Industrial provides solid returns amid uncertain environment

The industrial sector continues to lead all property sectors for pricing returns, a strong sign of its resilience and ability to attract investors, even in uncertain times. According to our data, overall property sales pricing showed improvements in recent months, with industrial recording the only positive annual growth in January. As we head toward a period of potential interest rate cuts and continued limited speculative construction, we expect investors to increase their industrial asset purchasing activity in the coming days and focus on this important asset class because of its track record of stability and clearly demonstrated strong rent growth potential.

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Industrial provides solid returns amid uncertain environment

U.S. property sales pricing showed improvement in recent months, with the industrial sector leading all other property sectors by a comfortable margin. While higher interest rates continue to impact commercial property sales, this improvement is a sign that better times are ahead.

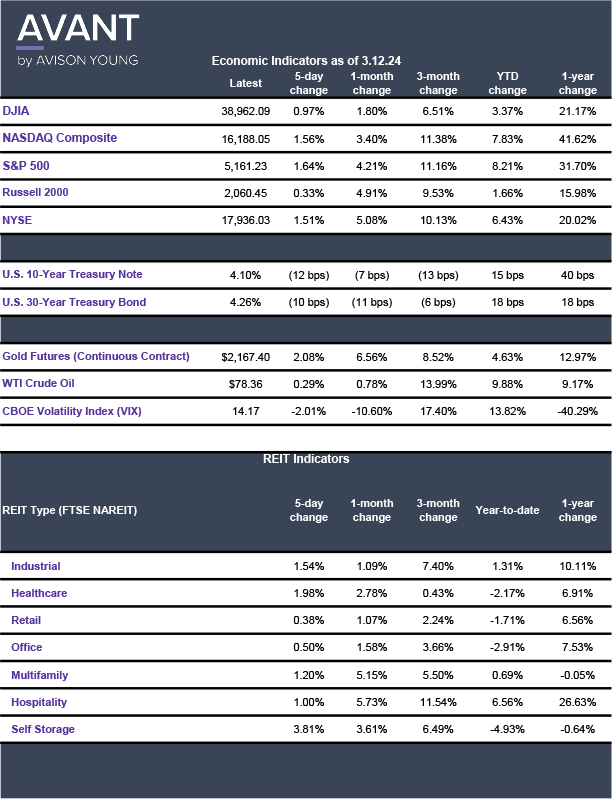

According to the RCA CPPI National All-Property Index, the pricing improvement is partly due to investor expectations that the Federal Reserve will begin lowering interest rates later this year. After 11 interest rate hikes since 2022, the Fed signaled in December that rate decreases are on the horizon. While there is no set timeframe, many economists expect rate decreases to start in the second half of the year, assuming the economy stays on the same course. The annual inflation rate fell to 3.1% in January from 3.4% in December, still higher than the Fed’s target of 2.0%, but close enough to prompt projections about loosening monetary policy.

According to the recent RCA index, covering sales across multiple asset classes through January 2024, prices were falling around 11% annually in Q3 of 2023, but slowed to a 4.7% annual decline in January. The index also noted a slight (0.1%) monthly decline from December. The only sector to record positive annual growth in January was industrial, posting a 1.4% increase, with was 0.2% higher month-over month. Industrial pricing has increased each month since June of 2023.

Industrial pricing also retained the gains experienced during the pandemic better than any other peer section, despite rising interest rates and the commensurate increased cost of debt. Industrial recorded the highest increase over a three-year (29.3%), five-year (54.7%) and 10-year (126.3%) period. Multifamily, which historically competed against industrial for the top asset position but has fallen to second place in recent years, posted the second highest pricing performance over the same periods, with 9.6%, 28.6% and 106.4% gains, respectively. We also see this trend continuing and feel that multifamily assets will not catch-up in coming years to the desirous level that industrial has with most investors.

Avison Young AVANT research from Q4 2023 shows industrial pricing at near historic highs and cap rates inching up from all-time lows. Asset pricing finished the quarter around $120 psf after peaking near $138 psf in early 2022. While there have been some moderate ups and downs, industrial property pricing has consistently increased from a level around $60 psf in 2008 as the surge in e-commerce adoption took hold and warehouse and logistics space utilization expanded. With the increase in interest rates in the aftermath of the pandemic, industrial cap rates increased from all-time lows near 4% to 5% in mid-year 2022 to finish last year at 6.04%.

Industrial has been the leading commercial asset class for investors in recent years due to high demand for warehouse and distribution space that has pushed up rents across the country. (Not to mention the onshoring and reshoring trends that are manifesting themselves across the globe which will draw even more demand in the coming years…more on that in another Sightlines!).

Direct asking rents have steadily increased from $5 psf in 2016 to end 2023 at around $10 psf nationally. Even some markets hit with an increase in supply saw double digit increases in 2023, including Dallas-Fort Worth, which had a 19% increase YOY to $7.60 psf; Atlanta, which had a 13.8% YOY increase to $8.65 psf and Chicago, which had an 11.9% increase to $7.90 psf.

Retail and multifamily see gains

According to the RCA Index, retail was the only other property type to post positive monthly growth in January, rising 0.1%. Retail property prices feel by 3.6% on an annual basis, but the longer-term trend shows that the rate of decline improved for six consecutive months.

Pricing for the multifamily sector dropped 7.9% annually in January, an improvement from August when pricing fell 14.1% annually. The office sector, which continues to experience occupy declines due to work-from-home issues, recorded the highest decline. CBD office posted a 28.9% annual decline and suburban office posted a 11.9% decline. Over three, five and 10-year periods, CBD office annual prices fell 35.1%, 35.9% and 11.5%, respectively while suburban office prices fell 6.1%, and then rose 1.1% and 33.5%, respectively.

Overall property prices in the 6 Major Metros (Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.) tracked by the RCA Index and Non-Major Metros, all secondary and tertiary markets, fell at similar year-over-year rates in January -- 5.0% for the major metros versus 4.6% for the non-major metros.

As the commercial real estate industry eagerly awaits interest rate cuts, the continued improvement in property pricing is a welcome sign that investors are willing to expand their activity. This research clearly points to the strength of the industrial sector and its ability to hold its value over the long-term, often at the detriment of certainly the office sector, and selectively, the retail sector.

Sources: Avison Young AVANT, MSCI/RCA research.