-

Office busyness in MSP: is this new normal here to stay?

Office busyness in MSP: is this new normal here to stay? -

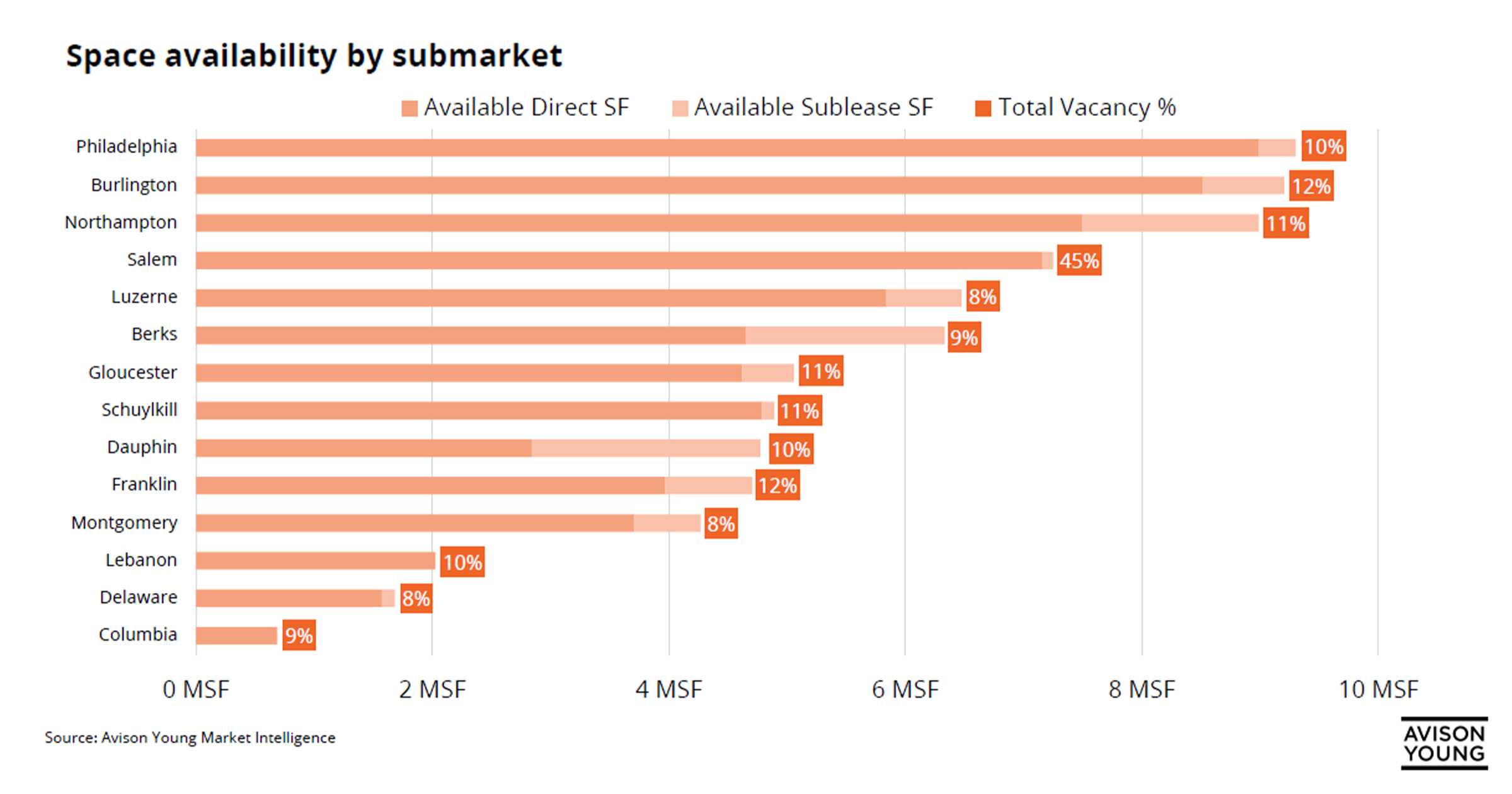

New product deliveries continue to place upward pressure on space availability throughout the Philadelphia industrial market

New product deliveries continue to place upward pressure on space availability throughout the Philadelphia industrial market -

