Indicators are mixed as the economy continues to recalibrate

Nearly 18 months after interest rates began to rise, there are signs that inflation is losing its grip on the U.S. economy. With interest rates at a 22-year high, however, commercial investment activity remains constrained. A slowdown in consumer spending is impacting many parts of the economy, including freight volumes. In this issue, we look at key economic indicators that shape the industrial world and the outlook heading into the fall.

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Inflation cools but headwinds persist

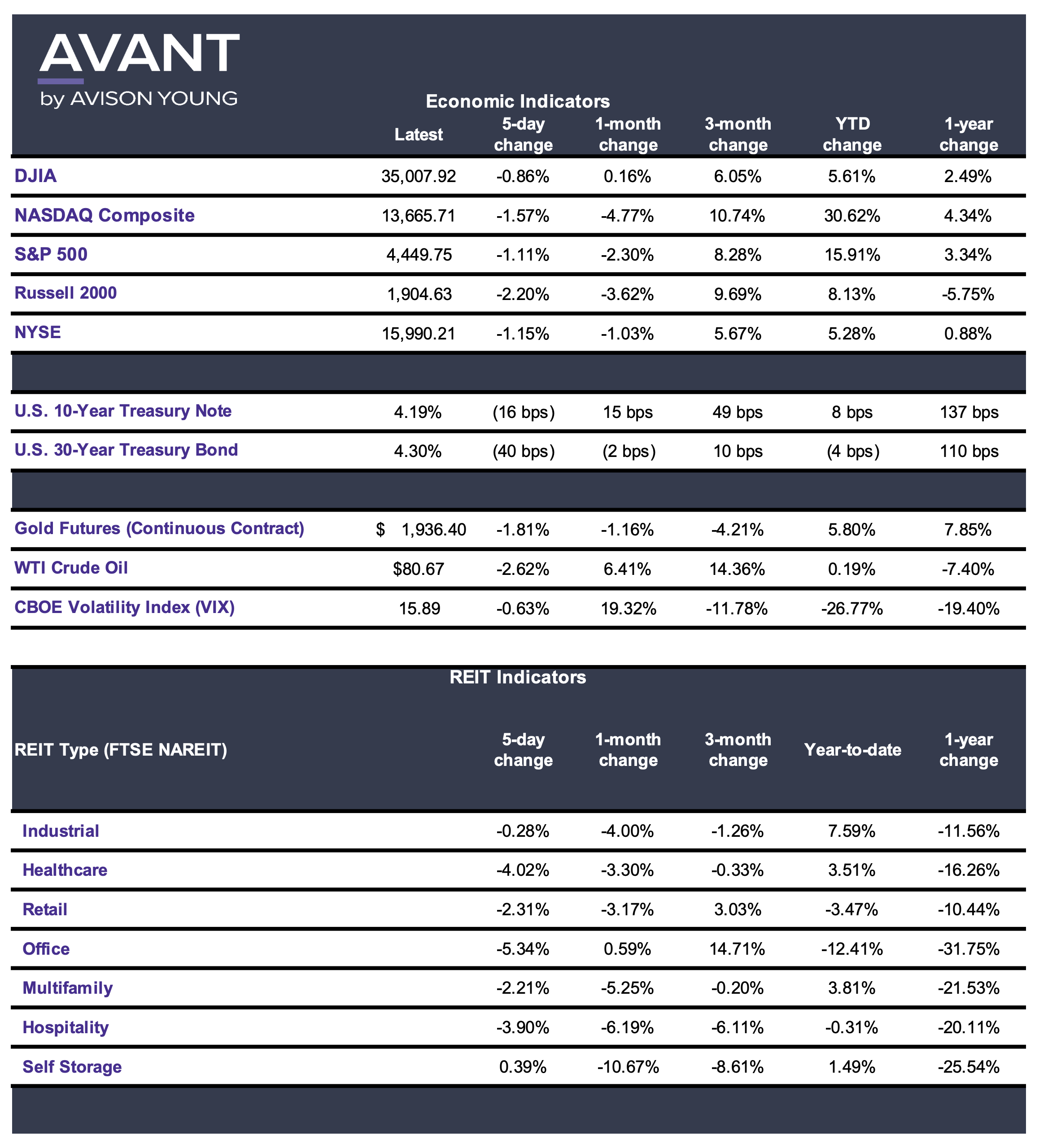

The battle between inflation and rising interest rates has become a familiar one over the past 18 months. A look at economic indicators in August shows that higher rates are having a notable impact and inflation is loosening its grip on the U.S. economy. The Consumer Price Index (CPI) for July rose 3.2% when viewed on an annual basis, an increase that was slightly below expectations. The core CPI, which excludes volatile food and energy prices, reached 4.7%. Both measures were up 0.2% from the previous month. Almost all of the monthly inflation increase came from shelter costs, which rose 0.4% and were up 7.7% from a year ago.

After adjusting for inflation, real wages increased 0.3% over June numbers and were up 1.1% from a year ago. While inflation has come well off its high of 9.1% in June of 2022, it is still above the 2% target rate for the Federal Reserve. The Federal Reserve has raised rates 11 times since March of 2022, with the most recent one in July bringing the federal funds rate to 5.25% to 5.5%. And, there may be another rate increase in the near term, given comments from Federal Reserve Chairman Jerome Powell at the Fed’s recent Jackson Hole Economic Symposium. He said the central bank will proceed carefully, but there is more work to do to cool the economy.

A look at second quarter 2023 capital markets activity found that commercial debt originations have declined by approximately 50 percent from a year ago. The good news is that there is plenty of pent-up demand and dry powder on the sidelines, but the industry is also facing more than $600 billion in debt maturities over the next three years.

According to MSCI, all U.S. commercial property sectors posted annual price declines in July as deal activity reached the lowest level of any month since the onset of the pandemic in early 2020. The RCA CCPI National All-Property Index declined by 9.6% from a year ago and increased by 0.3% in June. The industrial sector slipped just 1.7% from a year ago compared, showing its continued resilience. The other sectors showed higher declines: multifamily fell by 12.2%; office, fell by 7.5% (suburban) and 9.3% (CBD); and retail fell 8.2.

Freight Declines Amid Shrinking Demand

