From freight volumes to pricing to labor, new factors create new complications

As the summer gets into full swing, we take a look at this busy, and often hectic, freight season to see what's changed and how industrial businesses are faring. As the impact of the pandemic lingers on, there are mixed signs of recovery in the supply chain, such as shifts in the way freight is moved, priced and the realization that an "always changing, never normal" is now the standard within the freight of the industrial world.

Best,

Erik Foster

Principal

Head of Industrial Capital Markets

Erik.Foster@avisonyoung.com

+1 312.273.9486

Pandemic shifts changing summer freight cycles

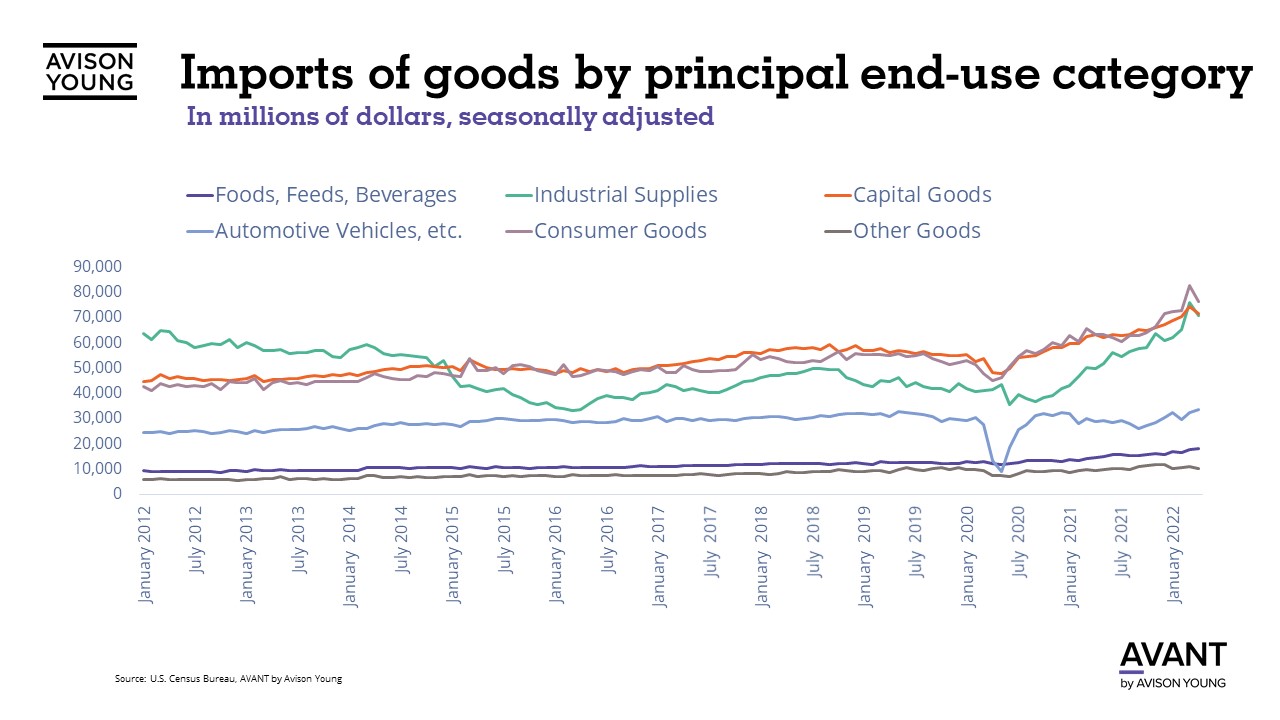

The late spring and summer months have historically been the peak season for freight delivery, with companies moving large volumes of goods through the supply chain in preparation for the holiday shopping season. That cycle changed dramatically with the pandemic, which ushered in frequent supply chain disruption, merchandise shortages, freight delays, and, now, an "always on" approach toward meeting consumer demand.

At the mid-point of 2022, volatility is still a constant theme impacting the freight industry. Fuel costs have risen exponentially, with diesel fuel jumping 74% from a year ago. Oil has been persistently over $100 a barrel. Here's a look at the many factors that impact the freight industry and what lies ahead for the next 12 to 18 months.

Port volume moderates but prices still high

The volume of goods moving through U.S. ports remains at near record levels, as businesses work to meet ongoing strong consumer demand. According to the June 2022 Global Port Tracker report by the National Retail Federation and Hackett Associates, total volume of loaded imports decreased by 63,000 TEUs, or 2.4%, to 2.56 million TEUs between March and April. The year-to-date volume imported through the first four months of 2022 was 9.94 million TEUs, a 5.5% increase from the same period in 2021.