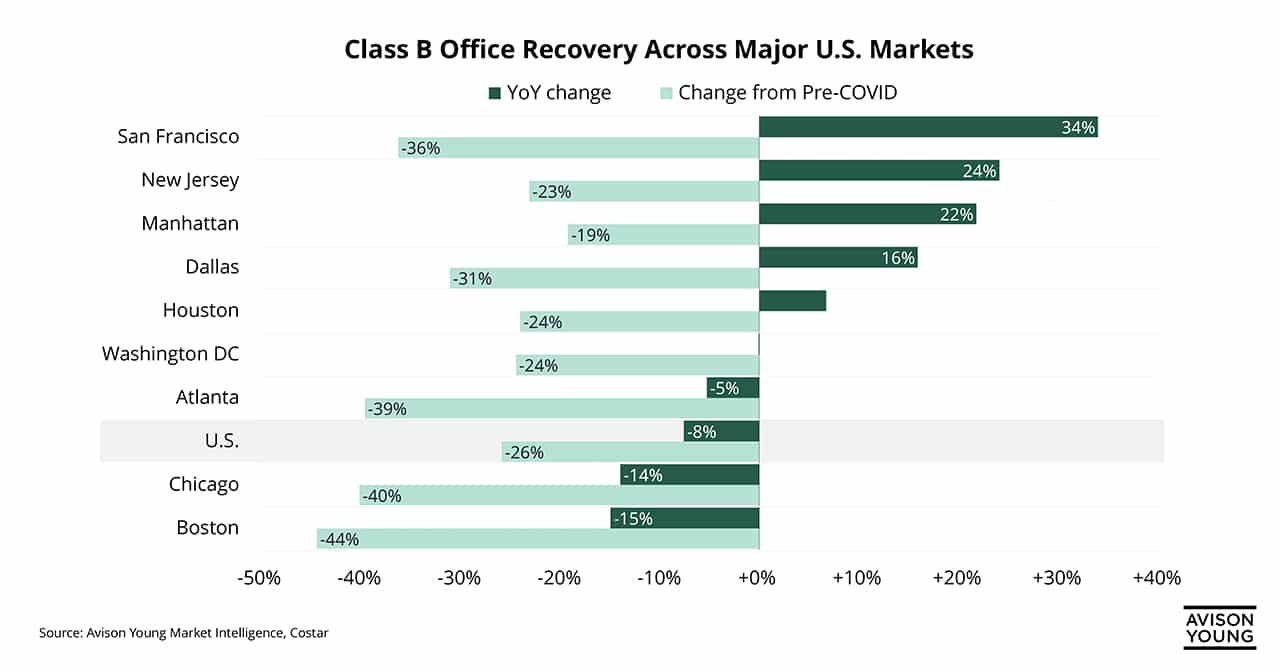

Class B office activity rebounding in New Jersey

Class B office activity rebounding in New Jersey -

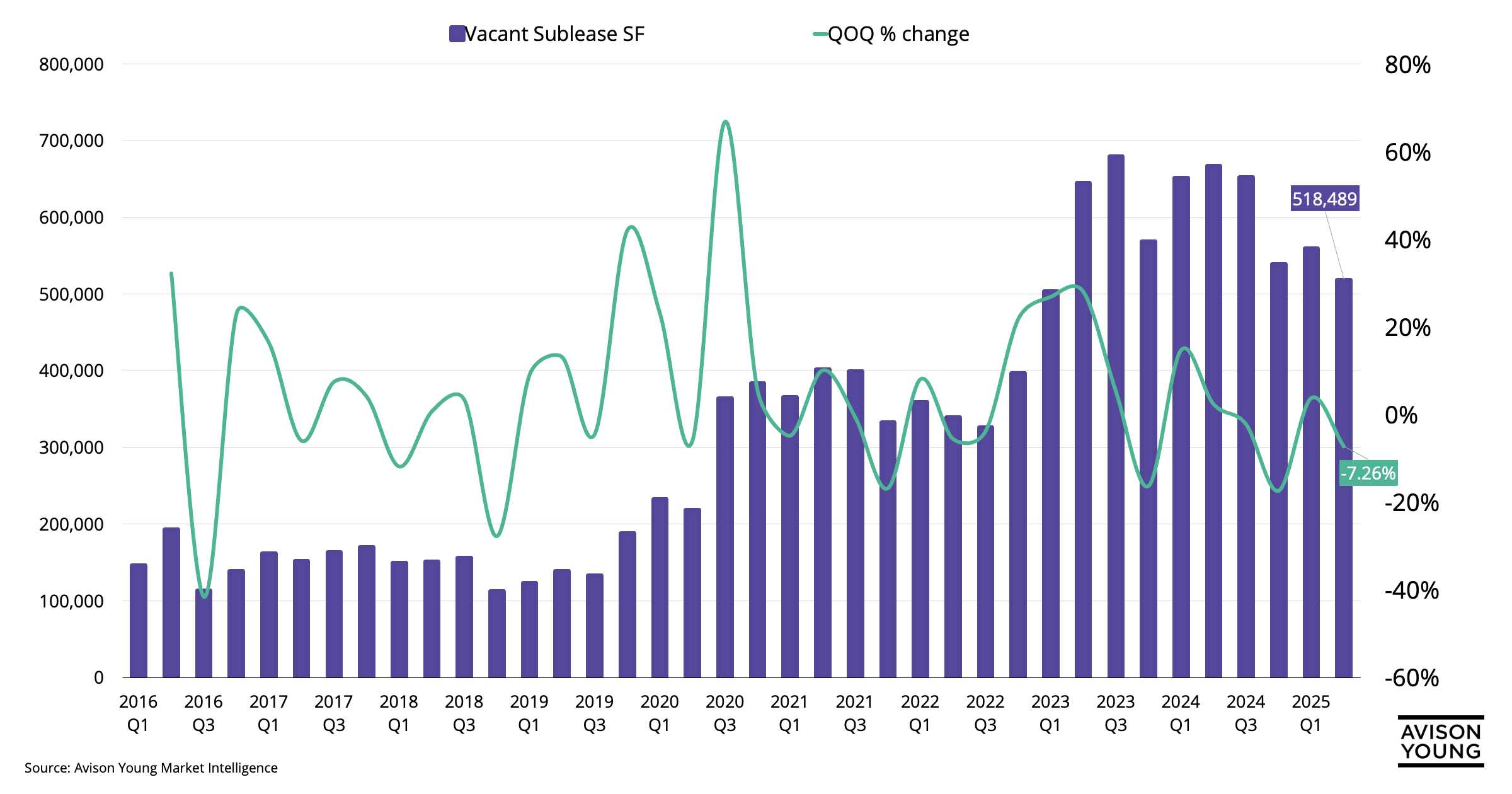

Law firms drive DTLA sublease drop - Down 24% from peak, yet still 269% above pre-pandemic

Law firms drive DTLA sublease drop - Down 24% from peak, yet still 269% above pre-pandemic -

