What’s ahead for industrial in 2024?

With 2024 just around the corner, the commercial real estate industry continues to face many challenges due to the fallout of rising interest rates. While the industrial sector is in a unique position to weather these challenges, it is not immune to the challenge of higher borrowing costs and the uncertainty that is keeping some investors and tenants on the sidelines. The economy is showing signs of improvement, but we are not out of the woods yet. Here’s what’s ahead as we turn the page from 2023.

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

2024 Outlook: Industrial shows resilience but uncertainty lingers

As 2024 approaches, the commercial real estate industry continues to face many challenges due to higher capital costs, a stubborn bid-ask spread and uncertainty around tenant demand. Trillions of dollars in loan maturities are coming due across all asset classes, with many facing refinancing hurdles.

While the industrial sector is in a unique position to weather these challenges, it is not immune to the fallout. Investment activity remains constrained due to higher interest rates and many large occupiers are retrenching because of economic issues and uncertainty in the market. This pull back in tenant demand is occurring as a large wave of new completions hits the market.

Industrial fundamentals remain strong, but are moderating to reflect the current environment. Rent growth has been strong, with a national average around 7.5%, but reaching into double digits growth in many top markets. In Chicago, for example, average rents are $7.10 psf, a 24.7% increase since 2019. Rents in Dallas-Fort Worth average $7.29, a 15% increase since the end of 2022.

Across U.S. markets, much of the growth is attributed to expansion in e-commerce, logistics and manufacturing. E-commerce and retail spending has increase by more than 30.2% since the start of 2020, with e-commerce reaching 15.4% of overall retail sales, according to Avison Young research. The large influx of industrial space is expected to push up vacancy a bit in some markets and could temper rent growth in the short-term.

There are several signs of strength in the economy and projections for a softer landing than many expected at the beginning of 2023. Inflation has dropped significantly and gross domestic product (GDP) growth was strong in the third quarter. Employment growth also continues to outpace many economists’ projections.

The economic outlook

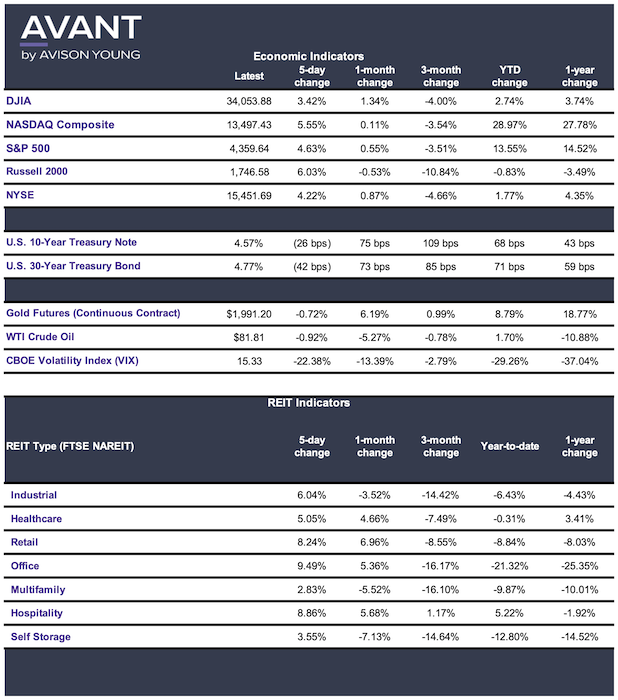

As expected, the Federal Reserve kept the Overnight Federal Funds Rate steady at 5.25% to 5.50% in November, where it has been since July. This is the second consecutive meeting when the Fed kept rates stable as it continues to gauge the health of the economy. The Fed expressed positive sentiments on economic activity, noting strong expansion in the third quarter and a moderated but strong level of employment growth.

Core inflation is down to 3.7% on an annualized basis, a significant improvement from the 9.1% rate recorded in June of 2022. The Fed continues to focus on achieving a 2% inflation level, however, keeping the prospects of another interest rate hike on the table.

GDP also recorded significant expansion, reaching a robust 4.9% growth rate from July through September, with nonfarm payroll growth reaching 336,000 in September. This level was well ahead of the outlook from Wall Street. This growth showed that consumers continue to splurge on items such as clothing, restaurants, vacations, and concert ticket despite higher prices, rising interest rates and forecasts of a recession. This was the fastest rate of expansion in the past two year and was more than twice the 2.1% annual rate of the previous quarter. Consumer savings has dropped notably, however, raising concerns about credit card debt and a decrease in spending levels.

As part of the third quarter growth, many businesses built up their stockpile of goods in warehouses and in stores. The increase in inventories accounted for about a quarter of the quarterly growth, but is not expected to repeat in the coming months. Economists are expecting GDP growth to decelerate heading into 2024 as higher interest rates and long-term borrowing rates chip away at business and consumer spending.

Industrial sales shift away from portfolios

According to Avison Young research, U.S. industrial portfolio transactions in the third quarter were on pace for their smallest yearly volume since 2016, as single asset transactions continue to disproportionately transact in the current interest rate environment. There were approximately $62 billion in total investment sales through the third quarter, included about $42 billion in individual property sales. This compares with approximately $160 billion in total sales for 2022, with $100 billion of those from individual properties.

Industrial pricing has retained the gains experienced during the pandemic better than any other peer sector due to the low exposure of maturing debt and the strength of continued demand. Investors continue to focus on cash flow improvement opportunities within industrial assets that do trade.

Industrial construction outlook

Industrial demand remains robust throughout the country, but a flood of new deliveries is driving vacancy higher in many markets and decreasing net absorption. While a high level of new industrial construction delivered to the market over the past year, the challenging financial environment has slowed new groundbreakings. This uneven flow is expected to create a large gap in new supply over the next 12 to 18 months, according to Avison Young research. Future new industrial completions will be extremely limited, as has been experienced in previous volatile environments, such as the four-year period after the 2007-2008 Global Financial Crisis and, to a lesser extent, the new space gap in 2021 following the onset of the pandemic.

Trillions in loan maturities in the pipeline

The commercial real estate industry is facing a significant wave of loan maturities coming due in a high interest rate environment. These loans are primarily in the office, multifamily and retail sectors. A review of Federal Reserve Flow of Funds data by Trepp showed $2.8 trillion in commercial loans coming due by 2027, including $537 billion of loans in 2023 and $540.6 billion in 2024.

There are many challenges to refinancing those loans, given the drop in property valuations, most notably in the office sector, and a shift toward more restrictive lending parameters. Trepp notes that many of the maturing loans were secured at a time of lower rates and less restrictive lending requirements that allowed larger amounts of leverage. Many of those deals will be difficult to refinance in today’s market.

According to Preqin, there is approximately $20 billion of capital designated for the U.S. commercial real estate market, but many investors are waiting for a pricing reset before reentering the market. This process could take another six to 12 months. And, as the 10-year Treasury hovering around 4.5%, some industry experts are concerned that investors will stick with that more certain investment rather than take on more risk in real estate.

Many in the commercial real estate sector have voice the “Stay alive to 2025” mantra as they look forward and try to put the turmoil of higher interest rates behind them. While there are many challenges looming for 2024, there is also good news regarding long-term demand drivers and the potential for opportunity as this cycle winds its way forward.