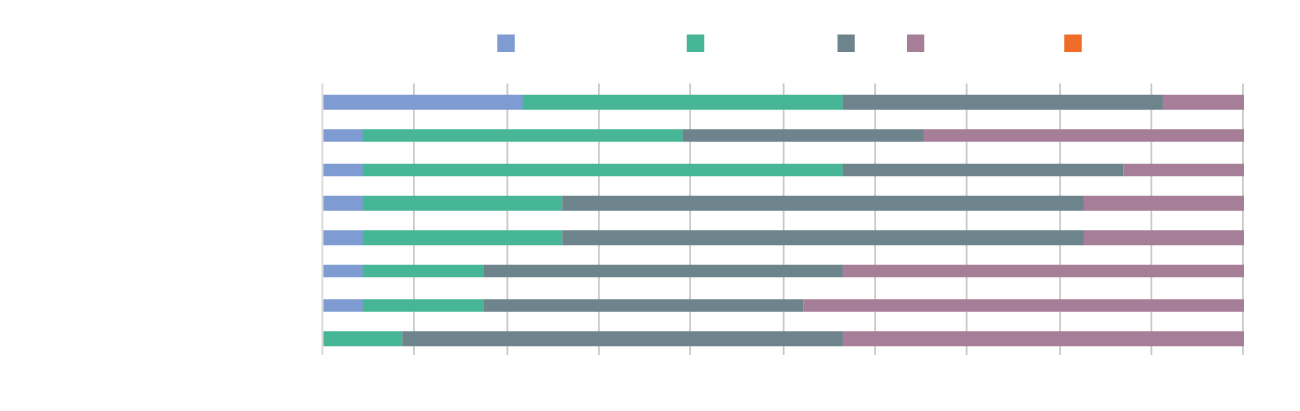

WHEN WILL SAN FRANCISCO VACANCY RETURN TO 12%?

Is San Francisco committed to the long haul? According to the Avison Young team, the outlook doesn’t foresee San Francisco returning to equilibrium in the next five years. Nevertheless, this situation presents a distinctive opportunity for occupiers aiming to establish a presence in one of the world’s most prominent markets.

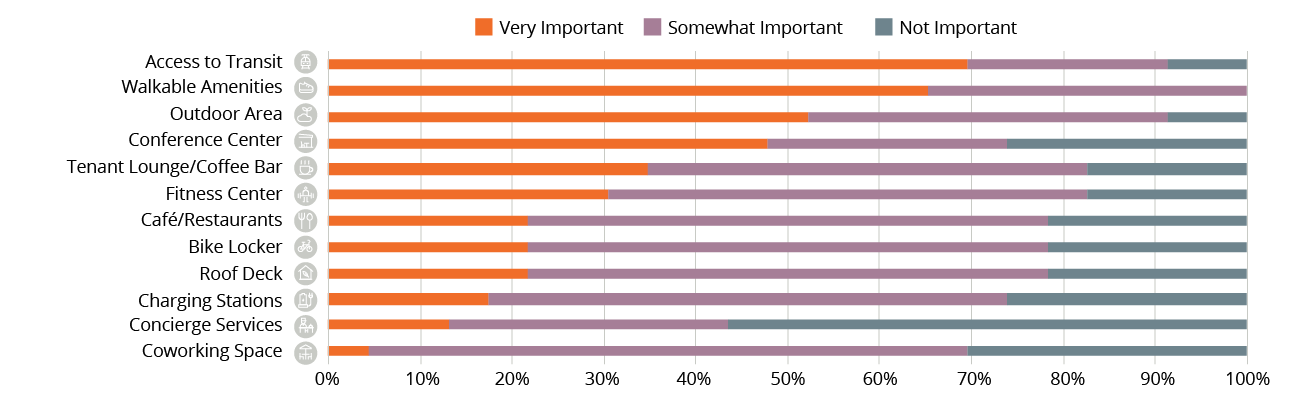

WHAT AMENITIES ARE IMPORTANT TO TENANTS?

