Historical low vacancies and continued strong tenant demand keep development activity at high levels

Industrial construction continues at a robust pace in many markets as developers work to keep pace with e-commerce and related logistics demand. Despite headwinds from material pricing increases and labor shortages, we continue to advise clients that the outlook will be strong for 2022, and beyond. Through many of our offerings we have currently in the market on behalf of industrial developers, we are finding a broad range of investors who continue to focus on these development opportunities (speculative construction, forward sales, etc.) as a means of gaining an early foothold into this coveted industrial asset class. In this issue we take a look at where we are from a development perspective and what’s ahead for the New Year.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Industrial construction outlook: Strong and steady

The seemingly insatiable appetite for modern distribution and warehousing facilities continues to fuel significant construction activity across the country. From Dallas - Fort Worth to Atlanta to Chicago and California’s Inland Empire, construction remains a strong barometer of the growing influence of e-commerce.

While the expansive construction cycle has kept developers busy for many years, it has also drawn many investors into this segment of the market. Given the intense appetite for industrial assets, many investors are now focused on the early entry stage, as a way to gain a foothold or increase their exposure.

Avison Young research shows that delivery of new industrial product averaged more than 300 million square feet per year between 2018 and 2021. There also is more than 300 million square feet of new product in the pipeline, with two-thirds of it (220.6 million square feet) being built for modern, high-bay bulk distribution, a reflection of the significant impact that e-commerce continues to have on the industry. The amount of general warehouse space under construction is considerably smaller while purpose-built manufacturing naturally accounts for only a small proportion of new development activity.

Industrial continues to follow population growth

This construction activity is generally occurring in areas of higher population growth as e-commerce, logistics and related occupiers rush to keep pace with consumer demand.

Where land constraints are not as much of a factor, many of these markets also have lower barriers to development, making them well positioned for future growth. Among the key regions for growth is Texas, with a 15.8% growth rate from 2018 to 2021, the highest rate across all regions. Dallas has been a top national market for construction for many years and currently has 50.6 million square feet under construction across 168 properties, according to Avison Young Q3 2021 research.

The Southeast, which includes the strong development markets of Atlanta, Nashville, and Charlotte markets, ranked second, with 14.3% growth. Florida, with its busy I-4 Corridor in the central part of the state and the South Florida port markets, had a 12.6% increase. Other growth markets included: California, particularly centered around distribution space in the much sought-after Inland Empire (7.7% increase), the Northeast, including the big-box hubs within the Lehigh Valley and Central Pennsylvania (6.9%) and the greater Midwest (6.6%).

The Northeast region, along with California, and Florida all had high shares of new construction skewed toward bulk distribution development, while other metro areas had higher shares of general warehouse developments. The average building size under construction nationally is approximately 400,000 square feet.

Key headwinds for construction

While the outlook for industrial construction is strong heading into 2022, the material shortages and overall supply chain disruption that jolted the industry in the early days of the pandemic remain a concern. Contractors continue to face challenges procuring lumber, paint and coatings, aluminum, steel, cement and other necessary materials. As with many segments of the economy, the availability of labor and increasing cost is also impacting the construction industry and its ability to keep pace with demand.

A recent analysis of government data by The Association of General Contractors of America (AGC) notes that, after months of rising construction costs, contractors are now passing along more of those increases, which is translating to higher overall project costs across many commercial projects. And, despite a large increase in what contractors charge for projects, the material pricing is still higher than what is being passed on.

A key measurement of contractor sentiment jumped 7.1% from September to October of 2021 and 12.6% over the past year. An index of pricing that goods and service producers charge climbed by 21.1% compared with October 2020, however.

Among the top pricing hikes were with steel products, which more than doubled, soaring by 141.6% in the past year. Aluminum, copper and brass products increased by nearly 40% in the past year, while asphalt increasing by 68.7%. These increases are also impacting the delivery sector, with trucking costs rising 16.3%, partly due to increases in diesel fuel costs.

With its robust growth in new development, the industrial sector has been a strong leader in the construction industry. Other segments were hit much harder by the pandemic and have lagged behind in finding stable ground. Much of this growth is tied to the significant expansion in e-commerce and the related impact on consumer shopping habits. As large retailers such as Walmart, Best Buy and Target continue to expand their footprints, their growth is translating to greater demand for warehouse and logistics space.

Looking ahead to 2022, there is much optimism that industrial construction will remain balanced and reflective of market fundamentals. With many markets seeing robust occupier demand and vacancy rates below 5%, it is difficult to see any slowdown in the near term.

Sources: Association of General Contractors of America, Avison Young research, Deloitte

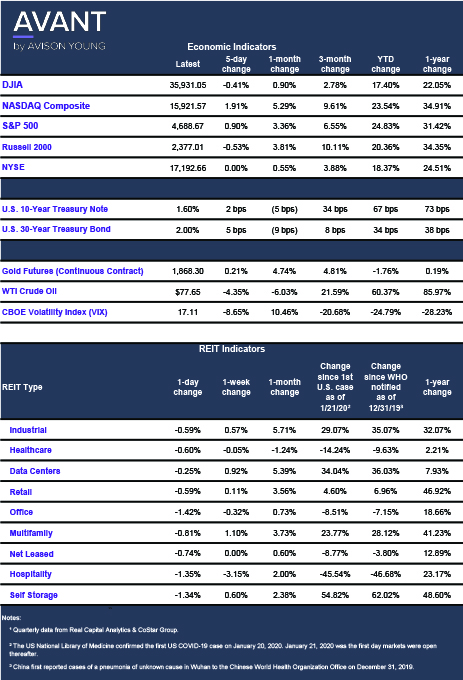

Click the image for Economic Indicators