Are Los Angeles office occupiers favoring mid-rise buildings over high-rises as businesses attempt to attract employees back into the office?

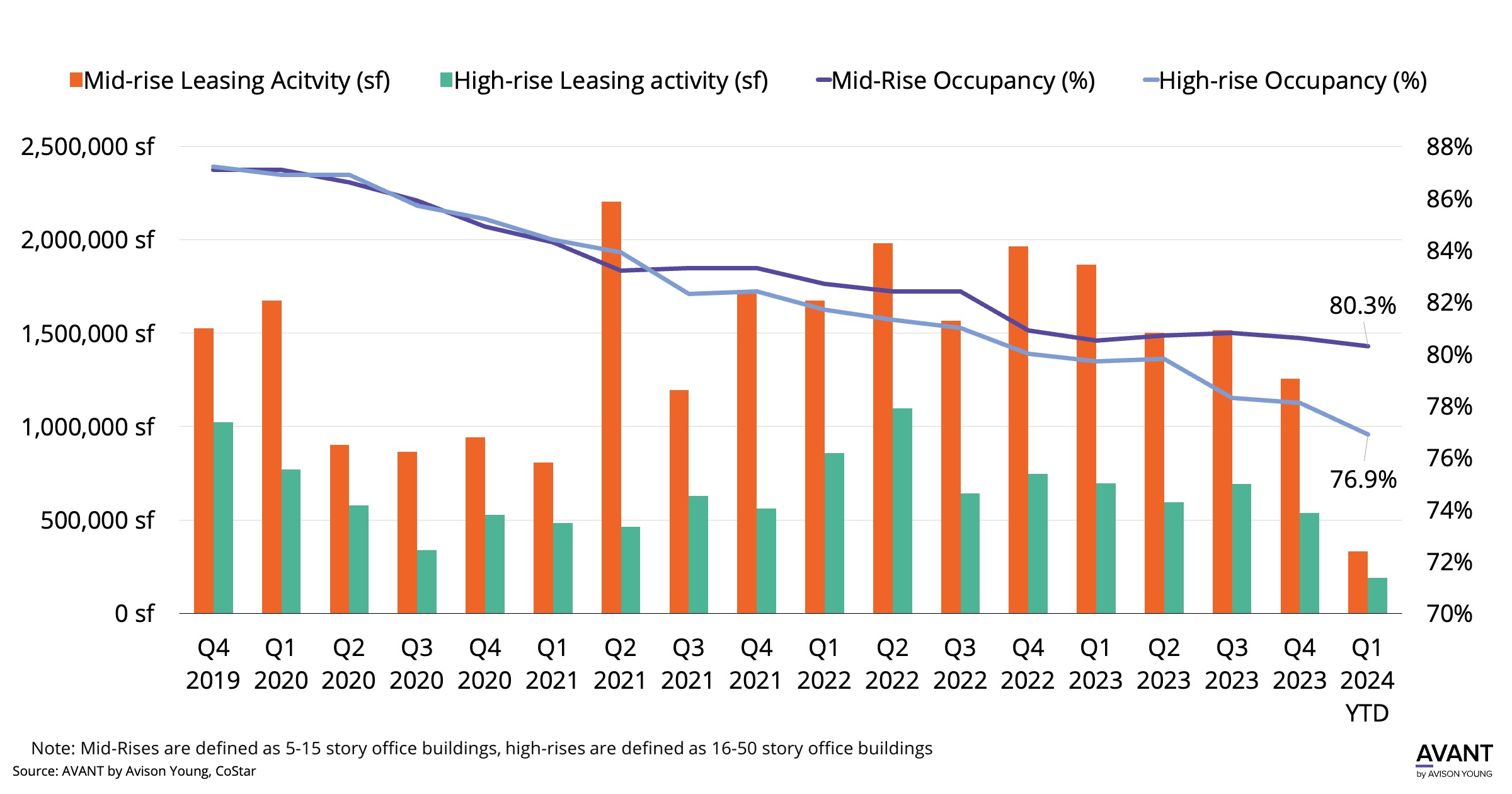

Leasing activity (sf) and occupancy (%) in LA mid-rise versus high-rise office buildings

Mid-rise office buildings have an occupancy of 80.3%, which is 3.4% higher than the high-rise occupancy of 76.9%. As of late, leasing activity has picked up in more suburban areas such as West LA and the San Fernando Valley, and we are beginning to see occupancy rates decreasing in submarkets concentrated with high-rise offices.

In 2023, mid-rises saw a total of 6.1msf of new leases signed, compared to 2.5msf for high-rise offices. On a practical note, most mid-rises in more suburban areas can provide better parking ratios along with better walk-scores to nearby restaurants and attractions, some important amenities occupiers are looking for to attract employees back into the office.

As businesses continue to implement “in office” work policies, we anticipate Los Angeles county will experience better leasing trends in 2024, especially in mid-rise suburban areas. As larger companies begin to explore new office options, traditional high-rise submarkets could experience additional hardships as occupiers widen their search for space to suburban areas that are able to provide additional amenities.

February 9, 2024