Avison Young brokers assert that traditional core amenities for office properties remain crucial for occupiers, with access to

transit beingthe most valuable. As more employees return to the office, there are significant increases in both traffic and

transit, positively impacting the surrounding retail and amenities. These factors rank second on the list of crucial attributes

that tenants prioritize.

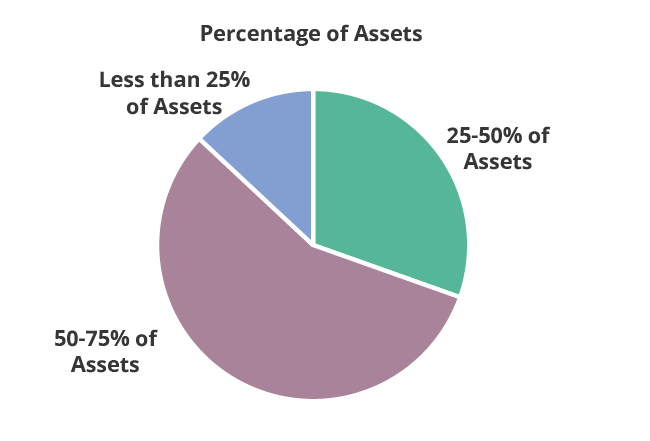

WHAT PERCENTAGE OF BAY AREA ASSETS WILL DEFAULT OR BECOME DISTRESSED OVER THE NEXT 12 MONTHS?

Workplace predictions

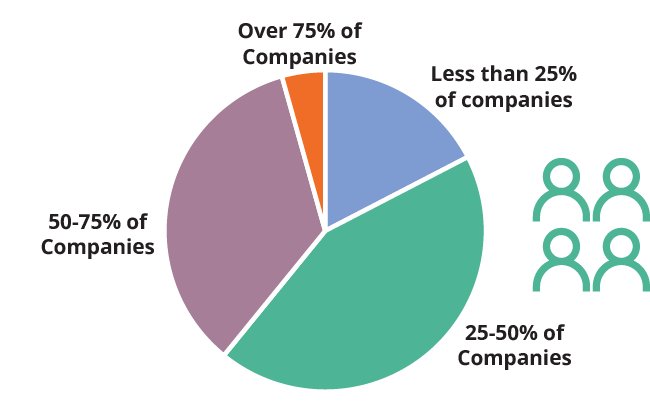

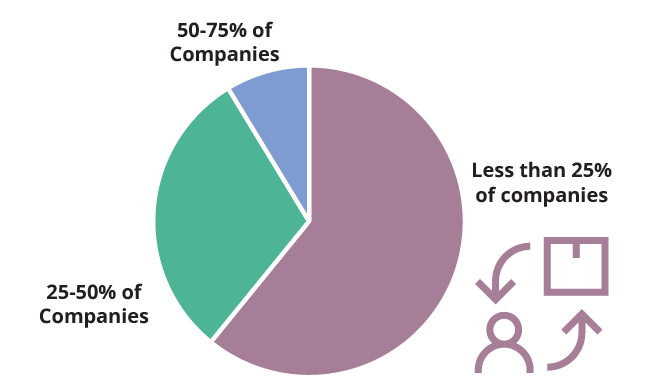

WHAT PERCENTAGE OF BAY AREA COMPANIES WILL ENFORCE RETURN TO OFFICE OVER THE NEXT YEAR?

As employers throughout the Bay Area systematically reevaluate the productivity of remote work, the Avison Young team foresees more than a quarter to half of all Bay Area companies mandating a return to office of at least three days per week over the next year, prompting employees to return to the office.

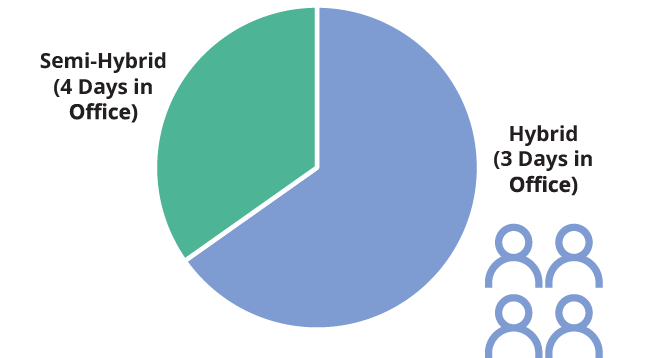

WHAT TYPE OF SCHEDULE WILL EMPLOYERS MANDATE IN THE NEXT YEAR?