While port congestion has improved -- to about 30 ships waiting offshore versus the 100 in line during the height of the pandemic -- another wave could hit soon. As the peak ocean liner shipping season picks up in August for the back-to-school and holiday shopping seasons, more congestion could result.

Port congestion is prompting some companies to continually examine their freight options and which combination of delivery options work best. The congestion is expected to continue until at least the beginning of next year, with rising shipping costs, longer transit times and continual uncertainty becoming the "new normal" for the shipping industry.

An overheated market is also impacting shipping contracts, with longer lead times and a need for advanced planning and procurement driving many decisions. As with much of the freight industry, shippers and logistics providers are having to work outside of the typical box to find new contracting methods and bid processes to minimize risk. Some are sending bid proposals for specific segments of a project, rather than the entire project in an effort to work in segments of time in order to control costs.

According to CNBC, DHL Global Forwarding and other logistics businesses are reporting that U.S. orders involving manufacturers in China are down by as much as 30%, due to consumers shifting spending from goods to services. A DHL executive noted that this was a tipping point for the “ship at any cost” mindset that has become prevalent over the past year as consumer demand surged and businesses shifted into multiple freight options, often without much regard for the higher costs.

Freight rates drop in Q1

Global freight rates have dropped by about 20% since the first quarter, in one sign that the movement of goods through the supply-chain is improving. The rates are still 13% higher than a year earlier and are expected to fluctuate over the course of the year, as the war in Ukraine, recent COVID-19 lockdowns in China and other volatility continues to impact demand for containers and overall global growth. The spike in oil prices is also pushing up shipping costs.

Pricing remains volatile domestically as well, however, as inflationary pressures and the threat of a recession loom. Some businesses are signing longer-term contracts with ship owners to help offset volatility and availability issues. This helps businesses achieve a level of certainty and, hopefully, reduce costs. An estimated 60% of shippers continue to use shorter term "spot" rates, however, which can expose them to supply chain risks.

Freight rates are expected to remain elevated from pre-pandemic levels throughout 2022. Rates should moderate in 2023 as more than 2 million TEU on order are added into the container capacity. It is unlikely that rates will decrease back to pre-pandemic levels due to carriers' disciplined approach to controlling capacity, however.

Although truck freight rates have begun to pull back from historic highs, the U.S. Department of Transportation's Bureau of Transportation Statistics reported that the Freight Transportation Services Index (Freight TSI) for April of this year is still up 12% above the dip in for-hire freight shipments that occurred in April 2020.

Labor pushes back at the ports

Another key issue impacting capacity and pricing is labor, most notably the current negotiations between the union representing 15,000 West Coast dockworkers and the maritime shipping companies that own 29 West Coast ports. At issue are wages and the use of automation versus workers. With 40% of all U.S. maritime imports moving through the West Coast ports and 30% of all containerized imports moving through the Ports of Los Angeles and Long Beach, the outcome -- or delay in approving a contract -- could have significant effects on the flow of goods into the country.

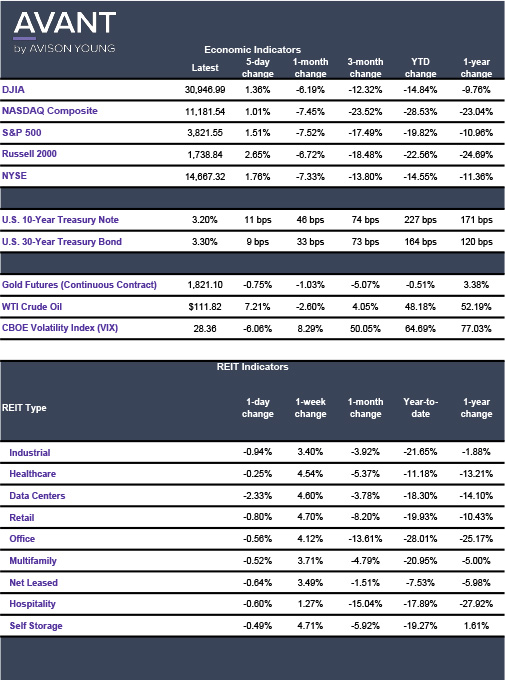

Click the image for Economic Indicators.

Sources: CNBC, Financial Express, L.A. Times, National Retail Federation, Reuters