Q2 2025 U.S. multifamily market overview

Multifamily demand continues its strong performance through H1 2025, as absorption for major U.S. markets is now on pace to surpass 2024’s record breaking totals. Multifamily deliveries are expected to reach near all-time highs in 2025; by 2026, new delivery activity is projected to decline by -57.3%, while rents have started to see signs of growth, increasing by 1.8% since Q4 2024.

-10.4%

average quarter-over-quarter (QoQ) decline in construction starts over last four quarters

3.0%

increase in rents over last 12 months for major markets such as San Francisco, Manhattan, Chicago, and Silicon Valley

40.6%

of major markets have seen rents increase by +1.0% in last 12 months

+1.8%

increase in investment sales activity in H1 2025 compared to H1 2024

For more information, contact:

- U.S. Multifamily & Client Data Solutions Lead

- Research

Subscribe to receive national multifamily market reports and insights

Snackable multifamily market insights

-

.png/9a8b8bab-aa4a-9722-9f17-c20a3b6c7664?t=1715026919258) Las Vegas multifamily market soars by a 118% increase in deliveries from 2022 to 2023

Las Vegas multifamily market soars by a 118% increase in deliveries from 2022 to 2023 -

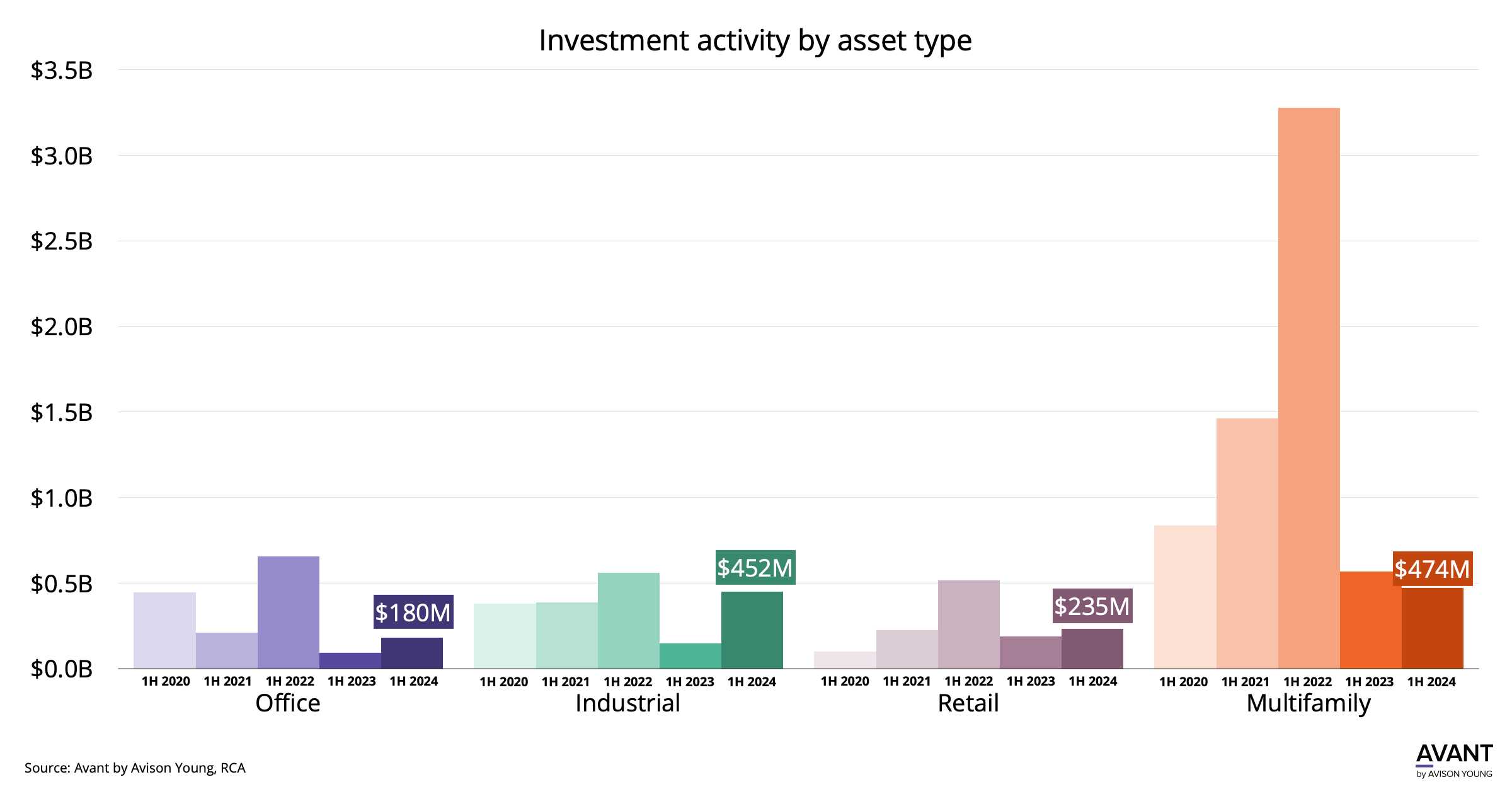

Nashville investment activity begins to rebound in the first half of 2024

Nashville investment activity begins to rebound in the first half of 2024 -

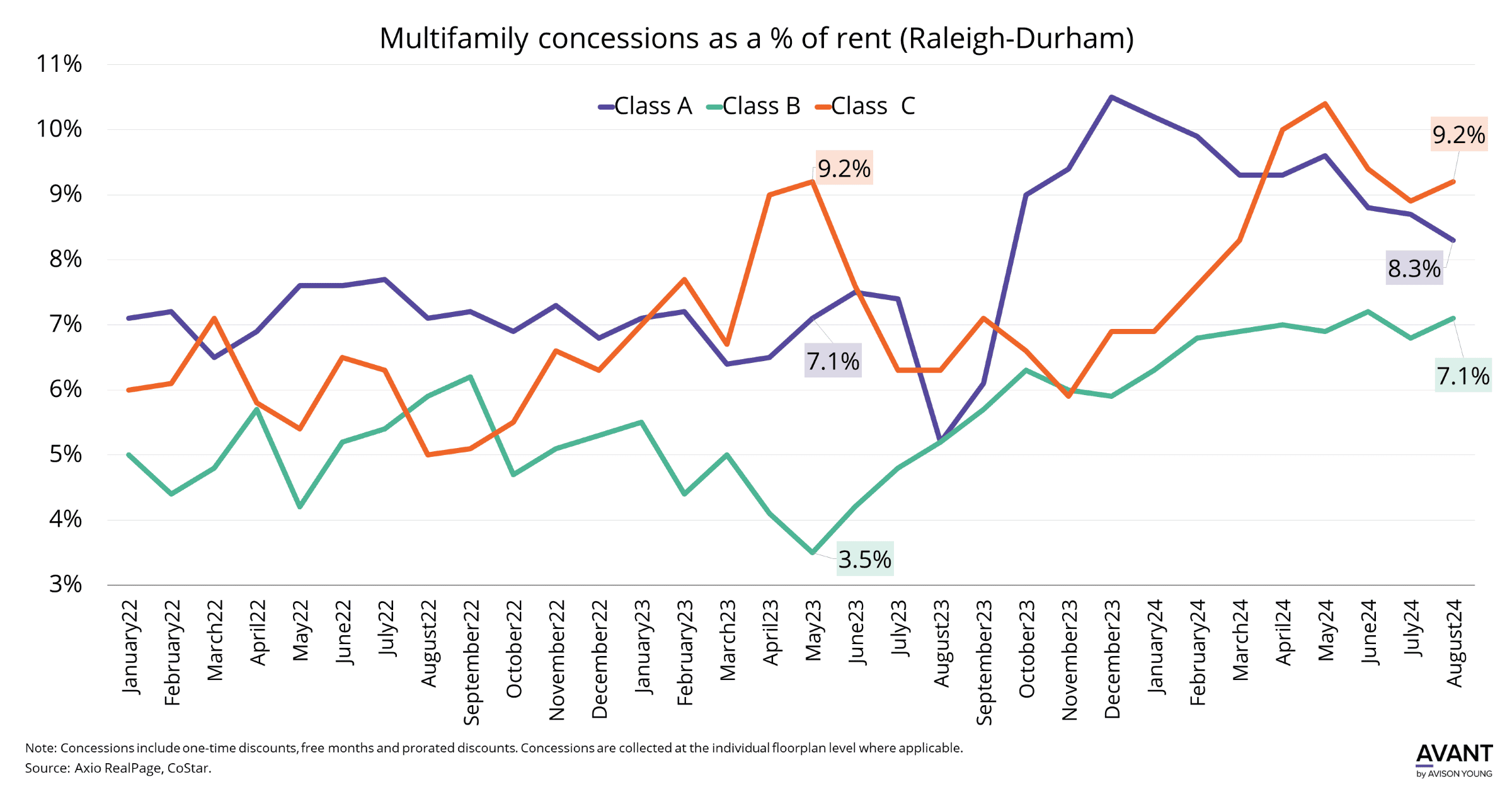

Raleigh-Durham multifamily sees hefty concession growth in classes B and C

Raleigh-Durham multifamily sees hefty concession growth in classes B and C -

Nashville investment activity across most sectors began to rebound in 2024

Nashville investment activity across most sectors began to rebound in 2024