Top industrial locations driving logistics growth

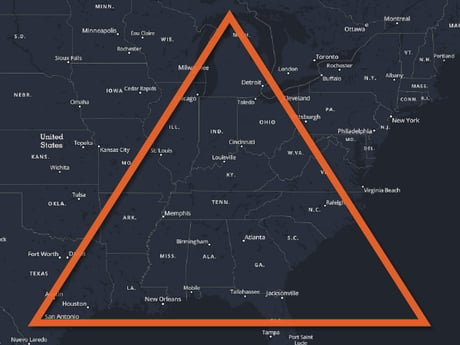

As logistics activity continues to align with growing population centers, a region CCIM calls the “Golden Triangle” has become important due to its proximity to 70% of the U.S. population. Many of the markets in that region -- from the Heartland to the Southeast and Southwest -- are also on the radar for investors, as the try to tap into growing industrial hubs. Here’s what our research is showing about why this region is drawing so much attention.

Principal

Head of Industrial Capital Markets

Erik.Foster@avisonyoung.com

+1 312.273.9486

Industrial’s “Golden Triangle” is epicenter of logistics growth

As population growth and consumer buying patterns continue to shape logistics activity, the “Golden Triangle” region, as noted by the Certified Commercial Investment (CCIM) Institute, has become the epicenter for logistics infrastructure. The region stretches from the Midwest down through the Southeast and over to the Southwest, encompassing burgeoning markets such as Nashville, Charlotte, Raleigh, Atlanta, Orlando and Houston. The region accounts for more than half of the U.S. GDP and is within a day’s drive to 70% of the U.S. population.

The Golden Triangle also provides the logistics infrastructure for efficiently moving goods along the north-south corridors connecting the U.S. to Canada and Mexico. The region encompasses five of the seven Class I railroads and contains more ports than any other region in the country, including growing ports in Savannah, Charleston and Houston. The region also includes states that are the largest beneficiaries of the surge in East Coast port activity and the continued investment in advanced manufacturing.

Six of the top 10 states with a notable increase in manufacturing construction are located within the Golden Triangle. Those include Michigan, Ohio, Kentucky, Tennessee, Georgia and Missouri, according to Oxford Economics.

Expanding population drives logistics growth

Several of the growing markets in this region are emerging port markets which are benefitting from continued diversification of points of entry for imports. New investments in additional ports such as the Port of Mobile is expected to offer additional options to logistics companies. And, the railroad merger of Canadian Pacific with Kansas City Southern will boost transportation options in that region and allow full North American coverage for rail service.

One East Coast port market to note is Charleston, which has invested $2 billion investment into port modernization that is helping to bring advanced manufacturing and other industries to the area. This market also stands out due to its ability to attract investor attention, despite the current interest rates environment.

According to Avison Young research, the Charleston industrial market recorded $580.3 million of investment activity in 2023, its highest annual sales volume in history. Due to high demand for proximity to the port, distribution buildings accounted for 78% of the volume. Notably, warehouse facilities have experienced a surge in investment sale volume, increasing from $91.3 million at the end of 2022 to $105.6 million by the close of 2023.

Charleston recorded 8.7 msf of industrial construction deliveries in 2023, a number that outpaced the five-year average for that market. Nearly half of those deliveries were composed of buildings larger than 500,000 square feet. Port activity remains strong, with loaded import container volumes reaching 2.27 million TEUS (the standard container cargo measurement) in 2023, slightly ahead of pre-pandemic levels, according to Avison Young research.

Among Florida’s growing industrial markets in this region is Tallahassee which recorded 4.2% annual employment growth in 2023. This growth reflects a thriving local economy which will fuel ongoing demand for industrial space, according to a recent Commercial Property Executive ranking of industrial markets. Along the Gulf Coast, Baton Rouge, had nearly 3.5 msf of industrial space under construction at the end of 2023, and Mobile currently has 3.3 msf in the pipeline, accounting for 8.6% of its total industrial inventory.

Industrial inventories increasing

Many industrial markets within the Golden Triangle region have seen significant construction growth over the past several years, particularly as the pandemic increased demand for online shopping. Dallas-Fort Worth, has recorded historic levels of new construction in recent years, expanding its industrial base by 193.1 msf since 2019. This translates to 100,000 net new industrial jobs, with 25,000 in the last year alone.

In Chicago, developers added 125.5 msf of new inventory since 2019, with 53% of that comprising big box inventory of 500,000 sf or larger. Atlanta added 125.1 msf since 2019, jumping from 21.8 msf in 2021 to 32.5 msf in 2022 before moderating to 28.4 msf in 2023.

As population shifts continue to draw industrial activity to growing markets along the center of the country and into the Southeast and Southwest, the Golden Triangle is expected to expand its presence as a vital region for supporting industrial logistics activity. Many of markets in the region are seeing record investments in advanced manufacturing, another factor that will support continued expansion in logistics and warehousing.

Sources: Avison Young AVANT, Commercial Property Executive