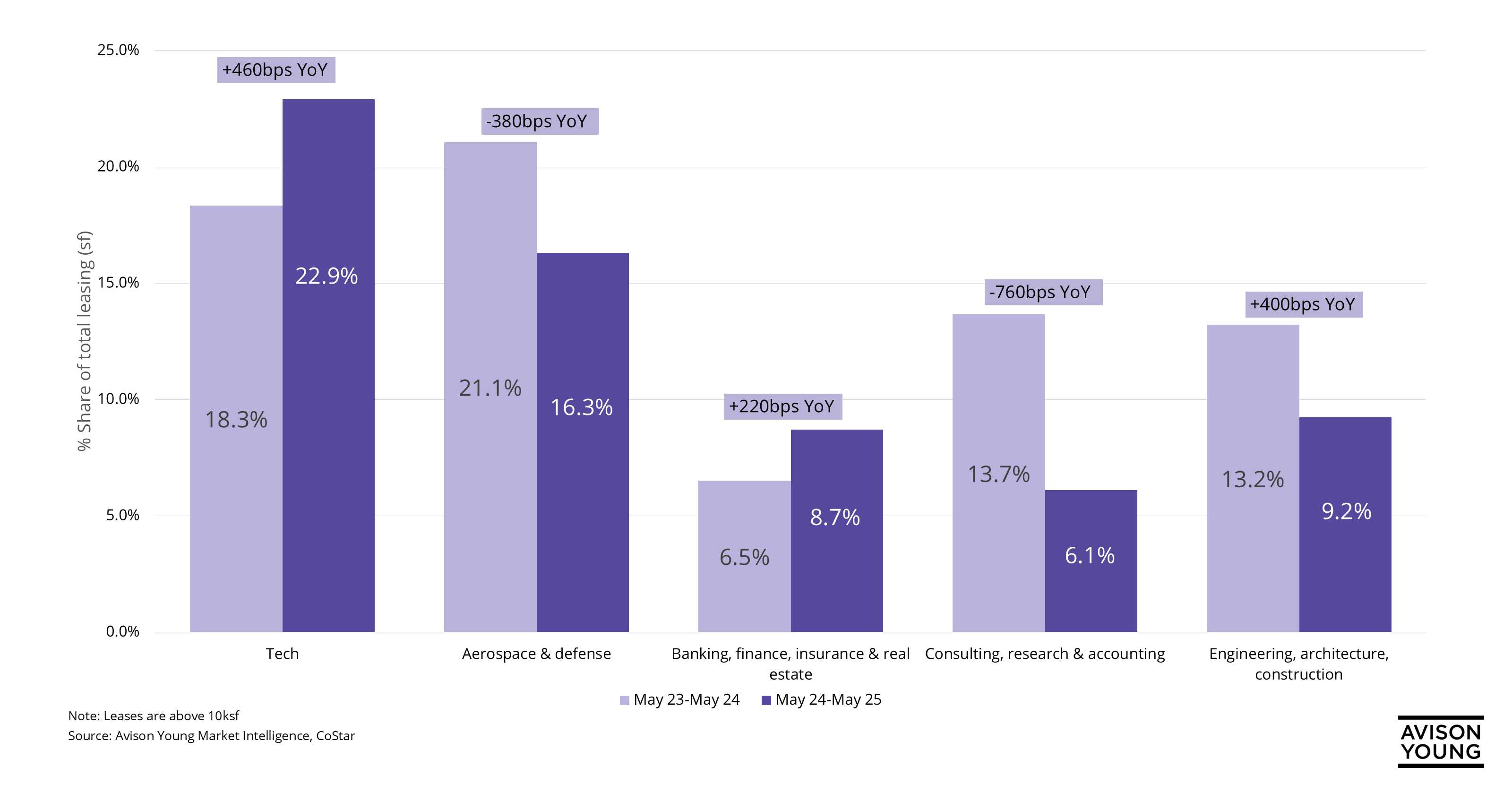

Tech and defense industries lead office leasing activity in Northern Virginia

Tech and defense industries lead office leasing activity in Northern Virginia -

Phoenix’s empty offices are quietly turning into apartments

Phoenix’s empty offices are quietly turning into apartments -

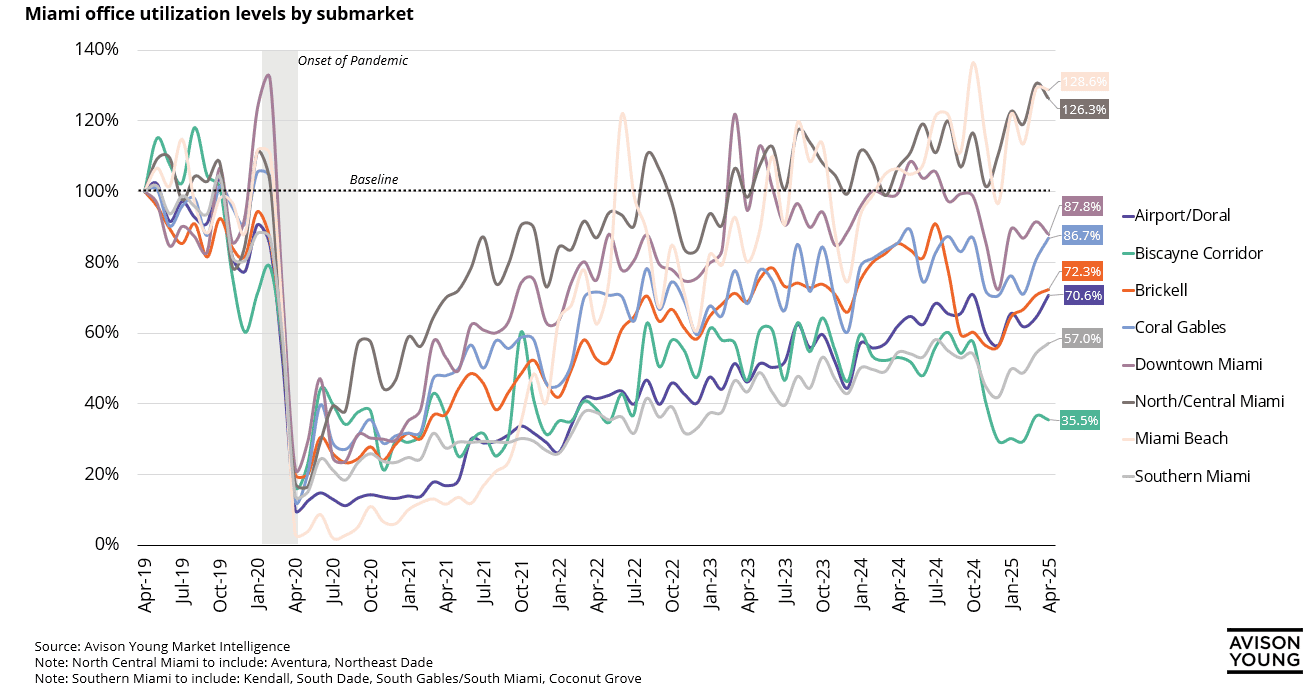

Miami Beach offices seeing strongest return-to-office activity

Miami Beach offices seeing strongest return-to-office activity -

What’s fueling the shift in Raleigh-Durham’s office sublease market post-COVID?

What’s fueling the shift in Raleigh-Durham’s office sublease market post-COVID? -

Exploring lease rate shifts across Charlotte’s office submarkets

Exploring lease rate shifts across Charlotte’s office submarkets -

Owner-User demand sustains retail pricing amid rising vacancy in Los Angeles

Owner-User demand sustains retail pricing amid rising vacancy in Los Angeles -

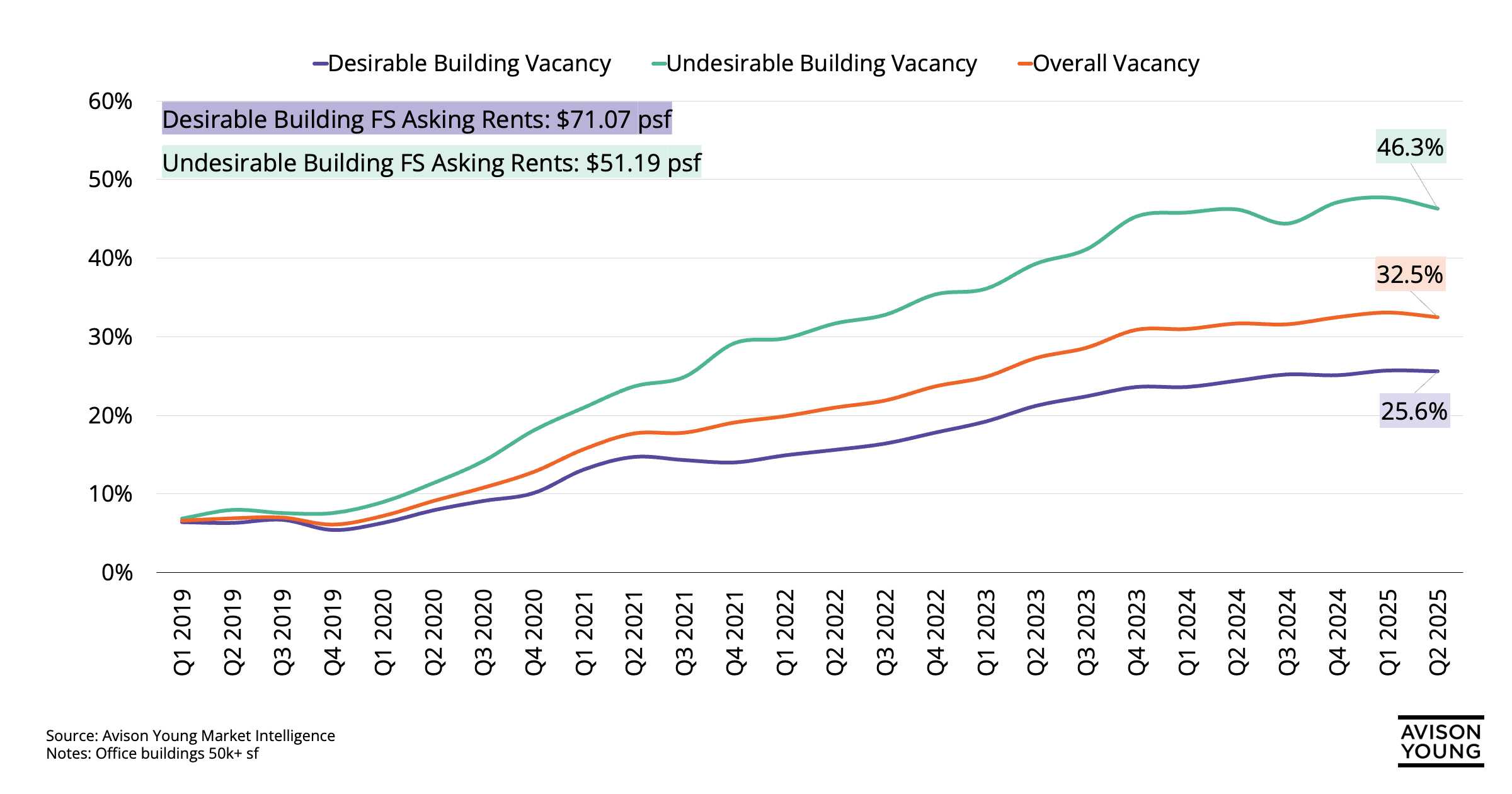

Undesirable assets continue to inflate San Francisco vacancy

Undesirable assets continue to inflate San Francisco vacancy -

Winners and laggards in the Silicon Valley office market

Winners and laggards in the Silicon Valley office market -

April Port Activity Rises, But Tariff Questions Persist

April Port Activity Rises, But Tariff Questions Persist -

Vacancy lower in smaller industrial buildings within Greater Boston

Vacancy lower in smaller industrial buildings within Greater Boston -

DFW’s shopping center sector – where did all the development go?

DFW’s shopping center sector – where did all the development go? -

Houston’s industrial landscape: Big-box vacancies climb while small-bay thrives

Houston’s industrial landscape: Big-box vacancies climb while small-bay thrives -

