Industrial property smaller than 200k sf is not all the same in Raleigh-Durham

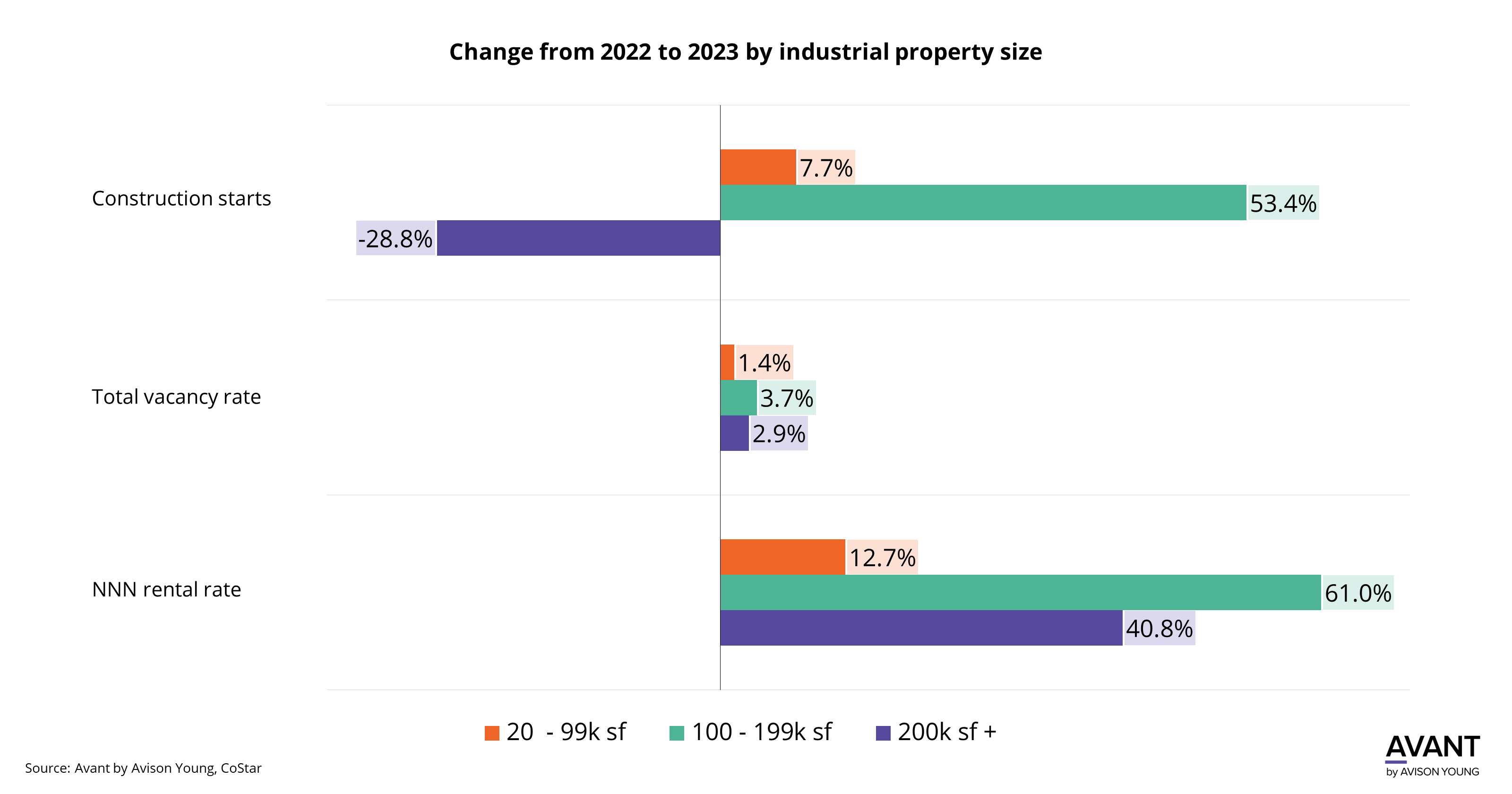

While the trend of increased industrial demand for properties smaller than 200k sf is real, in Raleigh-Durham properties with smaller than 100k sf have been more stable while properties in between 100k and 200k sf have seen more demand. While availability and rental rates soared for properties above 100k sf, construction starts experienced a 28% decline for properties larger than 200k sf.

In contrast, properties between 100k and 199k sf witnessed a noteworthy 53% increase in construction starts in 2023 over 2022. NNN rental rates increased in all property size buckets, but the largest increase was in properties between 100k and 199k sf where they increased 61% year over year. Total vacancy rates increased only slightly in all size buckets, and properties less than 100ksf had the smallest increase in vacancy.