National industrial developers weigh-in on market challenges

Navigating a challenging development cycle

A wave of industrial construction is hitting the market at a time of moderating demand and ongoing economic uncertainty. Long-term industrial asset demand drivers remain strong, but tenants are taking longer to commit and in some rare occasions users are scaling back on space usage or waiting for more clarity on the economic before committing. In this issue we talked with national development experts to find out how they are navigating these conditions and what’s ahead for the next 12 to 18 months.

Principal

Head of Industrial Capital Markets

Erik.Foster@avisonyoung.com

+1 312.273.9486

The U.S. industrial sector is seeing a large wave of new deliveries at a time of ongoing economic uncertainty and a correlating slowdown in tenant demand. The outlook remains positive, but, as total inventory growth continues to outpace historic trends, there are concerns about over-supply in some markets.

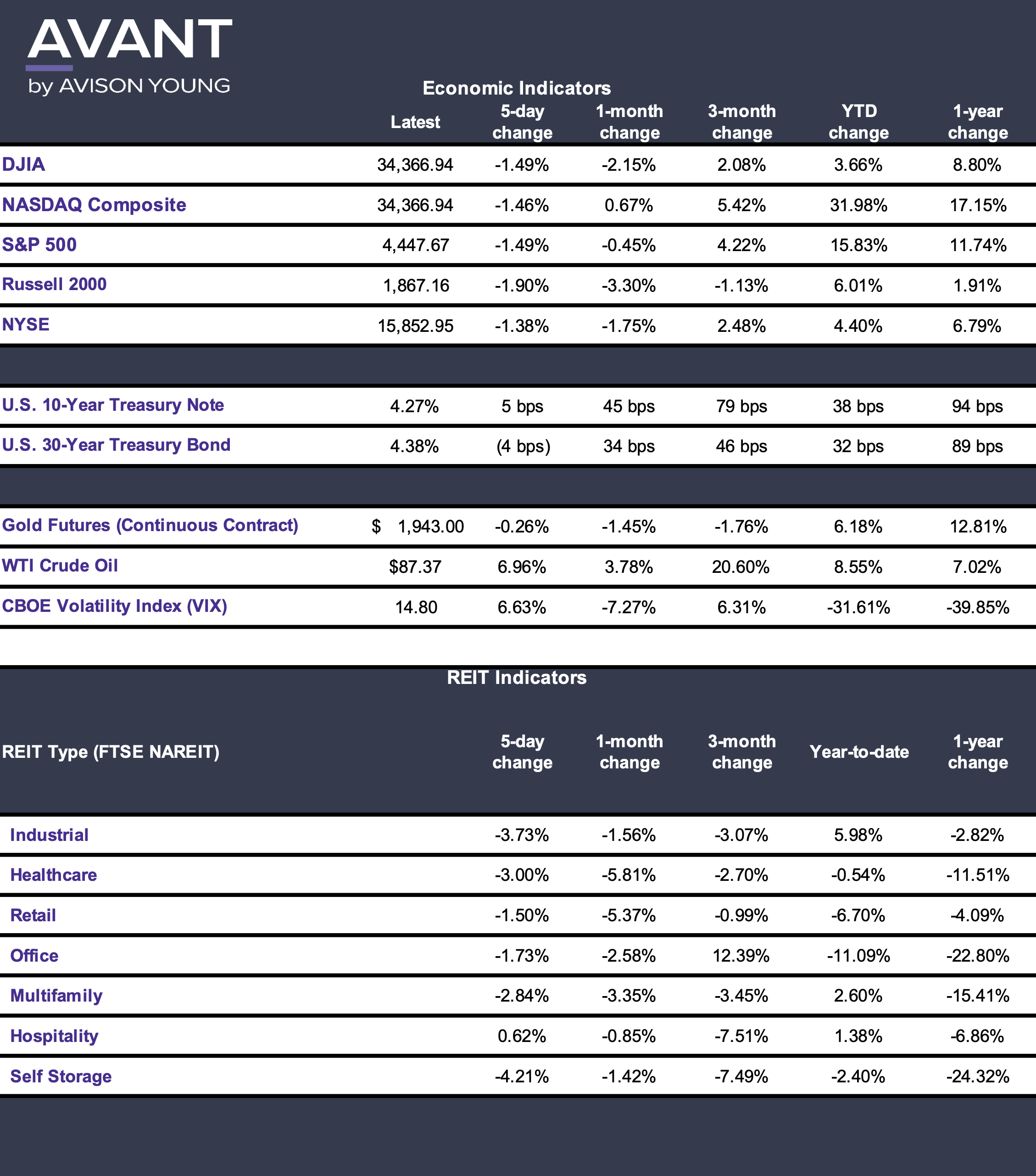

Avison Young reached out to several development experts to gauge their sentiment on market conditions and how they are navigating this challenging environment. While the short-term outlook is shaped by ongoing uncertainty about interest rates and other market indicators, there is significant optimism about the long-term demand drivers for industrial development. This is particularly true for coastal and port markets tied to expanding population centers.

