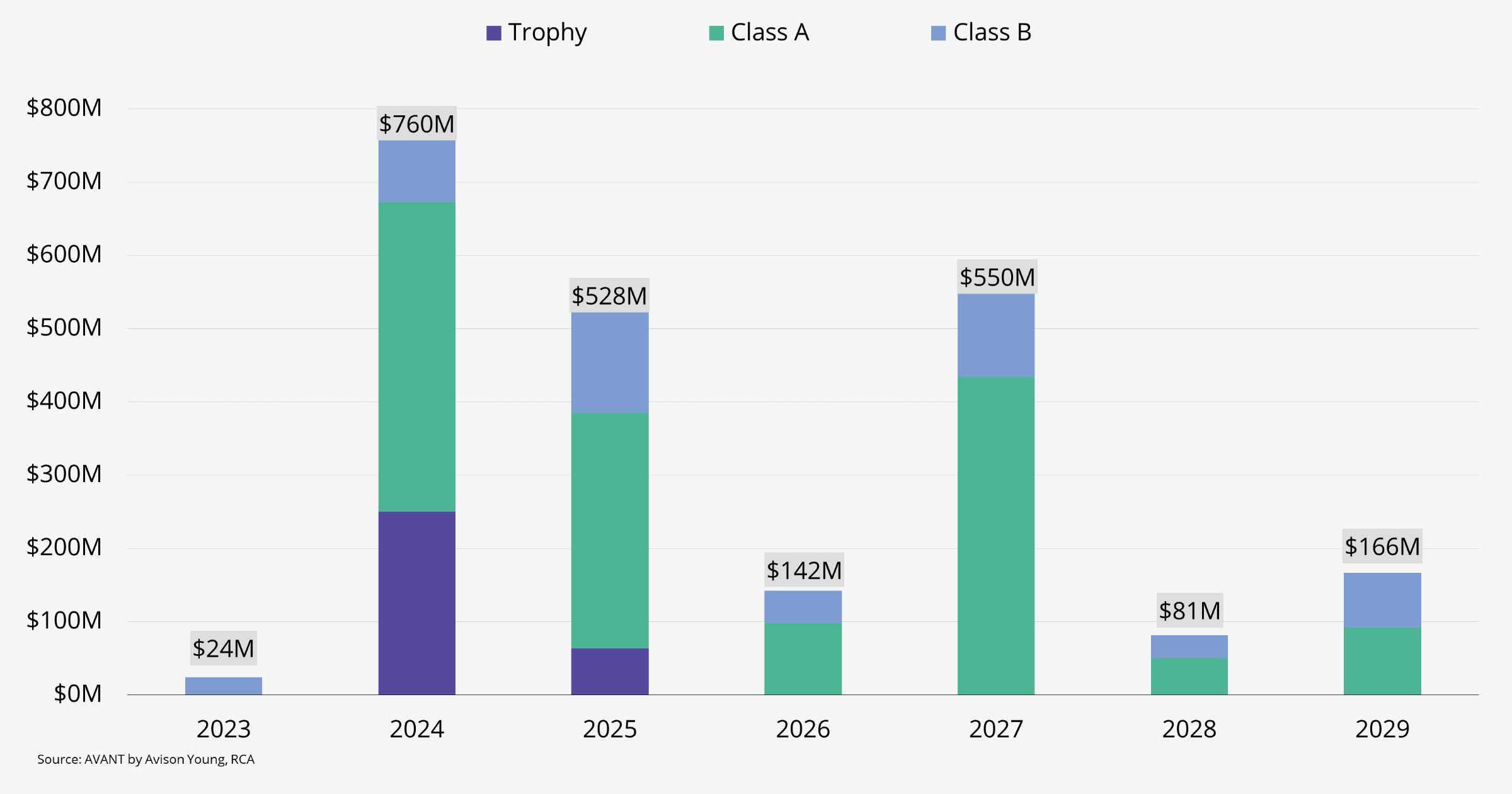

The Los Angeles office market will face some challenges with just over $2.2B in CMBS loans currently on the watchlist

$2.2B in CMBS loans are currently on the watchlist within the next 6 years with just over $760M maturing in 2024 alone.

Landlords continue to face financial difficulties as the office market struggles to recover to pre-pandemic levels. Tenants continue to make decisions to downsize office requirements or close locations due to the adoption of hybrid or remote work schedules, making it difficult for landlords to collect on rents. 14 properties with a collective total of over $760M in CMBS debt is maturing in 2024, which marks the highest rollover of loans within the next 6 years. These properties are faced with challenges in a tough capital markets environment if ownership is unable to sell or refinance the asset. Banks have tightened their lending parameters and borrowers will need to put more money into the deal as interest rates remain elevated at an average of 6.5%.

September 25, 2023