Office odyssey: A charted exploration of value correction in major U.S. cities’ office buildings

- The correction in office values in the wake of the COVID-19 pandemic has been a hot topic of conversation over the past four years, as utilization trends have fundamentally shifted, causing the sector to face a unique set of challenges. This includes cyclical issues stemming from an elevated interest rate environment, and the impact it has on cash-flowing assets. Until interest rates have returned to more normal levels, values will remain uncertain.

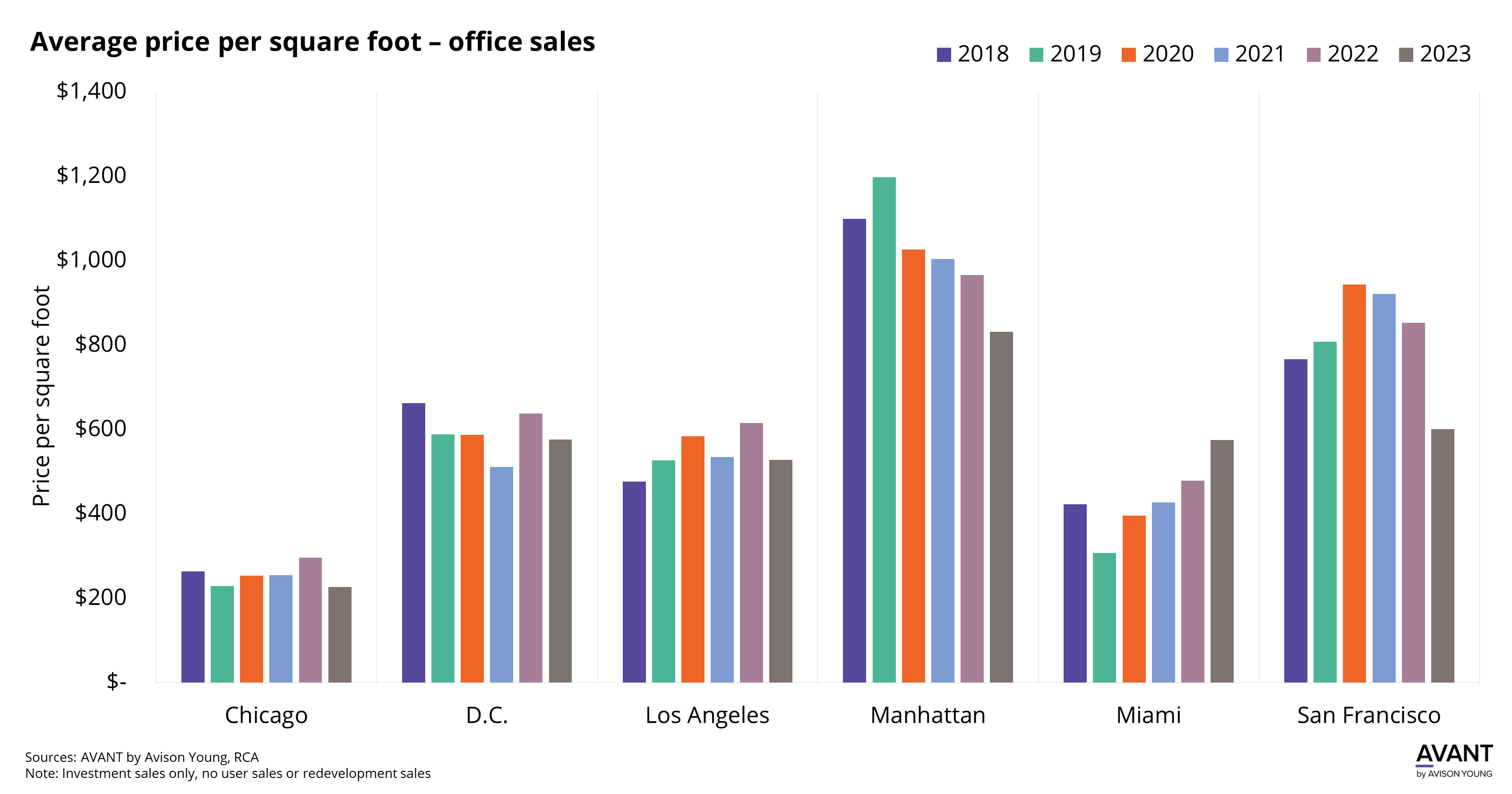

- Over time, markets have shown varied pricing trends based on geography; one notable example is the Miami market, which is the only analyzed market to show positive pricing momentum year over year, reaching roughly $575 per square foot on average, almost the same as San Francisco.

- With a large amount of loans maturing in 2024 and over $500 billion by the end of 2025, capital events are imminent and will serve as an early indicator for value corrections.

March 8, 2024