Solid demand growth and financial performance gains in the Dallas lodging sector

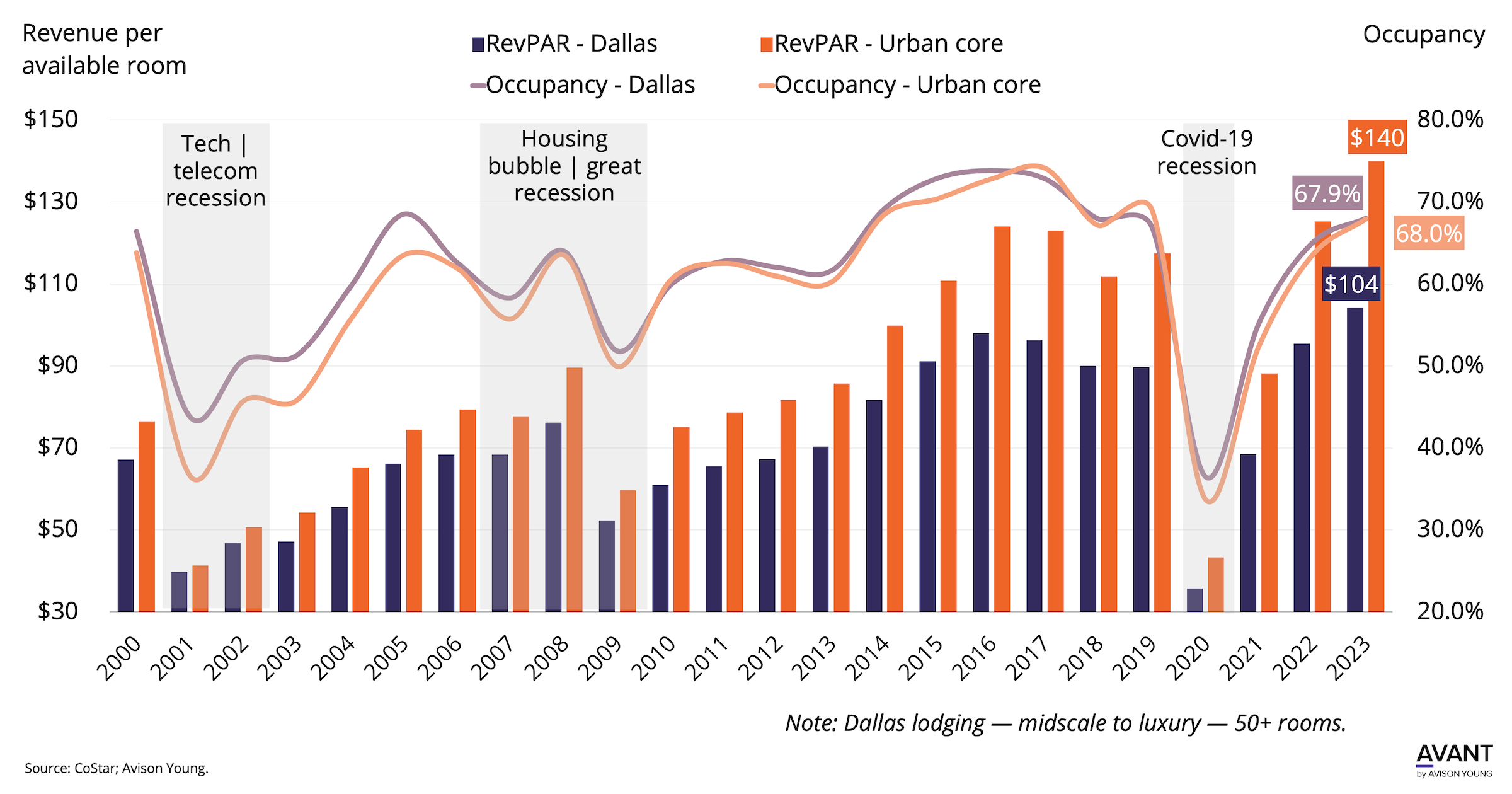

- Due to almost complete travel curtailment in 2020, Dallas lodging properties sank to their lowest revenue and occupancy levels since the early 2000s. Dallas lodging properties bounced back in 2021, with 2022 bringing operating performance essentially back to its pre-pandemic “trend line”.

- As of September 2023, the average daily rate (ADR) moved up to $150+ for Dallas hotels in the main commercial areas. In comparison, Dallas’ urban core properties hit $206, well above the $170 peak prior to the economic slowdown.

- Occupancy for overall Dallas and the urban core is close to 68%. While up greatly from their recent lows, they both lag the +70% that was typical over 2015-2017. Part of the reason for this is that room supply also increased over the period. For Dallas overall, 4,200 rooms (28 properties) were added, of which, 1,800 (10 properties) opened in the urban core.

- Even with slightly lower occupancy, room night demand has been strong. Since 2019, demand growth registered 9%-10%. This expanded demand has led to a steady ramp-up in revenue per available room. Over the period, RevPAR has increased 16% for overall Dallas and 19% for urban core properties.

December 21, 2023

Additional resources

Get market intel

US-TX-DAL Dallas