“We continue to execute on our projects in process, where our investments are largely in land constrained, coastal-oriented markets,” said Jojo Yap, Chief Investment Officer for First Industrial Realty Trust. “Future starts will be driven by leasing progress and an evaluation of submarket and macro dynamics.”

In the short-term, many developers are focused more closely on minimizing risk in development planning and construction, and closely monitoring tenant demand indicators. “We’re focusing on port, rail, intermodal, and trucking activity and are listening to where tenants are seeing growth or contraction,” says Michael Murphy, Chief Development Officer with CenterPoint Properties, which had $190 million in new development starts in FY 2023, which ended June 30.

He added that CenterPoint is taking a more tactical and focused approach to new development opportunities in today’s economy. “For deals already in the pipeline, that means pushing rents where possible and being more strategic in finding tenants earlier in the development cycle.”

Where’s the spec?

Developers are also turning away from speculative development or pursuing it selectively based on market dynamics. Many are also being more flexible with their building designs. “We have consistently designed our speculative buildings for single-tenant or multi-tenant occupancy,” said Murphy. “In the past, market demand didn’t require us to divide buildings. However, we are now more receptive to dividing up a building for multiple tenants.”

Overall, developers are having to shift and turn in an environment filled with uncertainty caused by higher interest rates and increasing cap rates. “It will take time for the market to absorb all these changes,” said Jeff Dillon, Chief Operating Officer for VanTrust Real Estate. “As a result, sales transaction volume is off significantly. Deals are happening but there is a lot of uncertainty, which creates a bid-ask gap in many instances. To get deals done, you need to match up the motivations of each party.”

Dillon noted the need to regularly stress tested projects to make sure the underwriting makes sense. “It also takes constant communication and collaboration amongst our internal and external team across the country to stay ahead of potential issues and allow time for problem solving,” he said.

That uncertainty is also being felt on the tenant side, as companies weigh their space decisions and debate when and whether to expand or enter a new market. While overall activity is good, tenants are taking longer to make decisions due to market conditions and the level of certainty about the economy, business growth and inventory levels.

“In the last 24 months, when vacancies were extremely low and demand was high, tenants didn’t have a lot of time to decide whether to take a space,” said Don Schoenheider, Executive Vice President, Market Leader overseeing Midwest markets for Hillwood Investment Properties. “With the lack of certainty in the economy, the timeline takes longer and sometimes they hit a window where it’s easier to just stay in place.”

Fundamentals remain strong

Despite uncertainty in the economy and a higher interest rate environment, industrial fundamentals remain solid. “Fundamentals remain good, with national vacancy at just 3.7 percent,” said Yap. “Supply chain needs continue to evolve. We hope for further clarity on the economic picture and interest rates in the coming months to help motivate tenant activity and decision making on incremental supply chain commitments.”

Although vacancy is likely to rise in the short-term due to the influx of new development, industrial rents continue their upward trajectory. Avison Young research shows U.S. asking rents reached $9.27 at Q2 2023, after steady increased since 2016 and sharper increase from $7.50 at the end of 2022.

“We are fortunate that we are not seeing any real deterioration in rental rates within our developments and across the industry -- yet,” said Schoenheider. “We’re all holding our breath to see what the next six months brings. We saw a meaningful slowdown in activity this summer, but that is typical during the summer months. We’re beginning to see some pickup and hope that continues. We’re cautiously optimistic about the next 6 to 12 months.

Yap noted that a number of markets have some near-term supply to work through. “So, for us, as always, we need to assess submarket specific conditions and continue to make progress in leasing projects already underway,” he said. “Build-to-activity is tough to predict and moving from concept and design to a transaction can take time.”

The development sector is moving through challenging times, but it buoyed by an economy in recovery, a more positive inflation outlook, and low vacancy rates across most markets. “The market continues to be choppy: leasing activity is certainly slower, but there is decent tenant demand in most markets,” said Dillon. “We still think, despite all the volatility, there is a strong investment thesis for industrial real estate. That is not going away. We’re just trying to transition into a new market dynamic without the benefits of cheap money.”

Source: AVANT by Avison Young research