While a recession has not (yet?) hit the U.S. economy, some sectors of the industrial world have been adversely impacted by the instability in the post-pandemic economy. The freight industry saw peak activity during the pandemic and then, more recently, a slump that has slowed activity across the transportation sector.

The August 24 Drewry World Container Index, which tracks global shipping, showed a decline of 70.5% from a year ago. This decline correlates with a drop in consumer spending that has negatively impacted retail shopping and the freight sectors. The composite index of $1,768.33 per 40-foot container is 83% below the peak of $10,377 from September of 2021 and 34% lower than the 10-year average of $2,682. This indicates a return to more normalcy but still remains nearly 25% higher than the average in 2019, before the pandemic sent rates soaring.

The index showed that freight rates declined by 5% for the Shanghai to Los Angeles route and declined by 3% from Shanghai to New York. Drewry expects East-West rates to be stable in the next few weeks. Long term, it expects combined spot and contract rates to fall by a third in 2024 due to weak demand, over-capacity and predatory pricing by some carriers.

Trucking activity has also declined due to slowing consumer demand, disruption at the ports and other factors. According to the latest DAT Freight & Analytics report, truckload freight volumes fell by 7% monthly in July and were 3% lower year-over year. Despite the declines, some trucking sectors saw the highest numbers on record for July given demand for fresh and frozen food, metals, machinery and other seasonal freight.

The challenges in the trucking industry are forcing some operators out of business. A recent survey by Truckstop, a freight matching service, and Bloomberg Intelligence showed declining rates and increases costs have brought the spot trucking market to a critical juncture. About 10% of carriers who took part in the survey noted plans to cease operations in the next six months to join larger carriers or go out of business. More than half reported moving fewer loads in the second quarter of 2023 than they did a year ago. The report also expressed optimism that rates are near their bottom and are poised to rise. The timing on that type of recovery is unclear, however.

Despite rising interest rates and a constrained lending environment, industrial continues to perform better than other asset classes. Long-term demand remains positive, vacancy rates are low and there is solid rent growth and leasing activity across the country. The next 6 to 12 months will provide more clarity on the direction of key economic indicators and when inflation will be fully under control from the Federal Reserve’s perspective.

Sources: Business Insider, ING, The Load Star