Flight to quality trend is real, but don’t discount cheaper offices

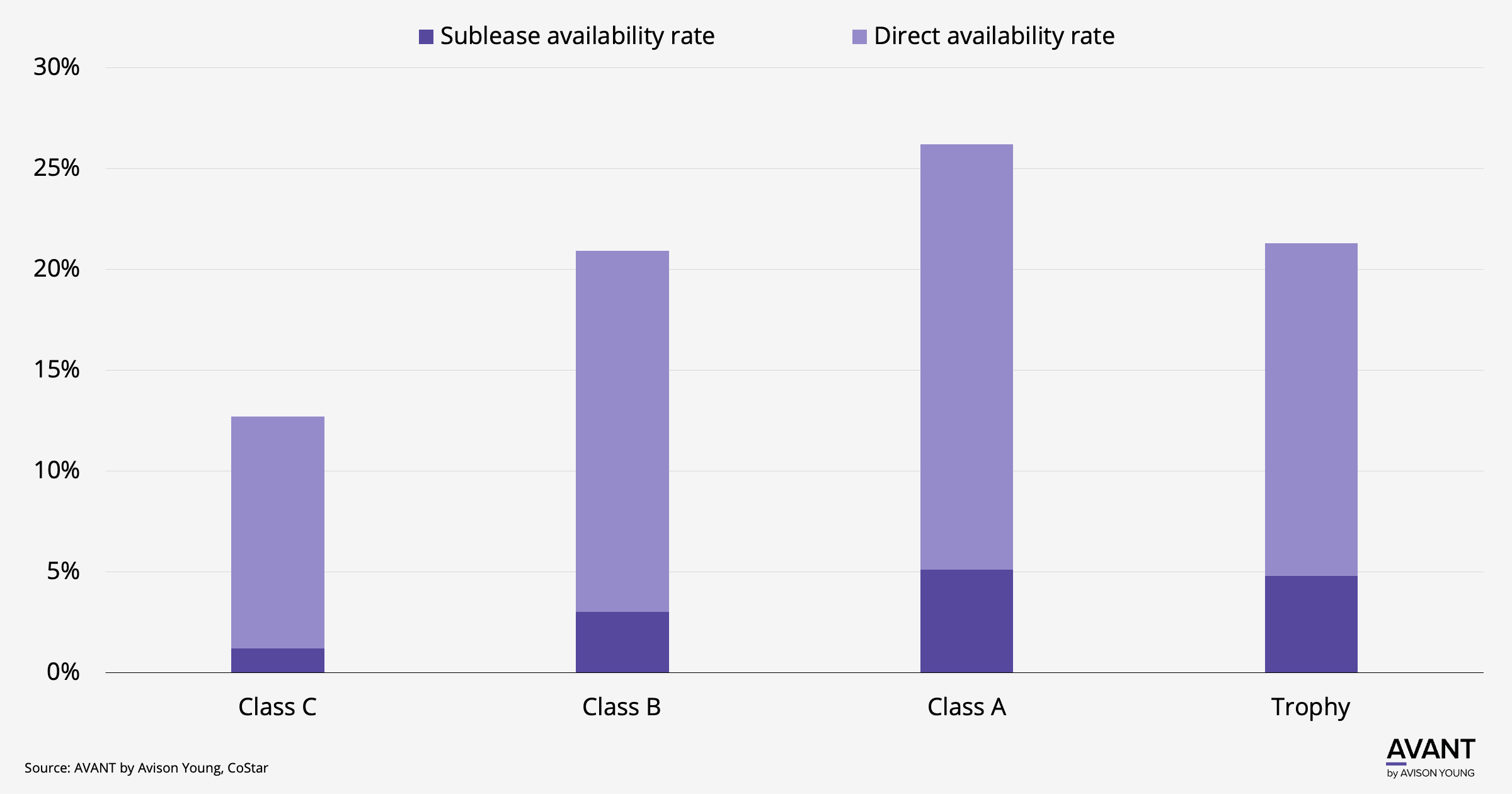

- The highest-echelon U.S. office properties still encounter strong demand, especially those in transit-oriented neighborhoods offering exceptional efficiencies, amenities and sustainability; however, there is a glut of Trophy and Class A space on the market. Class C properties currently list a total availability rate of just 12.6%, which is less than half that of Trophy and Class A properties at 25.3%.

- Tenants priced out of pricier offerings, such as governmental users that comprise a leading 15% of active Class C occupiers, have refocused on cheaper options, especially during uncertain economic conditions.

- While recent new construction deliveries are partly to blame, new projects delivered in the past 12 months account for just 1.7% of total existing Trophy and Class A supply.

Get market intel

US-MA-BOS Boston