Finding debt and equity in today’s market

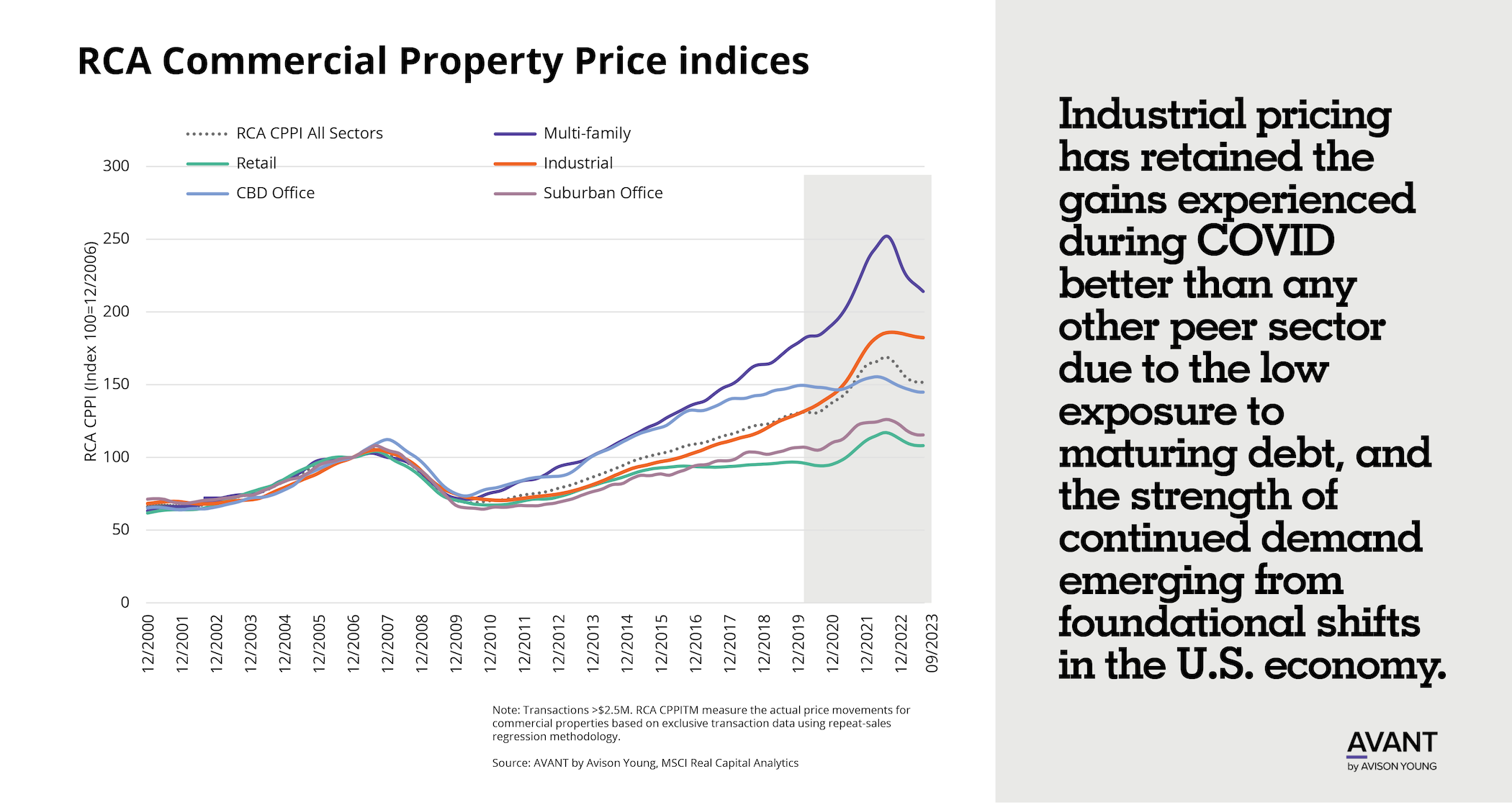

The dramatic boost in interest rates over the past 20 months continues to challenge deal flow, but there are some promising signs for the industrial sector. There is an enormous amount of liquidity to invest in commercial real estate, with industrial continuing to rank as a top choice. In this issue, we discuss the current debt and equity environment and the diverse range of capital sources available to help investors navigate the current market.

