Signs that a new hope will be unleashed in 2023

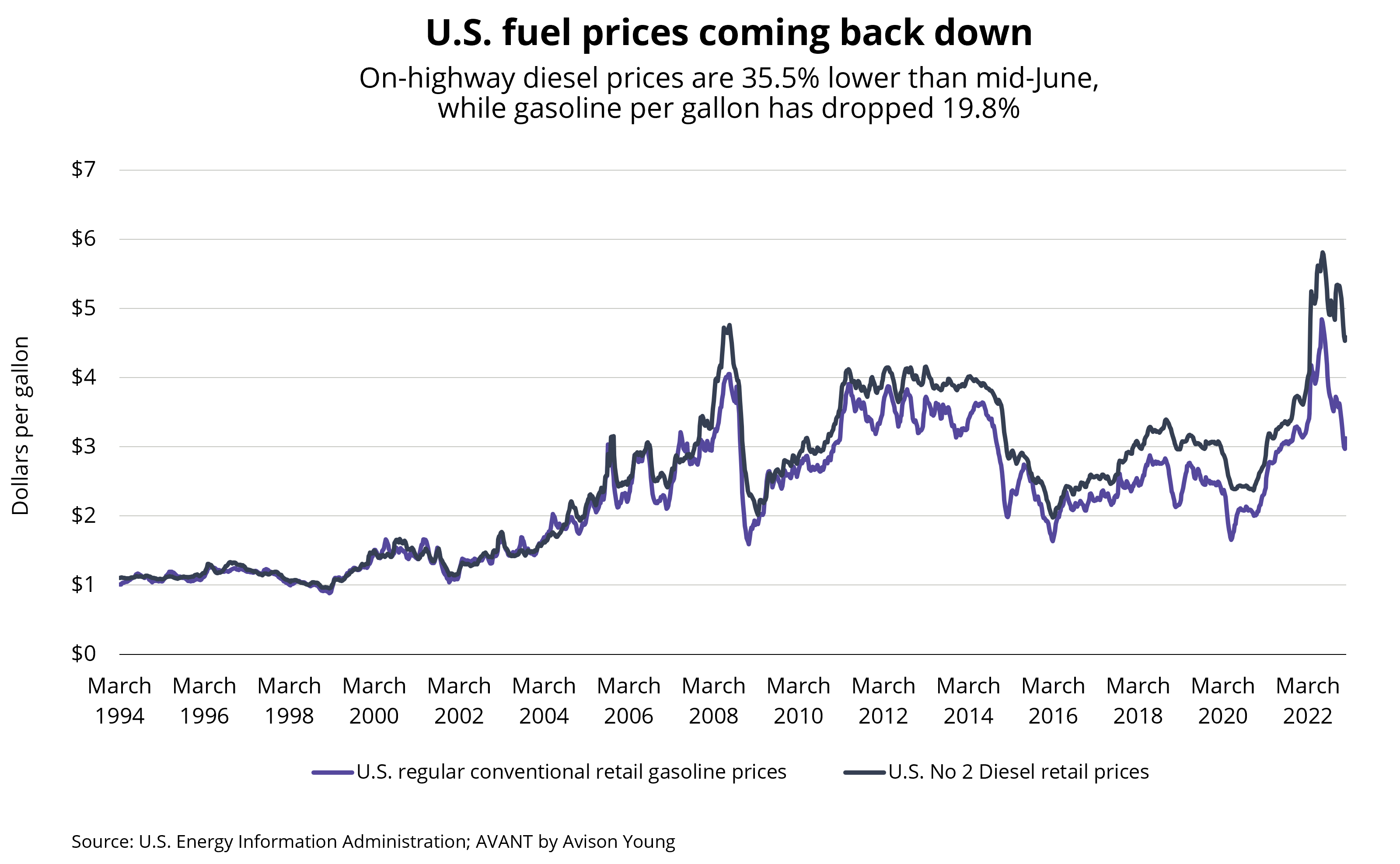

With the turbulence of 2022 behind us, there are signs of optimism as inflation slightly loosens its hold and key indicators keep trending in the right direction. Fuel prices have dropped significantly, consumers are spending but moderating their purchases, and China is expected to reopen its economy. Although challenges remain ahead, let’s examine some of the positive momentum that could lead to less volatility for the New Year.

