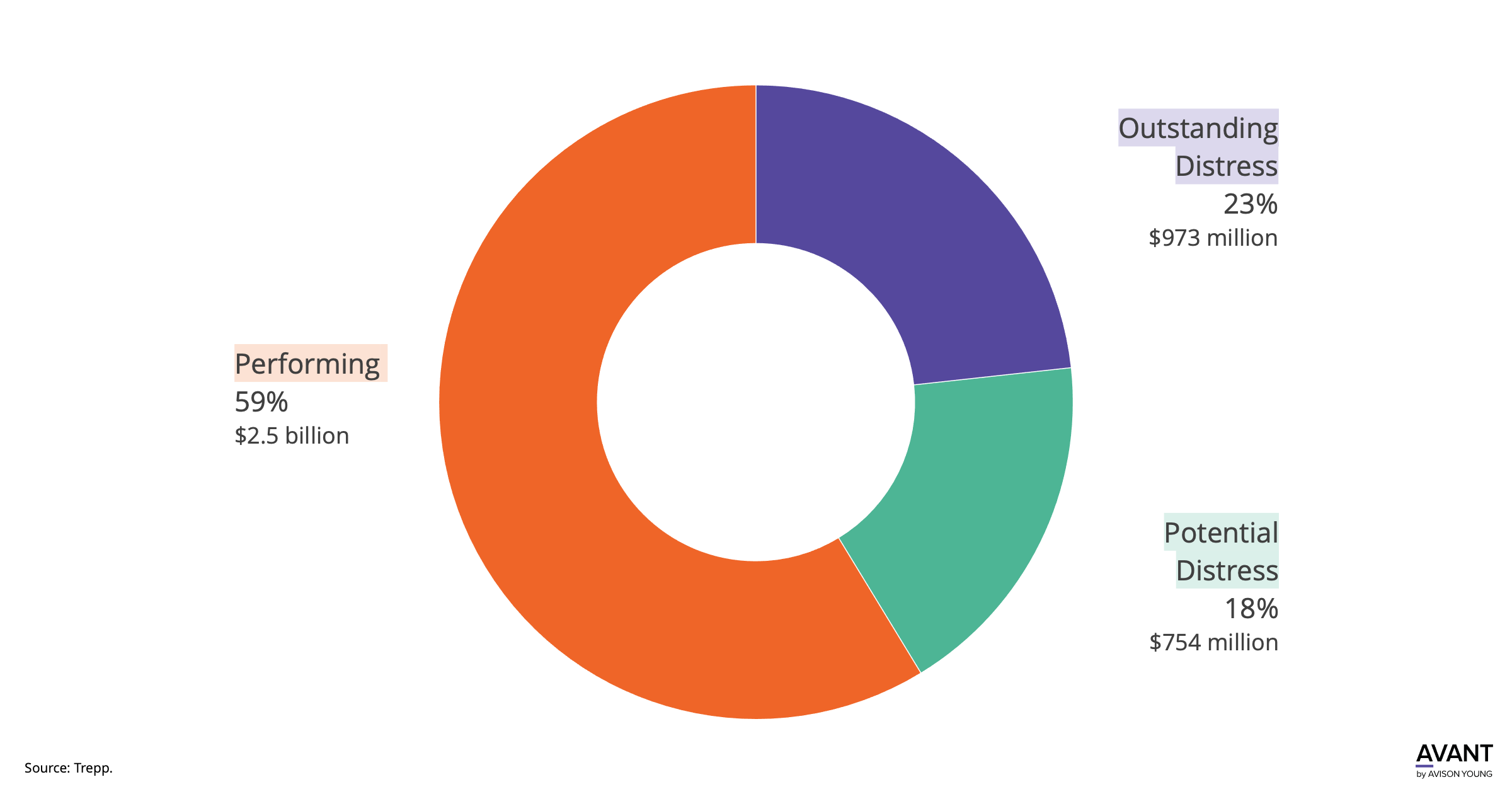

Could Houston have a problem with the looming $1.7B office CMBS loans?

- Like most of the office markets nationwide, Houston has its share of commercial mortgage-backed security (CMBS) loans with landlords facing some financial difficulties. This has led to tenants becoming more cautious about signing leases, and they are now asking landlords to provide more financial information and leveraging their position to negotiate better lease terms.

- Of the 26 Houston office properties that are already in distress, 9 have a collective loan balance of $355 million that will mature in the next 24 months. These properties could face challenges if ownership is unable to refinance or sell their assets in this tough capital markets environment.

- There are 60 CMBS-backed properties considered to be in potential distress. 18 of these properties have a cumulative loan balance of $248 million and will mature in the next 24 months. These properties are at risk if the owners are unable to restructure their loans.

August 30, 2023

Get market intel

US-TX-HOU Houston