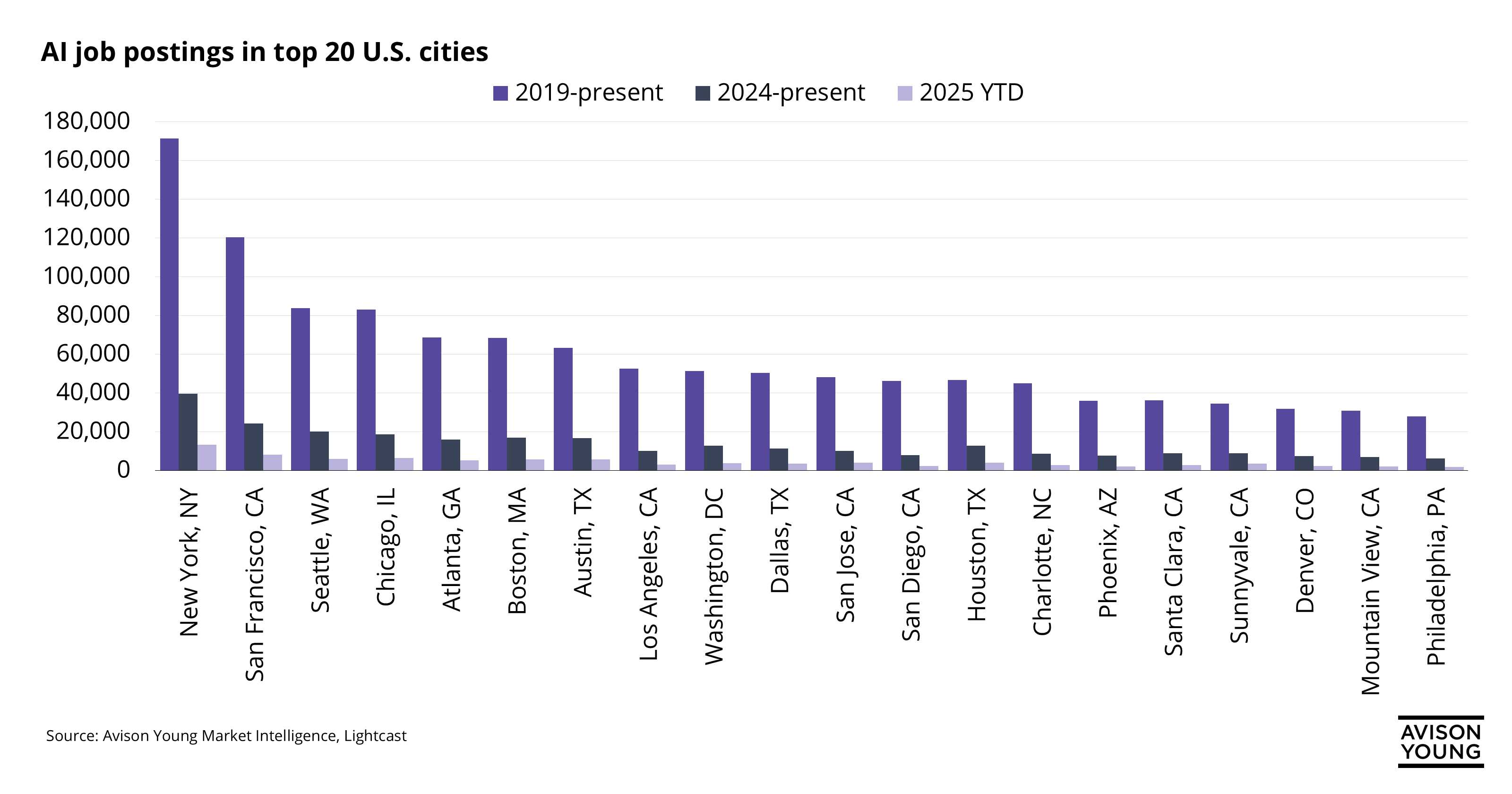

Tech talent in demand: The top U.S. cities driving AI’s hiring boom

Tech talent in demand: The top U.S. cities driving AI’s hiring boom -

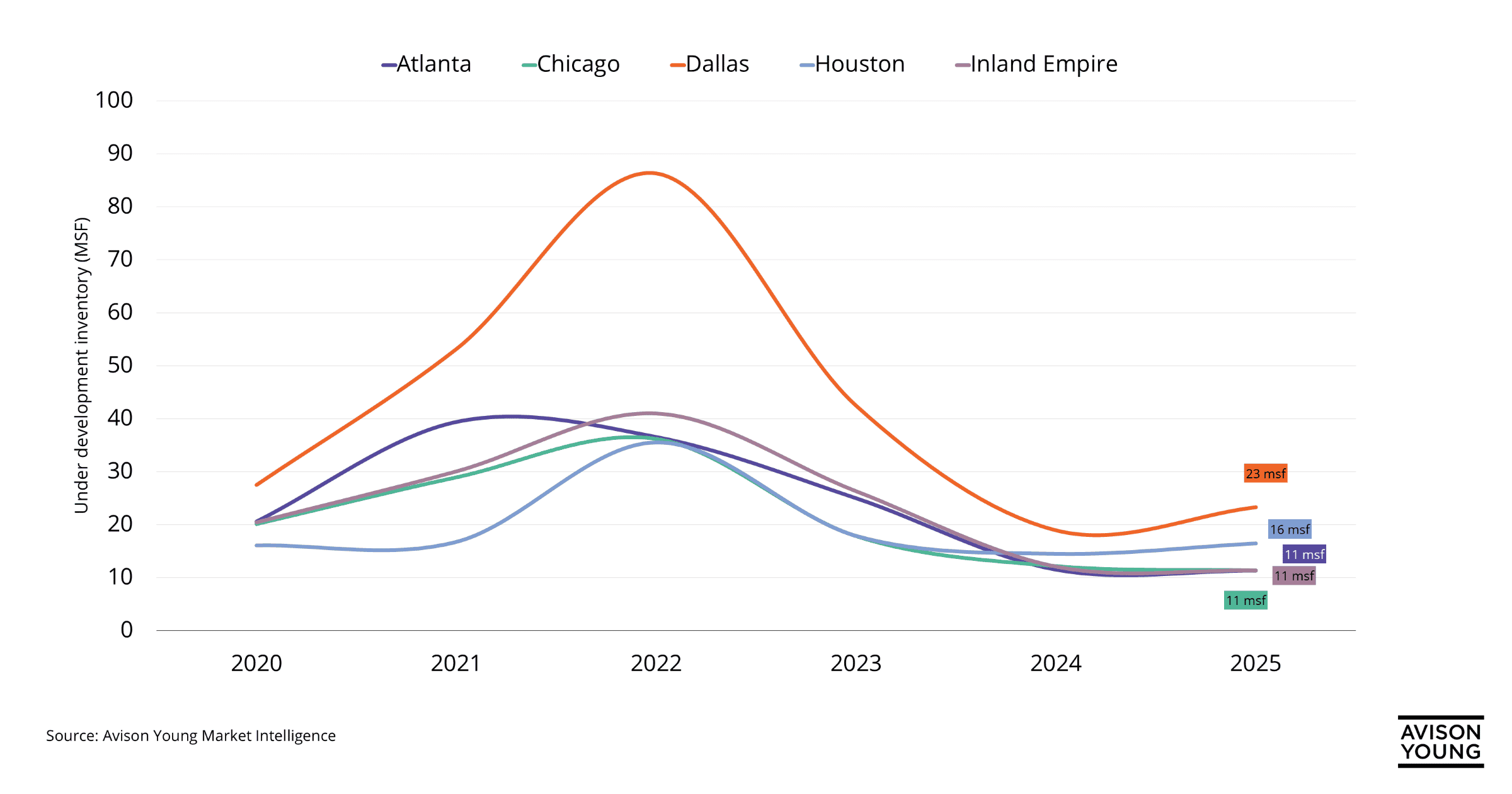

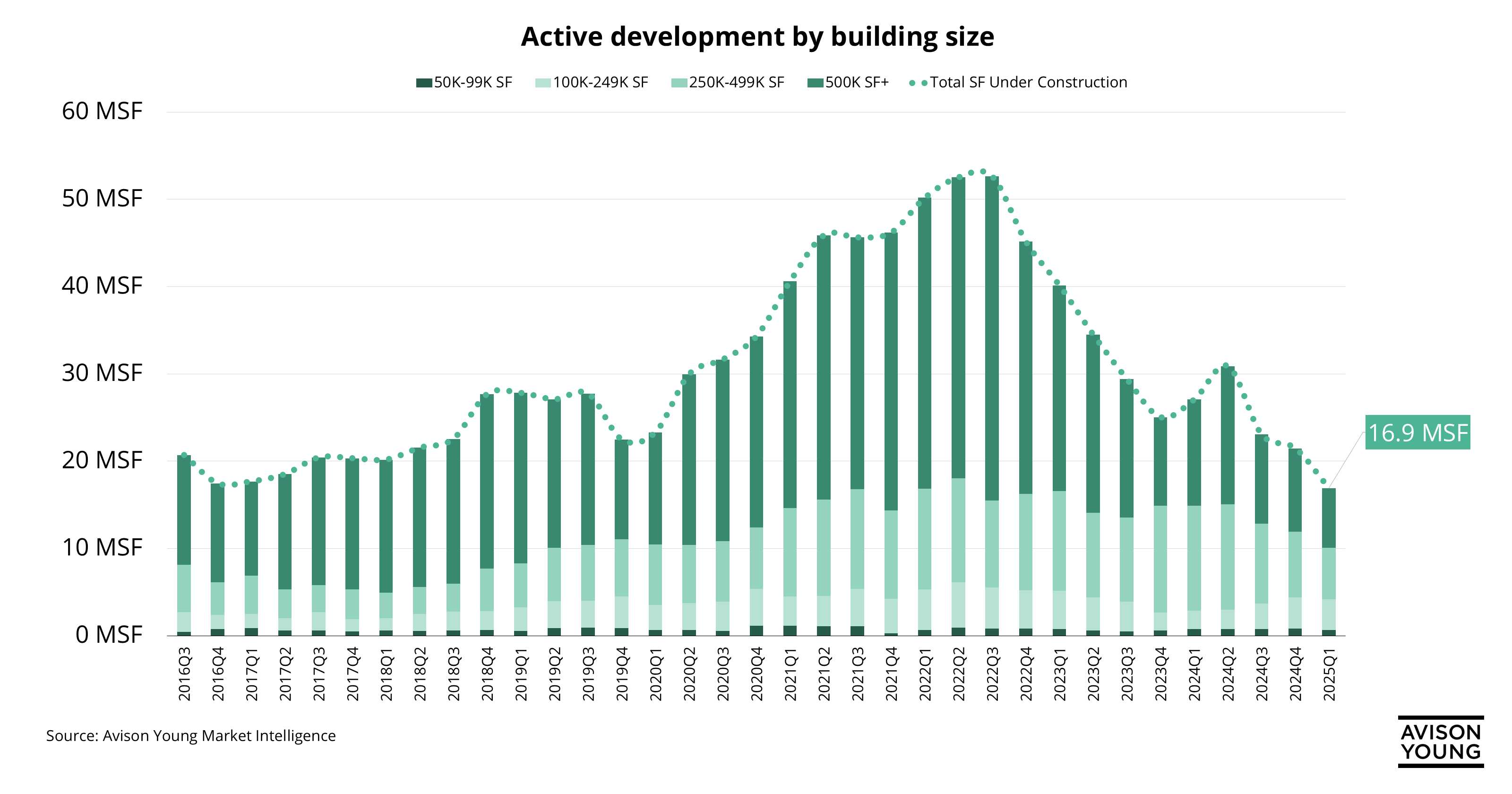

Atlanta’s industrial pipeline rightsizing after record-breaking years of development

Atlanta’s industrial pipeline rightsizing after record-breaking years of development -

[60].jpg/c0758e34-5c3b-b0d5-43df-c3a34abc9d2b?t=1749576480363) MSP office visitation is notably bifurcated by asset class

