The Los Angeles Mansion Tax's effect on commercial real estate

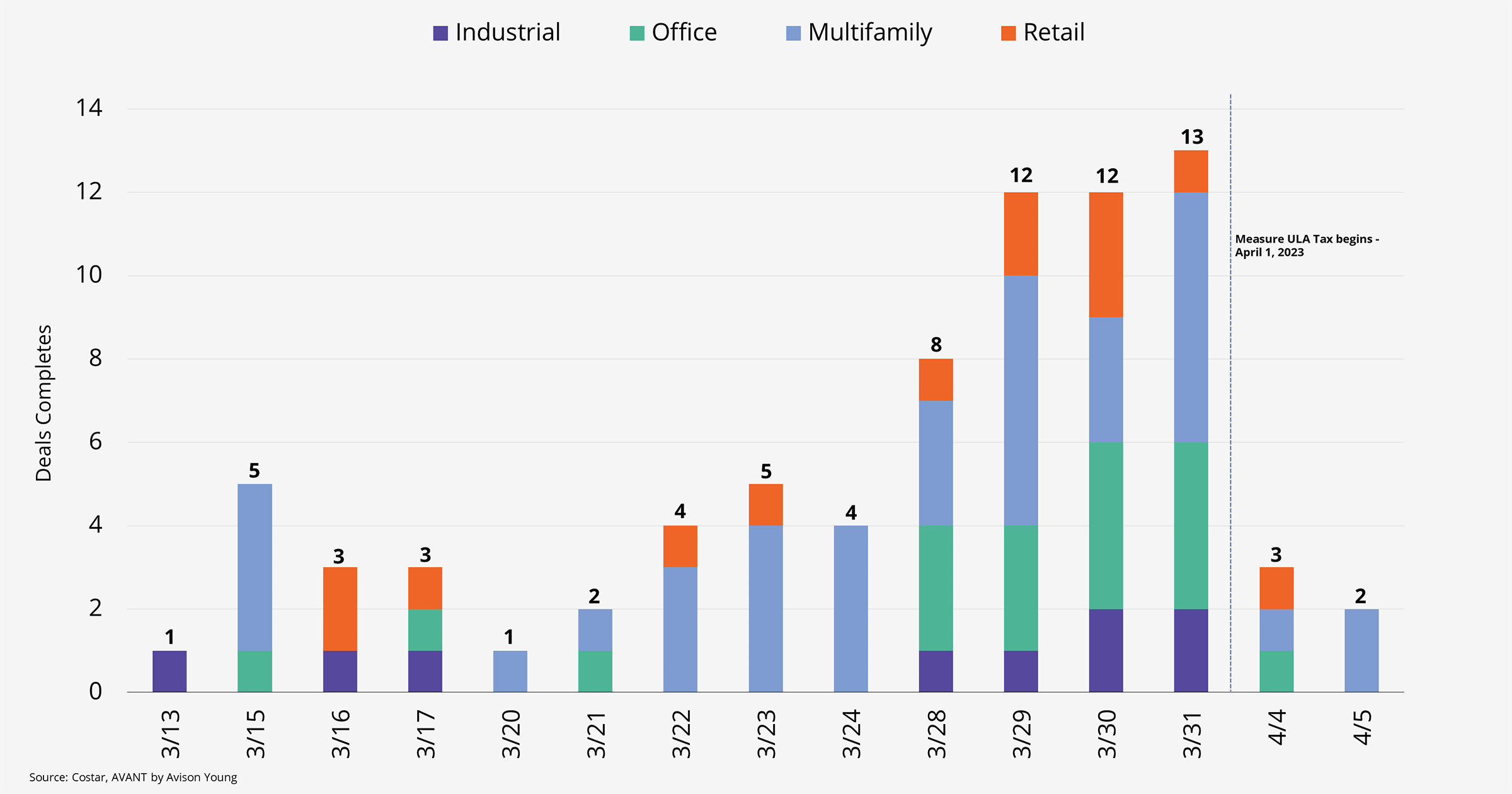

Deals completed before an after Los Angeles Mansion Tax

Back in November, voters approved of Measure ULA which would establish a revenue stream for housing projects and homeless prevention. The measure applies an additional 4% tax on properties sold or transferred for more than $5 million and 5.5% on properties sold or transferred above $10 million, respectively. The measure was set to start on April 1. After April 1, transactional volume for properties above $5 million slowed down significantly with many of the newer deals now falling under $5 million in order to avoid the tax. To put in perspective the effects of the ULA tax on properties, there were 45 transactions dated from March 25th till the April 1st deadline (7-day span). Since then, from April 1st to now, there have only been 10.

June 23, 2023