The Manhattan office market is set to experience further distress as CMBS loan maturities draw near.

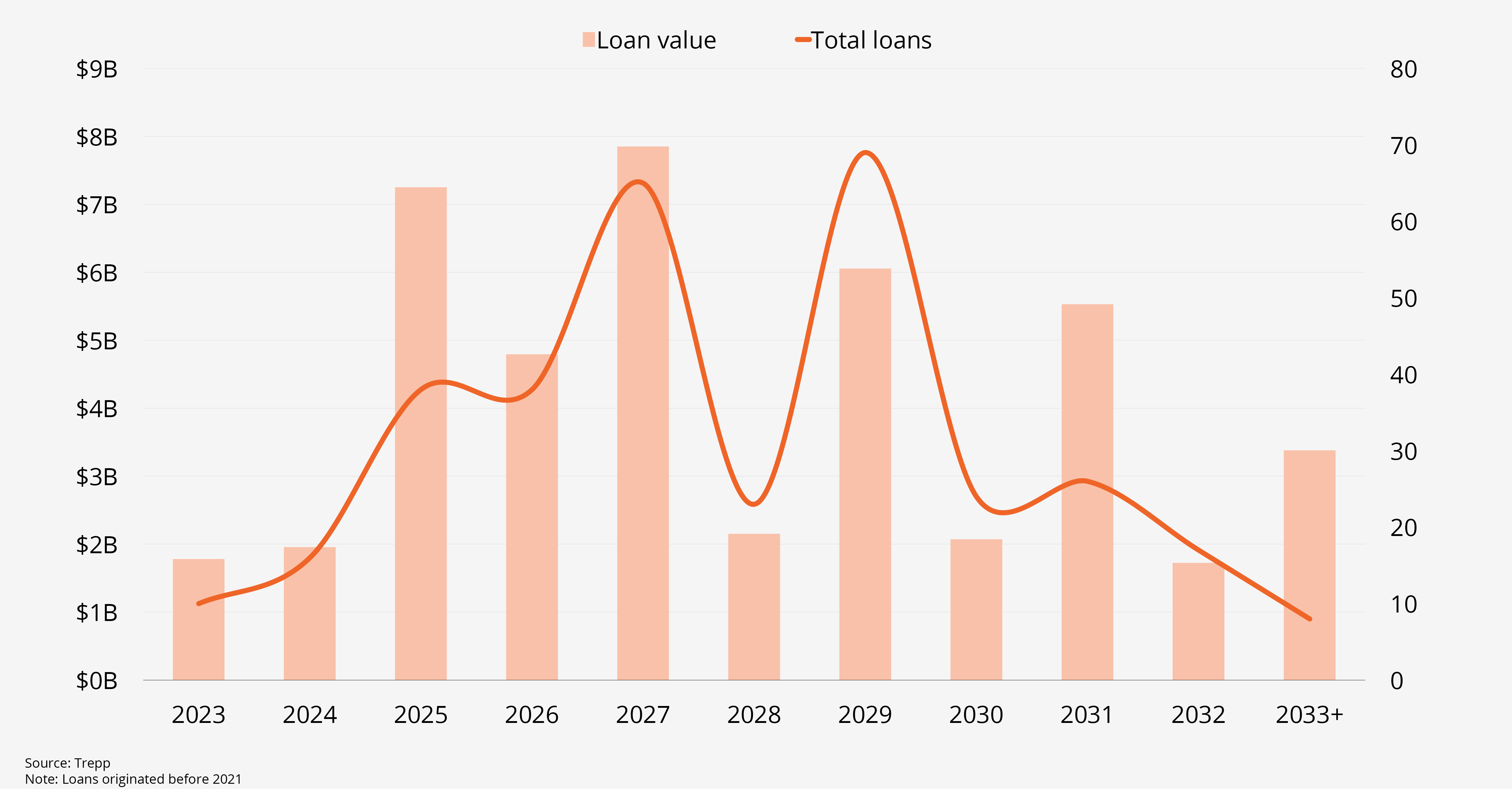

Fixed-rate CMBS office loan maturities

- The Manhattan office market has encountered significant challenges in recent years, primarily attributed to the impact of COVID-19 and the difficulties associated with bringing employees back to the office. Furthermore, the collapse of certain local banks and the escalation of interest rates have prompted real estate investors to exercise caution when making future investment decisions.

- In the next three years, a staggering amount of fixed-rate CMBS loans, exceeding $10 billion, will reach their maturity, with over $7 billion of these loans maturing in 2025 alone. This impending situation will compel numerous real estate investors to make critical choices: either relinquishing their properties or maintaining their office exposure within their investment portfolios.

- As stakeholders navigate through this uncertain economic landscape, the Manhattan office market is poised to experience a notable year, with each party developing their strategies to address the challenges ahead.

May 18, 2023

Get market intel

US-NY-NYC New York