MSP office visitation is notably bifurcated by asset class -

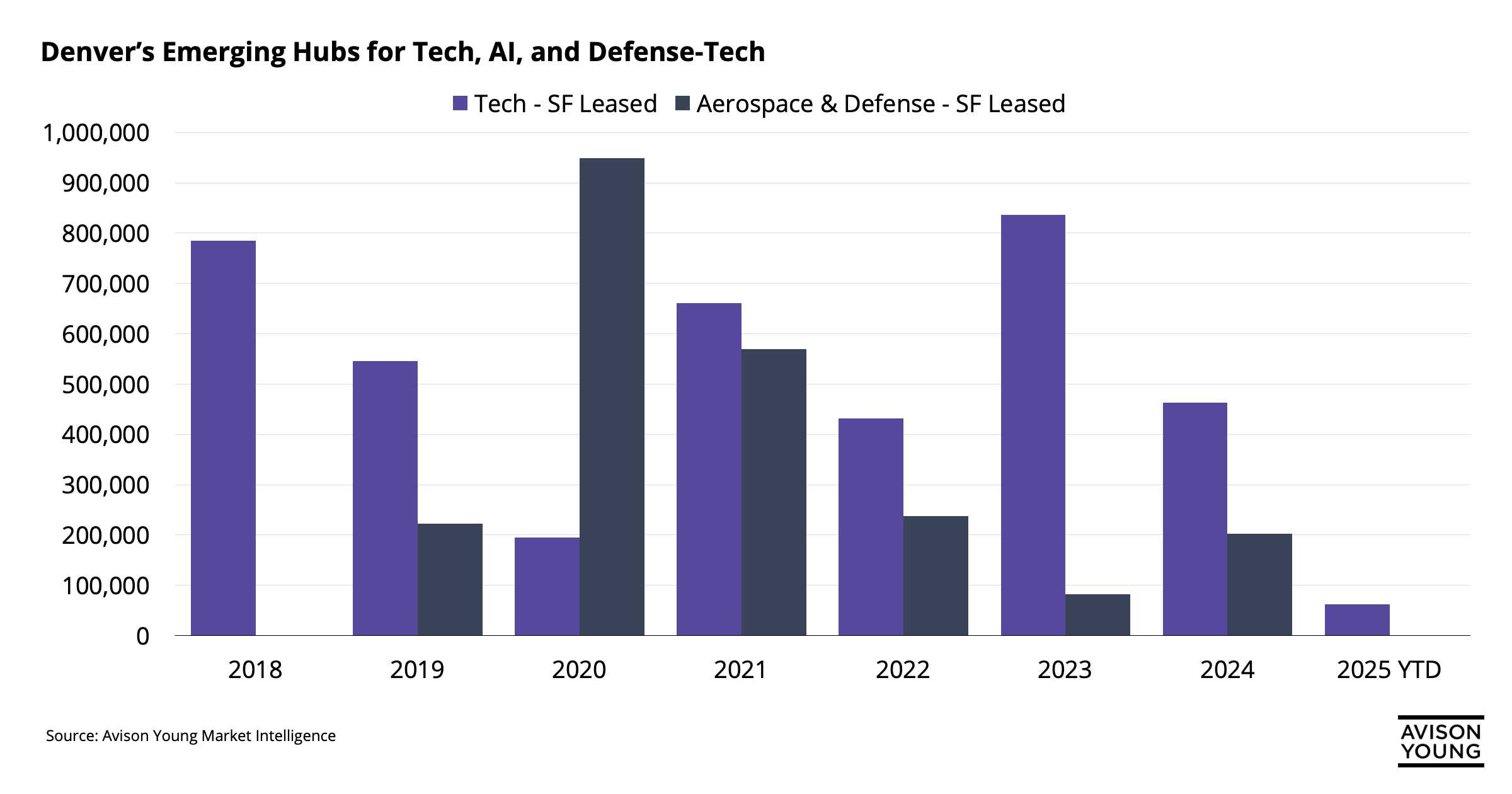

Tracking the rise of tech and defense in Denver CRE

Tracking the rise of tech and defense in Denver CRE -

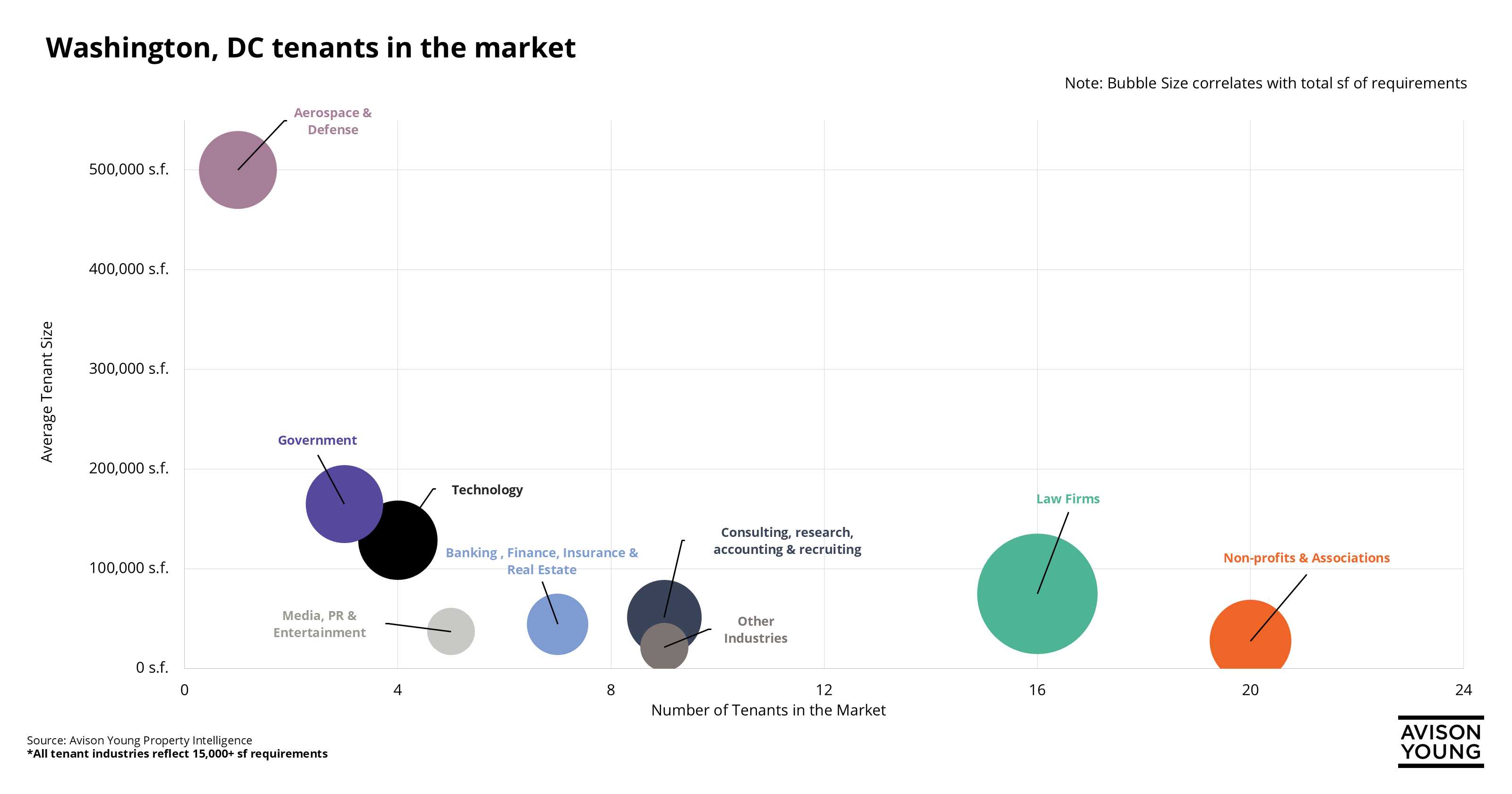

Law firms lead office space demand in Washington, DC

Law firms lead office space demand in Washington, DC -

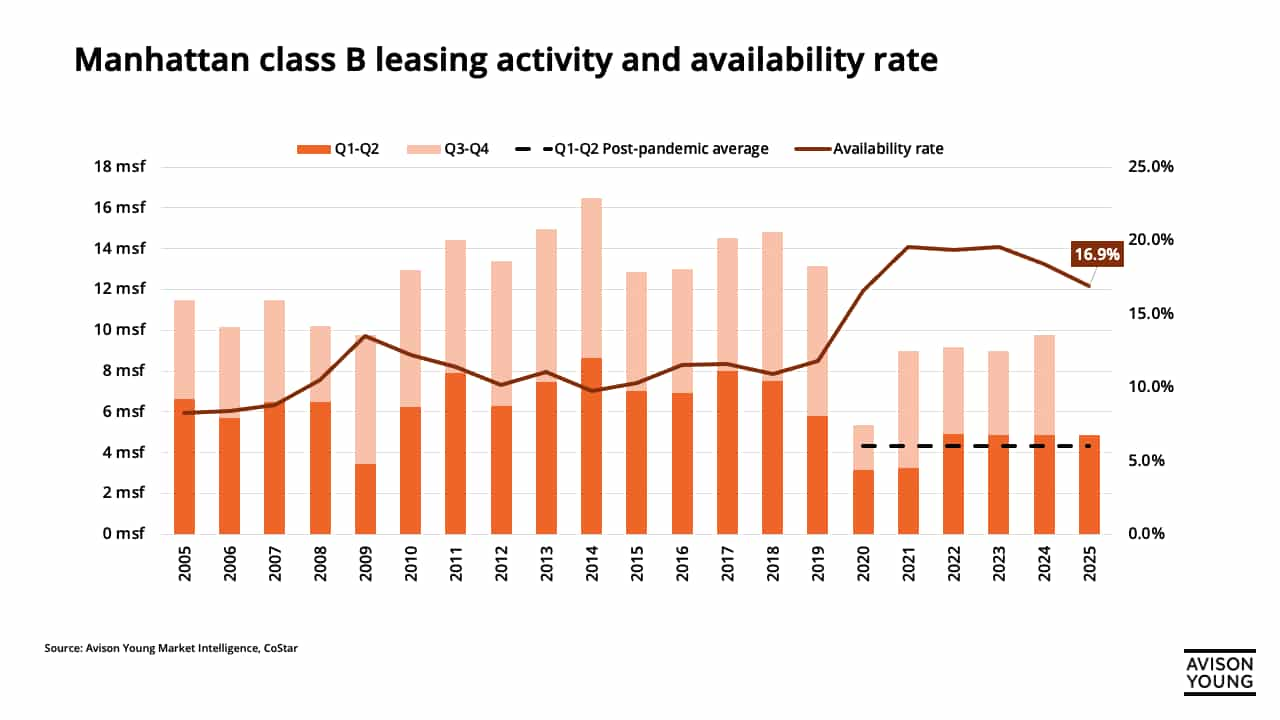

