Top national developers provide short- and long-term perspective on the state of the market

The construction industry has faced many challenges since the beginning of the pandemic, yet continues to deliver record volume in many U.S. markets. Given recent interest rate increases and concern of further economic pullback, in this edition we look at the current state of industrial construction and how developers are navigating this challenging environment.

Erik Foster

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

What's ahead for industrial construction?

The construction industry has faced many challenges since the beginning of the pandemic, from material and labor shortages to subsequent cost increases, project delays and ongoing supply chain issues. While industrial construction volume has been robust in many markets -- and tenant demand remains strong -- developers are facing uncertainty over a shifting economy, rising interest rates and other economic factors. Heading into year-end, here's a look at the outlook for industrial construction, with insights from two leading developers.

"We're cautiously optimistic about the next 6 to 18 months," says Aasif M. Bade, Founder & CEO, Ambrose Property Group, based in Indianapolis. The firm builds Class A industrial and logistics space and has $1.4 billion of new development in the pipeline across the country. "Clearly there has been a reset in value, both with land values and values of real estate as it sells, but leasing demand continues to be robust and completely unprecedented. Across the board, I think there is consensus that we will beat or be near a record for leasing activity during 2022."

A look at market fundamentals paints a positive outlook for new construction over the next 12 to 18 months, yet here are many questions about whether a recession is on the horizon and how developers should approach these uncertain times. "Market fundamentals couldn’t really be much better than they are right now," says Kevin Matzke, Managing Principal with Chicago-based Clarius Partners.

"Vacancies are in the low single digits across the board. Leasing and rents growth are incredibly robust, pretty much everywhere. And every spec project we have delivered in the past year has been pre-leased." Clarius Partners has about 5 msf under construction in the Midwest, Southeast and Southwest regions, with more than 60% of the space pre-leased or pre-sold.

However, positive fundamentals are sometimes overshadowed by negative sentiments in the market. Investors, lenders and other industry professionals are concerned about inflation, interest rate uncertainty and the possibility that the Fed's moves to curb inflation will lead to a recession. "Personally, I am on the side that thinks this is an over-reaction," says Matzke. I think perception is worse than reality right now."

Developers are weighing whether to scale back their plans for the next 18 to 24 months or move ahead with the assumption that either a recession will not occur or that it would be mild. In that case, those who moved ahead with new projects might be well positioned to succeed in a less crowded pool of projects. "Maybe we won't have a long, protracted recession and because fewer planned spec projects actually get built because of all the fear in the market, maybe rents will get pushed even higher?" says Matzke.

Robust tenant demand remains a top driver

There are a variety of factors driving tenant demand, from e-commerce growth to expansion of 3PLs and strong fiscal performance from many Fortune 500 companies. As businesses rebuild their supply chains for a new post-Covid era, certain building specifications and geographic factors continue to drive tenant demand. "Other than one tenant who’s supply chain building pause has been widely publicized, we have not seen a single tenant hit the pause button on any project, whether it's a build-to-suit or a lease of an existing building," says Bade. "It seems to be that modernization of the supply chain has been unaffected by the economy."

Other factors that are fueling industrial space absorption are the increase in onshoring and in just-in-case inventory strategies. "Leading up to Covid, many companies had gotten so lean with their inventory with a just in time inventory approach, they were down to having 10-11 days of product in their supply chain," says Bade. "Companies today are realizing that they need more inventory, an average of 40-45 days, to provide a buffer against supply chain disruption."

Costs still rising

Among the indicators developers are closely watching are construction costs, which are at an all-time high. According to a Q2 2022 Construction Cost Index report from Mortenson, prices rose 3.3% nationally, with Chicago having the biggest jump in pricing, at 4%. Milwaukee came in second with a 3.9% jump. Portland, Minneapolis, Seattle, Phoenix and Denver all had increases between 2.2% and 3.6%. The report predicts similar pricing for the second half of the year, noting challenges with materials shortages, higher shipping costs and longer product lead times.

"In the recent past, by far the biggest challenge we have had, as pure-play ground-up, developers, has been construction pricing," says Matzke. "You can pick the best markets and sites in the country and you can be incredible at marketing and leasing, and you can even be really lucky when it comes to timing, but if you can’t manage development costs, then you aren’t going to make it."

The debate remains about a recession occurring and how deep it will be. Market sentiment still points to a strong need for industrial space over the long-term. "The difference between a soft landing and a recession will have an impact on the industrial sector but it won't drastically change the need for industrial real estate," says Bade. "A recession will not make it more efficient to distribute out of a building with a 28-foot clear height."

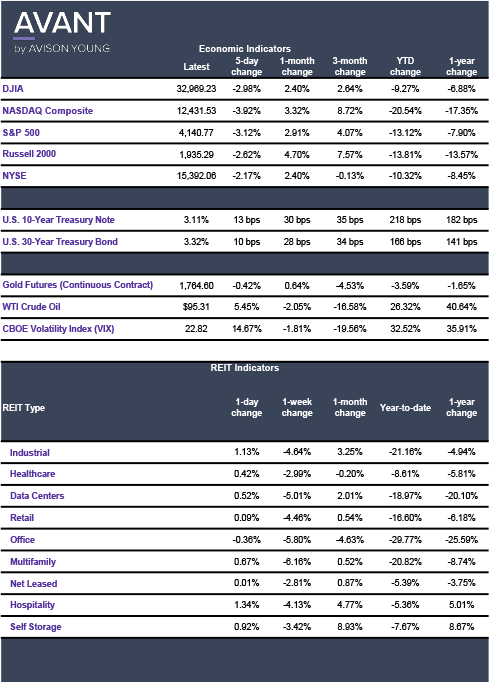

Click the image for Economic Indicators.