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Positive Signs Emerge for 2023

We enter the New Year with the economy showing hints of hopefulness. Inflation slowed in the fourth quarter, fuel prices have dropped significantly, and the prospects of trade growth with China are emerging as it moves out of its pandemic lockdown. Significant uncertainty in the U.S. financial markets lingers, particularly around interest rates and the potential for an economic recession. These positive indicators are welcome signs as the country moves into the New Year and they continue to bolster our optimism in industrial real estate.

The Fed is expected to continue to focus on reigning in inflation, making consumer spending a key barometer to watch, as it accounts for more than two-thirds of U.S. economic activity. According to the latest data, spending in November rose just 0.1% from the previous month, a decrease from the 0.9% monthly jump recorded in October and less than the 0.2% many analysts predicted for November. Some of the slowdown in spending reflects a shift in demand from goods to services, along with slowing price increases that lowered the total dollar amount spent.

More importantly the core PCE index, which excludes food and energy costs and is the Fed's favored metric for tracking inflation, rose just 0.2% in November, down from 0.3% in October. That may still provide little relief for many families, however. Food prices saw their smallest gain in nearly a year, increasing just 0.3%. Prices for energy goods and services dropped by 1.5%. The index increased by 5.5% year-over-year in November, the smallest gain in 13 months.

The current U.S. inflation rate is 7.1% for the 12 months ending November 2022, a decrease from 7.7% in October and 9.1% in June. These decreased inflation rates are welcome news, but more work is needed to attain the Fed's 2% target level.

Fuel Prices Dip But Volatility Remains

Fuel prices are also declining after a turbulent year in 2022 when gasoline prices hit a record high of $5 per gallon nationally following the Russian invasion of Ukraine. By year-end, the national average dipped to around $3.06 per gallon and was even lower in some markets. This is a welcome relief for consumers and offers some positive news for the trucking industry, which has been grappling with the soaring price of diesel fuel, along with other cost increases.

While this decrease may benefit retail gasoline and diesel shipping pricing over the short-term, it portends other issues in the transportation supply chain related to demand. According to FreightWaves, FTR Transportation Intelligence reported that trucking conditions hit an 18-month low in October. The company's Trucking Conditions Index noted sharp increases in fuel and financing costs, along with unfavorable freight rates in its measurements. Declining diesel prices are a strong short-term boost for the industry and the impact of higher financing costs are expected to moderate by mid-year.

Analysts are predicting some volatility in fuel pricing in 2023, however, given the ongoing war in Ukraine, refinery disruptions and an increase in demand from the reopening of China's economy as its Zero Covid policy is loosened.

China to Re-emerge from COVID Isolation

After three years of a strict, government imposed COVID lockdown, China is about to re-emerge and reposition itself in the global economy. Given worldwide challenges with slowing growth, high inflation and energy shortages, the reopening could provide a much needed boost to worldwide trade. There is concern, however, that the reopening could be erratic and create a bumpy ride for China's economy and its trade partners.

China is also seeing a surge in COVID cases and has more limited vaccine options, which could dampen activity and lead to further health and economic issues in the months ahead. According to DC Velocity, one of the biggest supply chain risks of 2023 is a potential surge in COVID cases in China that could hamper manufacturing capabilities and disrupt supply chains again.

Positive signs, real estate benefits

The U.S. supply chain is well positioned for China's reopening and is expected to see minimal disruption from it. Many businesses have already adapted to the current slowdown in China's trade flow and have reshaped their supply chains to include other trade partners and an increase in domestic warehousing.

While the economy is still in a transitionary stage, the outlook is more stable for the near term. Several headwinds have softened and the overall market sentiment reflects an economy on the mend -- hopefully without many additional periods of volatility.

Download Economic and REIT Indicators

Sources: FreightWaves, MarketWatch, Reuters