Strong start to 2025 for Manhattan class B leasing activity

Strong start to 2025 for Manhattan class B leasing activity -

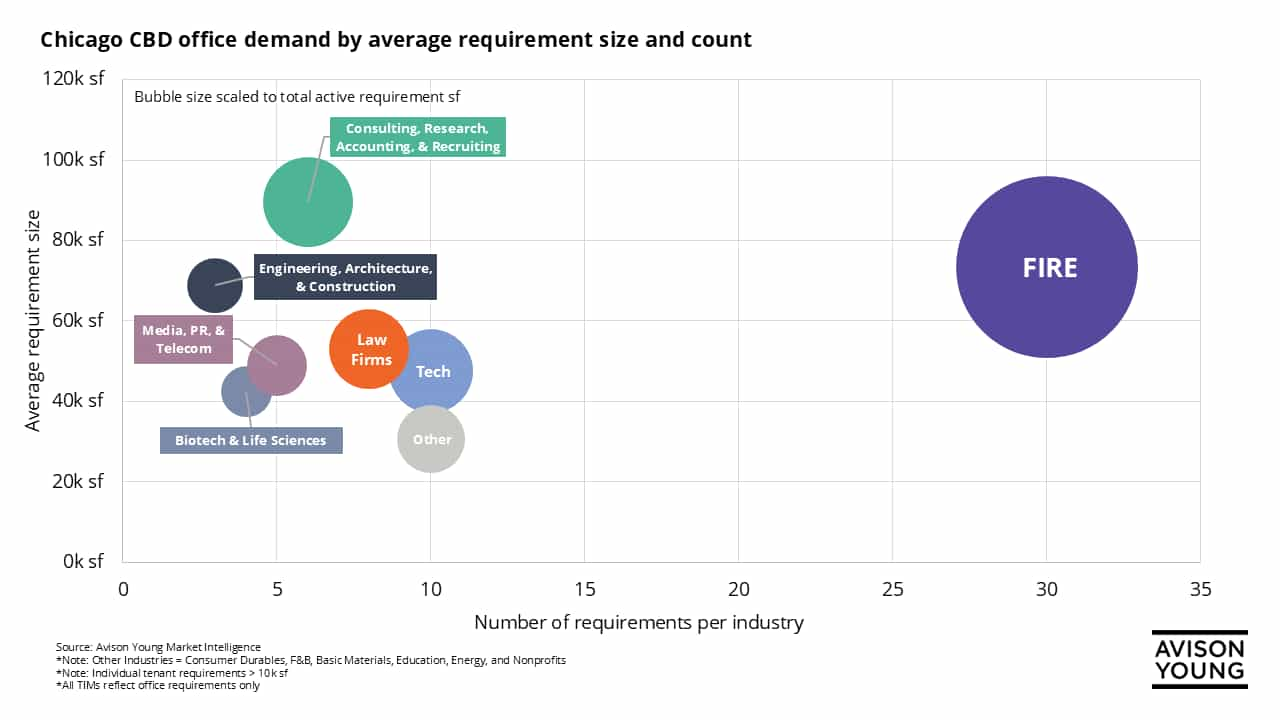

Demand disparity: Financial services drive tenant requirements in Chicago CBD with tech and consulting to follow

Demand disparity: Financial services drive tenant requirements in Chicago CBD with tech and consulting to follow -