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

The dramatic boost in interest rates over the past 20 months continues to challenge commercial property investment and prevent many transactions from moving through the pipeline. Higher capital costs, more restrictive lending requirements and a lack of price discovery have led to a dramatic drop in commercial lending since rates started increasing in March 2022.

The good news is that, despite myriad economic challenges, there are deals transacting. How are they getting through and what’s the key to success in today’s market? “There is still an enormous amount of liquidity to invest in commercial real estate and industrial is among the most important asset class for a wide segment of investors,” says Scott A. Singer, Principal and Co-Lead of Avison Young’s New York City Tri-State Debt & Equity Finance team.

The challenge today is finding the right mix of factors – from debt and equity combinations to tenant and locational characteristics -- that can support moving a deal to completion. Here’s a look at how deals are getting done in today’s more restrictive capital environment.

Lending forecasts remain restrained

Commercial property lending has dropped dramatically since March 2022, as 11 rate hikes pushed the Overnight Federal Funds rate from near zero to the 5.25% to 5.5% range in Q3 of 2023. While the Fed has held the rate steady during its last two meetings, the ongoing uncertainty about future rate hikes has kept many investors on the sidelines.

According to a recent Fitch Ratings report, all U.S. banks will need to take defensive measures to conserve capital over the next year amid expectations for higher losses. Given higher interest rates and capital costs, there are fewer revenue opportunities and more issues with credit quality, the report notes. This creates challenges for commercial real estate as small and large banks move in opposite directions, with small banks growing loans and the large deposits and larger banks retrenching from commercial lending.

While banks are working through their challenges, there are many other debt and equity sources willing to fill the void, although in a more methodical way than during the flurry of activity during and immediately following the pandemic. Some experts point to a gradual loosening of credit, a resetting of cap rates and the realization that the Fed’s rate hikes are nearing an end. This should lead to an increase in deal volume in the second half of 2024.

In the industrial sector, warehousing and manufacturing assets with strong fundamentals and locational qualities are in high demand, but the investment approach is more tempered today. Overall, institutional capital sources are more cautious and fund investors tend to be more opportunistic.

“Both types of sources have liquidity for industrial assets in this environment and in fact there is some counter-intuitive mixing between them,” says Singer. “Certain investment funds have received separate account allocations from institutional investors and some institutions have also begun seeking more opportunistic returns – pushing them towards development and value add transactions.”

While reaching the finish line is a challenge, there are a wide range of equity sources expressing interest in industrial transactions, from ultra-high net worth individuals to family offices and sovereign wealth funds, in addition to the investment funds and institutions mentioned above.

Getting across the finish line

As capital sources look to transact while also managing their risks, there is a flight to quality that injects more stringent requirements on property type, location, tenancy, rent flow escalations, lease terms and other factors. Transactions that are strong in all aspects will check the most boxes for lenders and attract the least expensive capital. Deals with any significant issues will require double-digit returns even at the senior debt level, says Singer.

Deals that have a few flaws face more hurdles. A large logistics company deal in a tertiary market may be better than an average tenant in a hot market for some investors, whereas others may have redlined the tertiary markets altogether.

Loan sizing has also shifted downward, given that borrowing rates for all assets and deal types have increased by at least 200 to 400 basis points, which is having a notable impact on debt service coverage. This has made equity placement a critical component of current deal flow. “The primary challenge will be reaching a meeting of the minds on value and control between existing owner and new investor, but motivated parties connected by an experienced and creative intermediary are reaching solutions and many productive new relationships are beginning,” says Singer.

What’s the forecast for commercial lending?

While investor interest remains strong, it is not enough to keep overall transaction volumes in line with recent performance. According to the October Mortgage Bankers Association (MBA) lending forecast, lending for commercial and multifamily properties is expected to fall to $442 billion for the year. This is a 46% decline from the $816 billion level recorded in 2022. Higher interest rates continue to stall transaction flow and delay the pricing discovery needed to reset valuations and bring more investors back into the market.

The MBA notes that commercial mortgage originations have historically followed property prices, but the uncertainty around the interest rate trajectory has contributed to the transaction slowdown. If interest rates and cap rates were to fall, it should boost property values and encourage additional borrowing. The forecast is for rates to remain higher for longer, however, which will likely constrain activity.

Third quarter commercial real estate activity reflected these trends and is prompting many investors to shift their focus past the typically busy fourth quarter toward 2024. And, Federal Reserve Board Chairman Jerome Powell has indicated that interest rates will remain elevated in the near term, which pushes off the likelihood of lower rates until mid-to-late 2024.