Public transit and highways are seeing increased activity. According to prevailing sentiments within the Avison Young team, a significant majority anticipates that over half of employees will return to the office for at least three days a week, a trend expected to gradually drive up occupancy in buildings. However, the team does not anticipate seeing a full return to office of 5 days a week, especially in the urban locations of San Francisco and Oakland.

What Percentage of employers will do additional layoffs?

Is the pace of layoffs decreasing? A significant number of Avison Young brokers predict that less than 25% of companies will conduct additional layoffs in the coming year. Nevertheless, the technology sector might witness more workforce reductions as companies undergo restructuring following a surge in hiring post-pandemic. Investor decisions and returns on investments are heavily influenced by factors such as the stock market and interest rates.

2024 FORECAST predictions

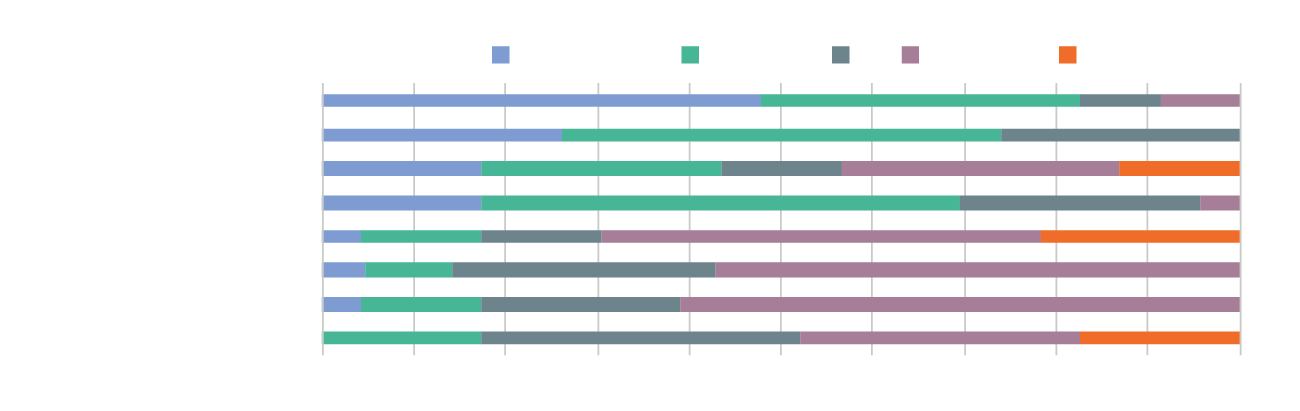

OFFICE FUNDAMENTALS

Majority of Avison Young brokers expect concession packages to be significantly higher in 2024 as landlords start to compete with limited activity. However, the AY team also sees tours activity moving slightly higher next year which will also drive an uptick in leasing velocity.

Industrial FUNDAMENTALS

While industrial has remained one of the bright spots for the commercial real estate market through the pandemic the Avison Young brokerage team anticipates slowing in 2024 with fundamentals mainly staying flat or slightly higher.

Retail FUNDAMENTALS

Avison Young brokers anticipate the retail market to remain either stable or show a slight increase in leasing and sale fundamentals. The positive release of Black Friday figures for 2023 adds an interesting dimension, as shopper turnout across websites and stores hit an all-time high of 200.4 million according to a survey by the National Retail Federation.