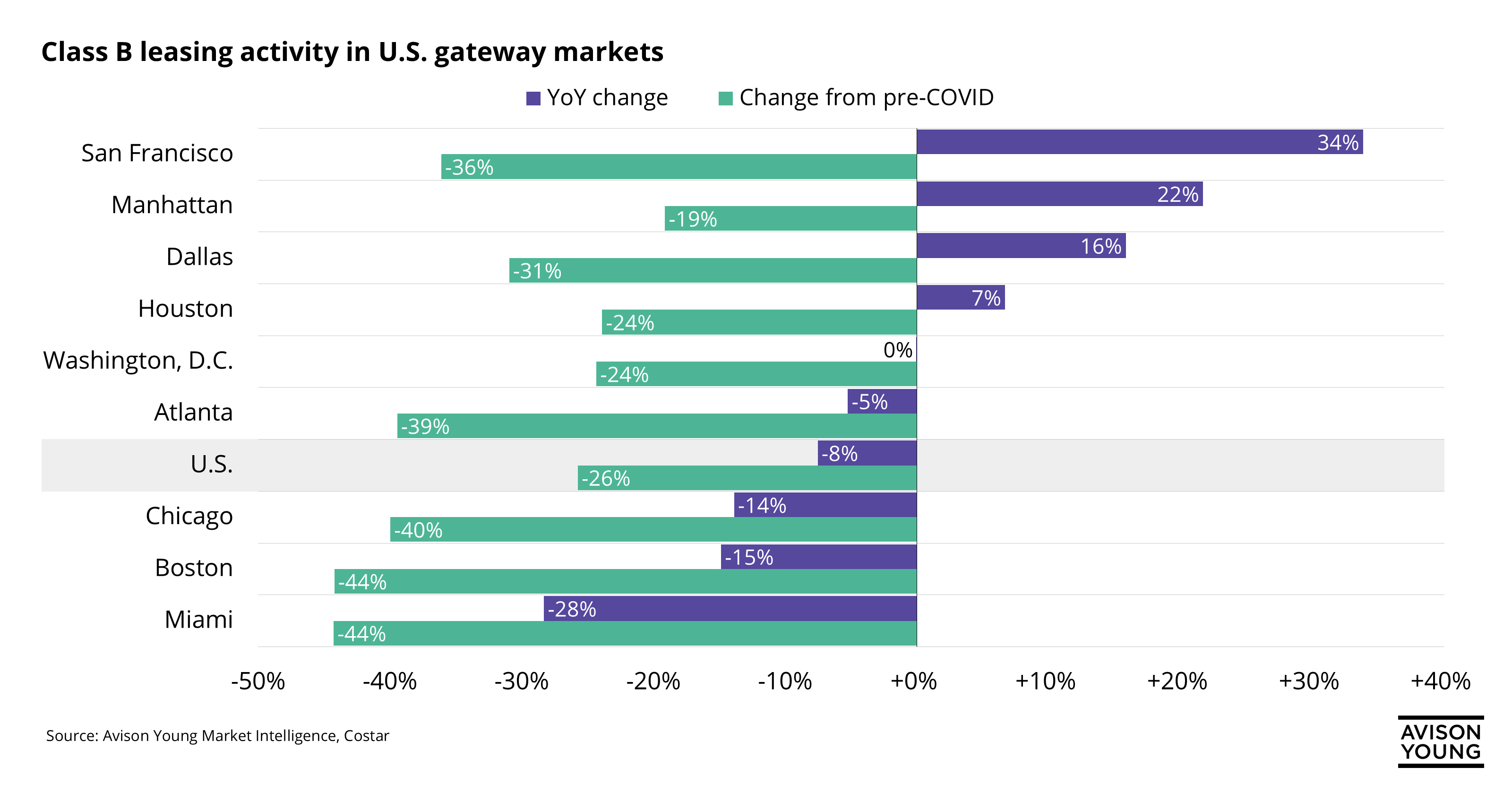

Which U.S. office markets are seeing a class B rebound?

Which U.S. office markets are seeing a class B rebound? -

Strong occupancy, stronger rents: Post-COVID realities in Fort Lauderdale industrial's market

Strong occupancy, stronger rents: Post-COVID realities in Fort Lauderdale industrial's market -

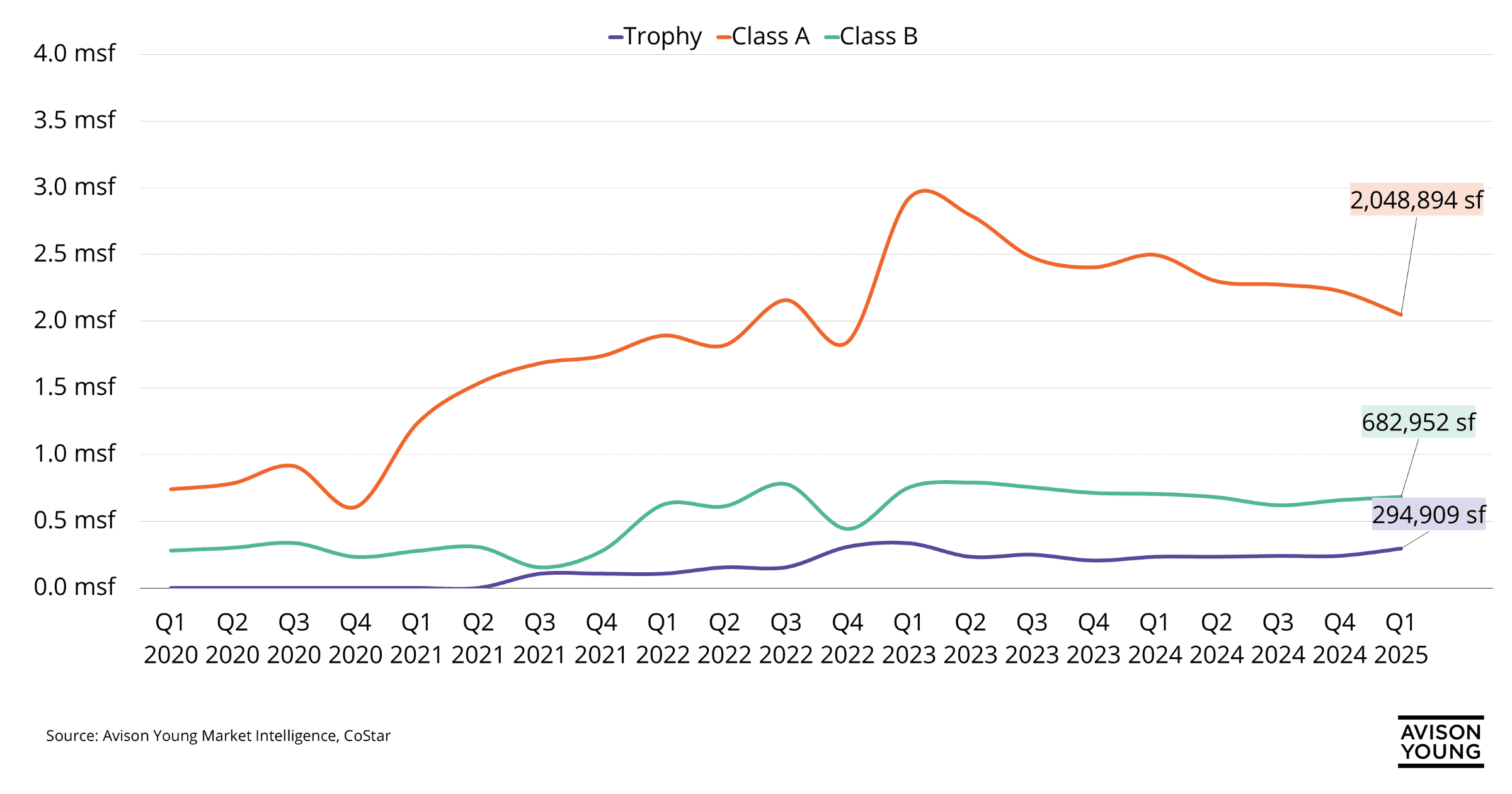

Miami continues to lead the next phase of industrial growth across Florida’s core markets

Miami continues to lead the next phase of industrial growth across Florida’s core markets -

Across the Philadelphia industrial market developers continue to scale down as demand drives shift toward 50K–249K SF projects

Across the Philadelphia industrial market developers continue to scale down as demand drives shift toward 50K–249K SF projects -

Law firms drive largest YoY growth in Boston office leasing

Law firms drive largest YoY growth in Boston office leasing -

Tampa sees strongest office leasing activity in first five months of 2025

Tampa sees strongest office leasing activity in first five months of 2025 -

Hiring hustle: Chicago’s Industrial sector shifts into high gear

Hiring hustle: Chicago’s Industrial sector shifts into high gear -

Century City tops Los Angeles office market with unmatched rental growth

Century City tops Los Angeles office market with unmatched rental growth -

Medium to large industrial users are the “sweet spot” in the Dallas-Fort Worth industrial market

Medium to large industrial users are the “sweet spot” in the Dallas-Fort Worth industrial market -

No case of the Mondays for Nashville’s return-to-office

No case of the Mondays for Nashville’s return-to-office -

Sublease supply shrinks in NoVA’s top office hubs amid post-COVID stabilization

Sublease supply shrinks in NoVA’s top office hubs amid post-COVID stabilization -

