DFW’s new urban core apartments — seeing mixed lease-up and taking longer to stabilize at a wide range of rents

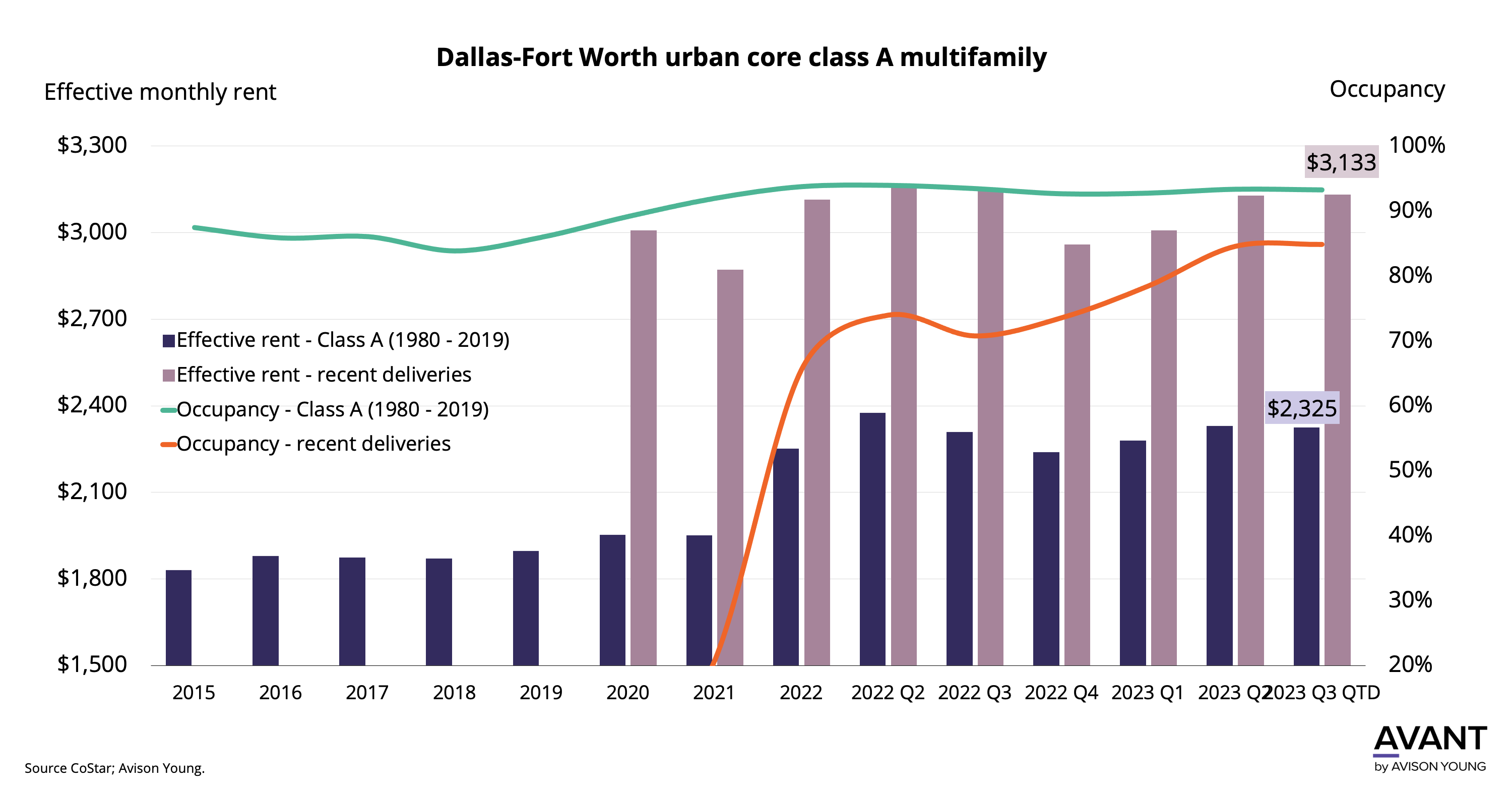

- Dallas’ existing class A urban core apartments (29,500 units) have been performing well. Since 2020, occupancy has been steady at above 92% and effective rents now average $2,300+ per month or around $2.45 psf — a 20% increase over the period.

- Since 2020, more than 5,500 apartment units have been delivered. Lease-up performance of these units has been mixed. Rents average over $3,100 per month ($3.20 psf) – a 35% premium over the existing class A stock. What is even more significant is that this average masks that effective rents in the newest units can range from $2,000–$2,500 to over $4,000–$5,000 per month ($3.30–$4.00+ psf).

- The significant deliveries combined with high rents have blunted lease-up in many projects. Even though occupancy is 85%, monthly lease-up has averaged only 15–16 units (including projects not yet stabilized). In comparison, that pace was 23–25 units a handful of years ago.

- This slower pace translates into longer stabilization periods. In fact, 8 of the 18 newest projects are still in initial lease-up. While a few have recently delivered, some (and even a few now stabilized assets) saw lease-up of sub-12 units per month. This translated into more than 2 years for some to stabilize. Generally, apartments should stabilize (90% occupancy) within a year or so to avoid competing with their own resident turnover and to minimize the impact of residents leaving to chase introductory pricing and free rent at newer offerings.

Get market intel

US-TX-DAL Dallas