Holiday weekend visitation recovery to pre-pandemic levels continues to be uneven among U.S. retailers

- The National Retail Foundation estimates that, compared to 2022, holiday spending is expected to increase this year by 3% to 4%, bringing total holiday spending to just under $1 trillion. Online spending is expected to grow faster than in-store spending, rising between 7% to 9%, continuing to shift the notion of how consumers prepare for the gift-giving season.

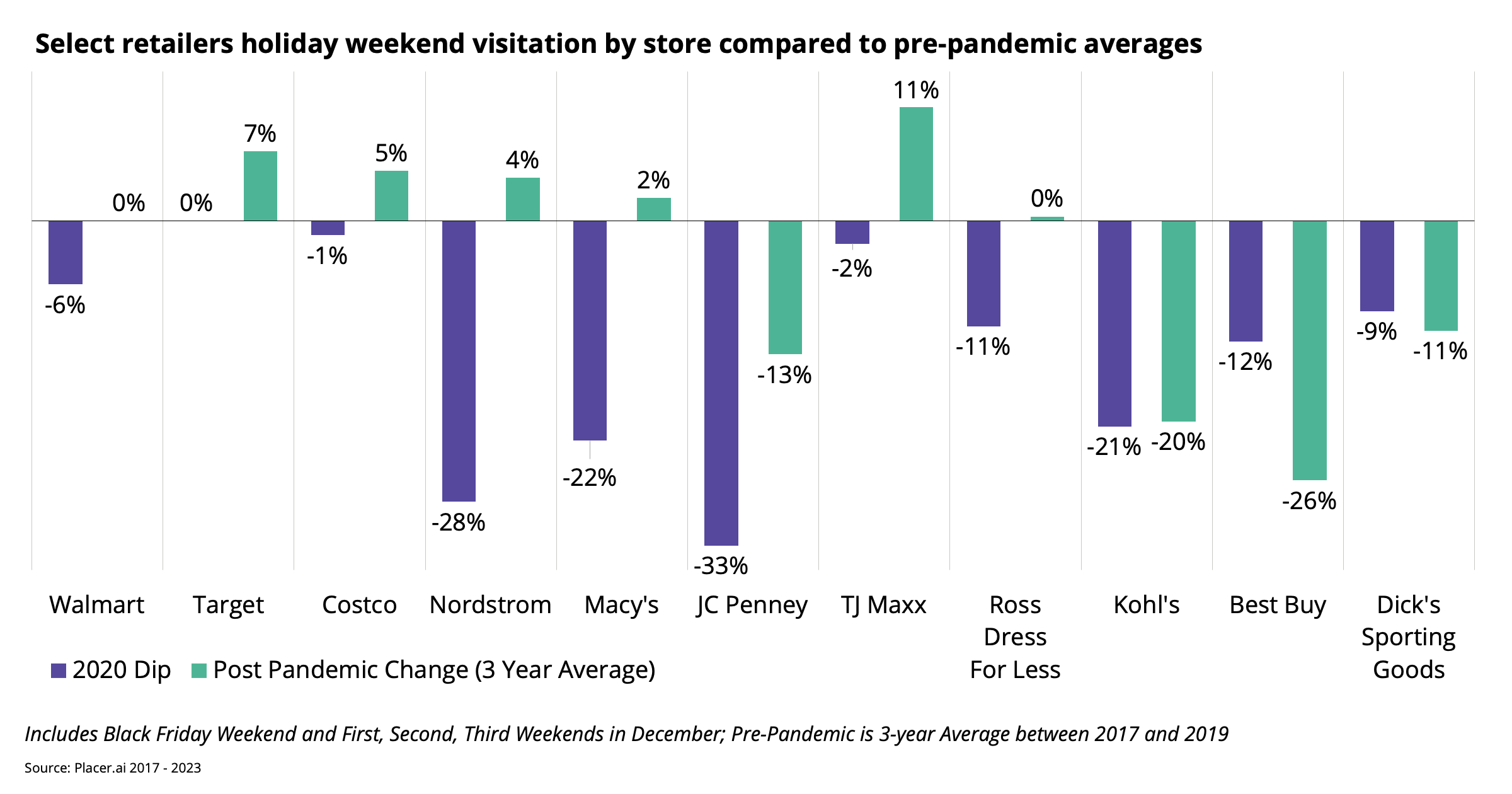

- Analysis of in-store visitation patterns reveals an uneven recovery across national retailers since 2017, with mass-merchandisers such as Walmart, Target, and Costco demonstrating resilience. They experienced minimal, if any, downturns in 2020 and have recovered single-digit percentage points above their pre-pandemic averages.

- Conversely, department stores encountered the most substantial decline in visitation during 2020, attributable in part to COVID restrictions at regional shopping centers. Yet, in 2023, despite ongoing initiatives for landlords to optimize store portfolios, consumers gravitated towards brands offering superior and higher-end product selections, demonstrating resilience in the higher-priced sector as well as the retail centers in which these brands are located.

- Discount and specialty big-box stores present a nuanced scenario, with some off-priced brands seeing a significant bump in visitation by store from their pre-pandemic averages, while more established brands with specialized merchandising have observed a reduction in visitation. This reduction could potentially be indicative of consumers increasingly favoring online deals within their websites or on platforms such as Amazon and Walmart.

January 3, 2024