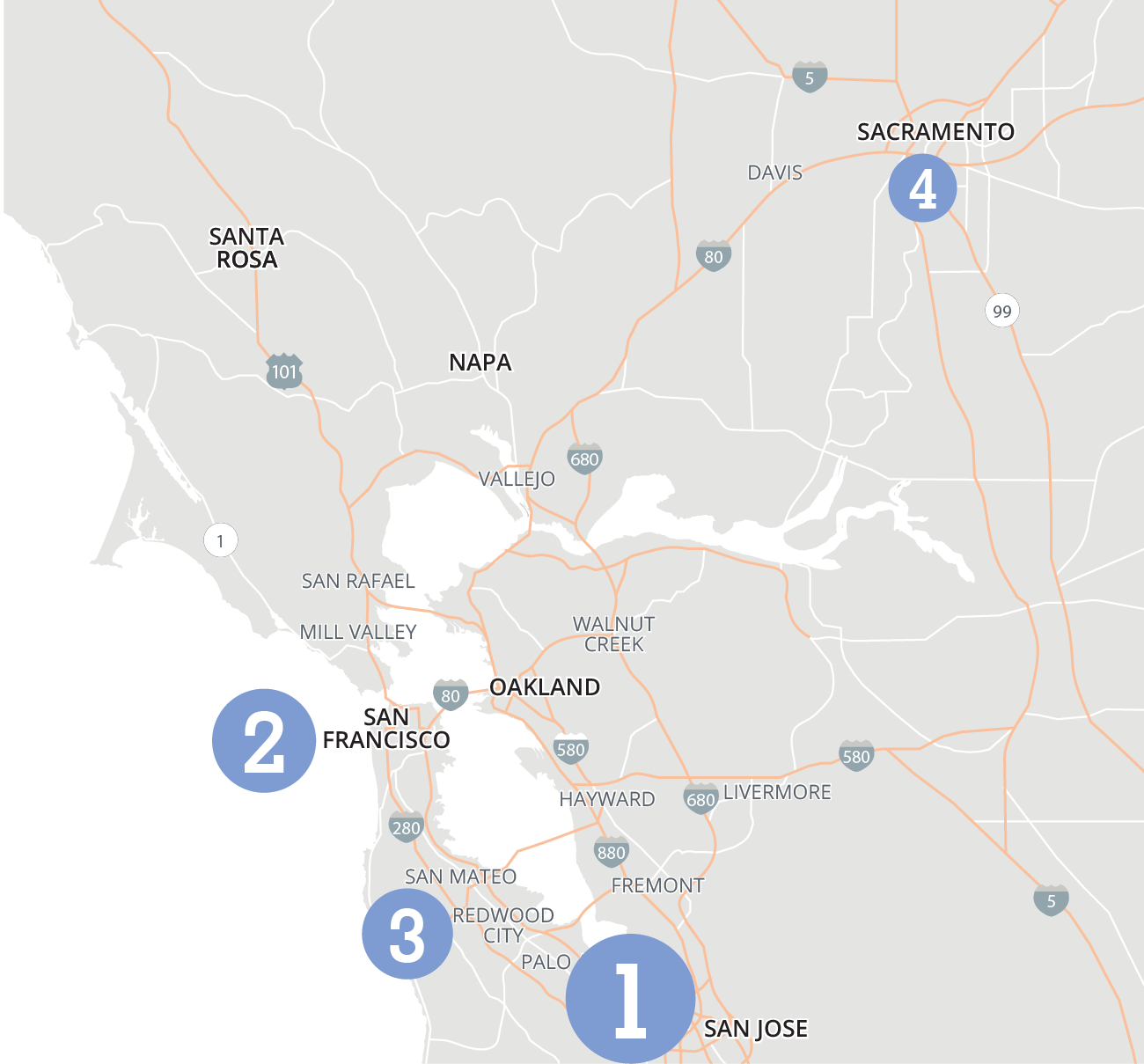

Which Northern California markets will recover first?

Avison Young brokers anticipating the market to exhibit the initial signs of recovery in 2024 with Silicon Valley remaining a robust indicator for the Bay Area.

Which Emerging Industries will develop through this downturn?

Our team holds the belief that AI will emerge as the predominant industry following this downturn, maintaining momentum for the foreseeable future. Additionally, other industries exerting a positive influence on the market include industrial manufacturing, clean tech, sustainable energy, and biotech.

-

Market Intelligence Manager, West Region

-

Market Intelligence