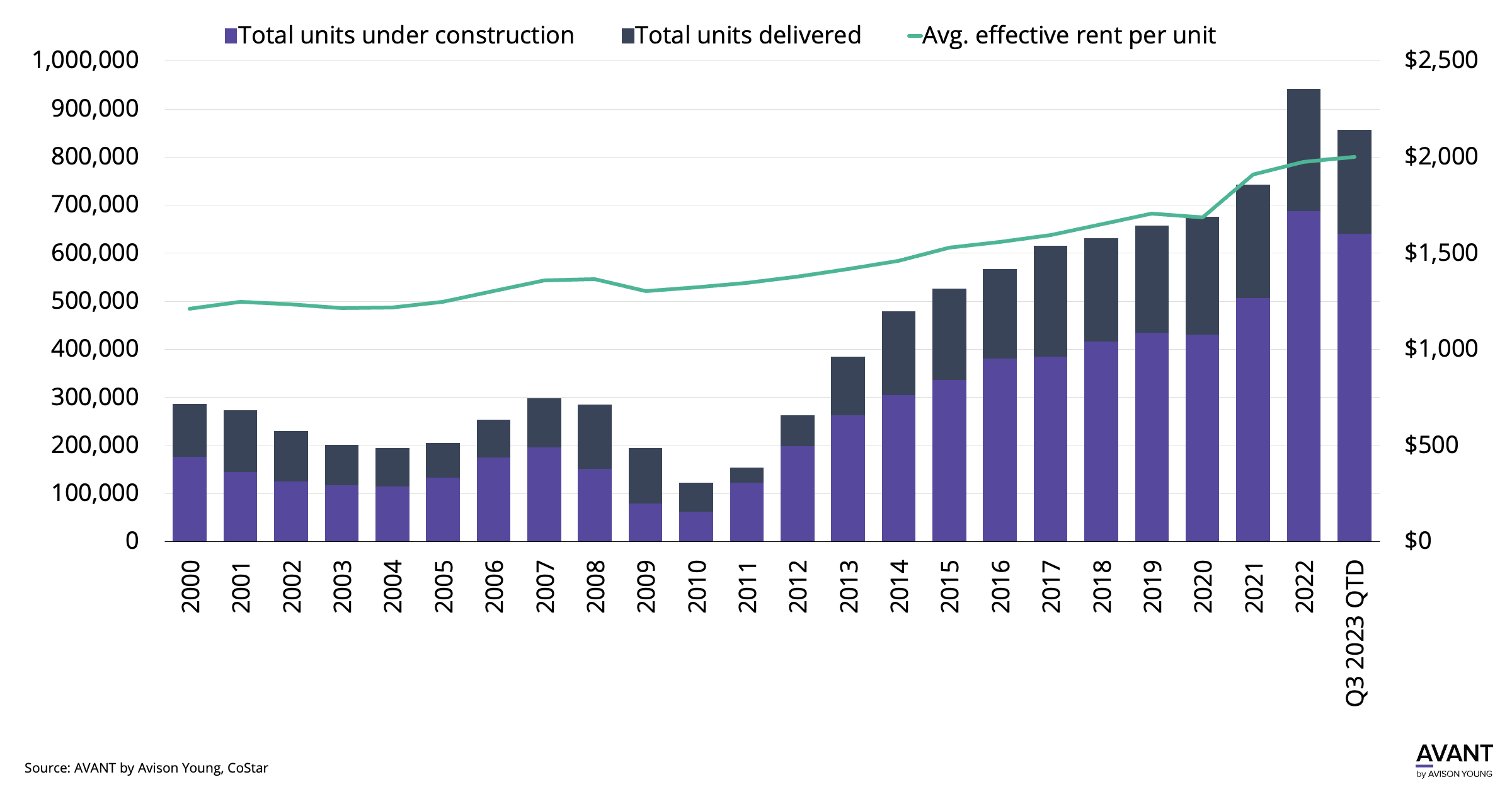

After reaching all-time highs, U.S. rent growth and multifamily development activity begin to stabilize

- In 2021, occupancy rates reached new highs of 94.5% helping boost effective rents by 12.0% between 2019 and 2021. To keep pace with the market, development activity has surged across the top multifamily markets and increased the overall supply by 13.3% since 2019.

- Meanwhile, 641,000 units are currently under construction and expected to increase the inventory by another 7.9% over the next 24-36 months. The flood of new supply has moderated rent growth with effective rents increasing by a year-over-year average of 2.4% since 2021.

- As homeownership continues to remain expensive and new product delivers at higher rental rates, demand for moderately priced product is expected to remain strong which could shrink the rent premium gap between the Class A and B/C markets.

October 5, 2023