Small space users remain active amidst low MSP leasing activity

Small space users remain active amidst low MSP leasing activity -

- Read-Only.png/c92ee327-6d11-9b78-a4c2-11594649c3a9?t=1747923465942) Boston industrial subtypes react differently to economic shifts

Boston industrial subtypes react differently to economic shifts -

From expansion to equilibrium: Orlando industrial positions for sustainable growth

From expansion to equilibrium: Orlando industrial positions for sustainable growth -

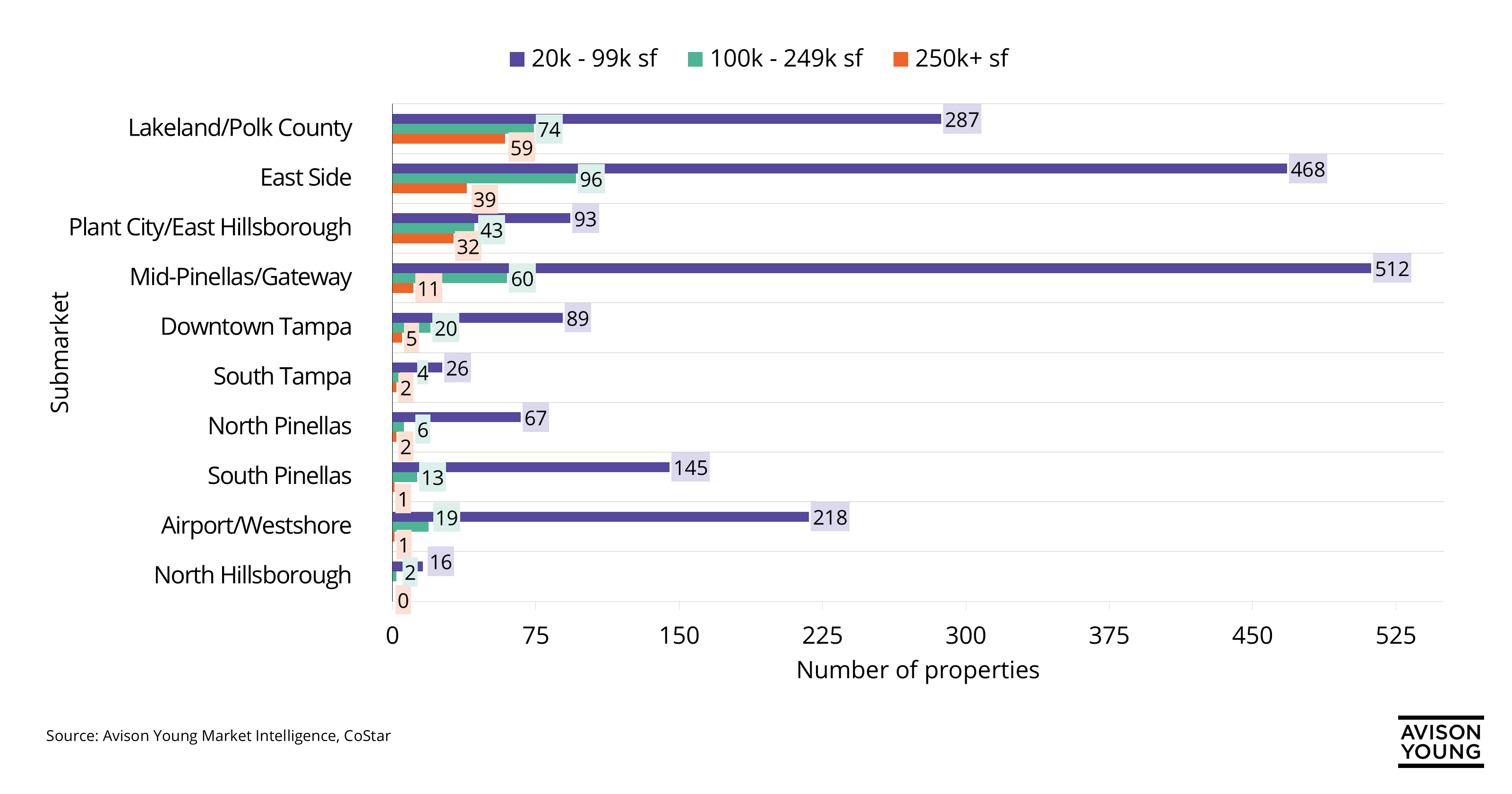

Tampa Bay industrial availability is shaped heavily by submarket

Tampa Bay industrial availability is shaped heavily by submarket -

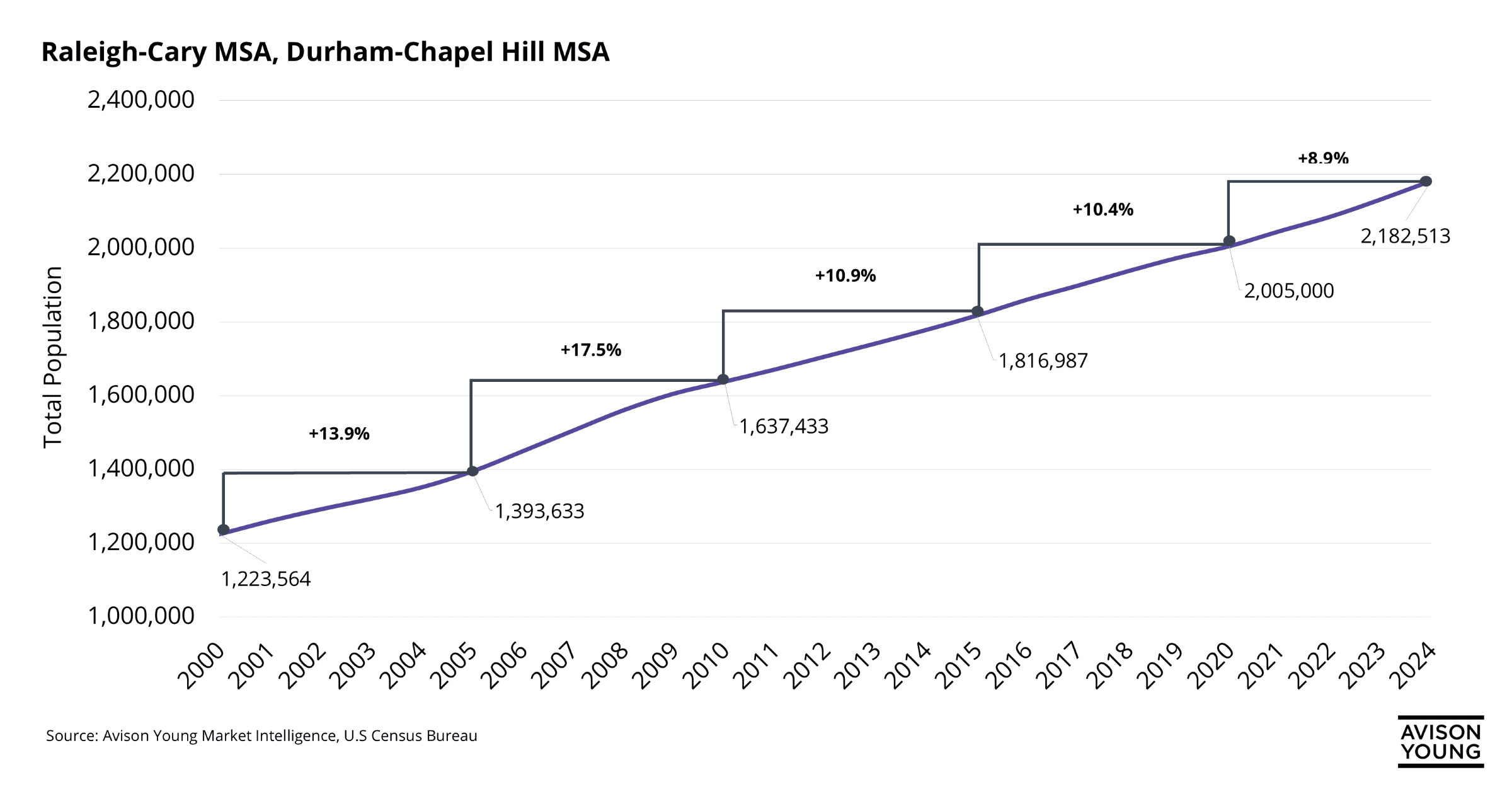

How Raleigh-Durham is defying national trends with robust growth

How Raleigh-Durham is defying national trends with robust growth -

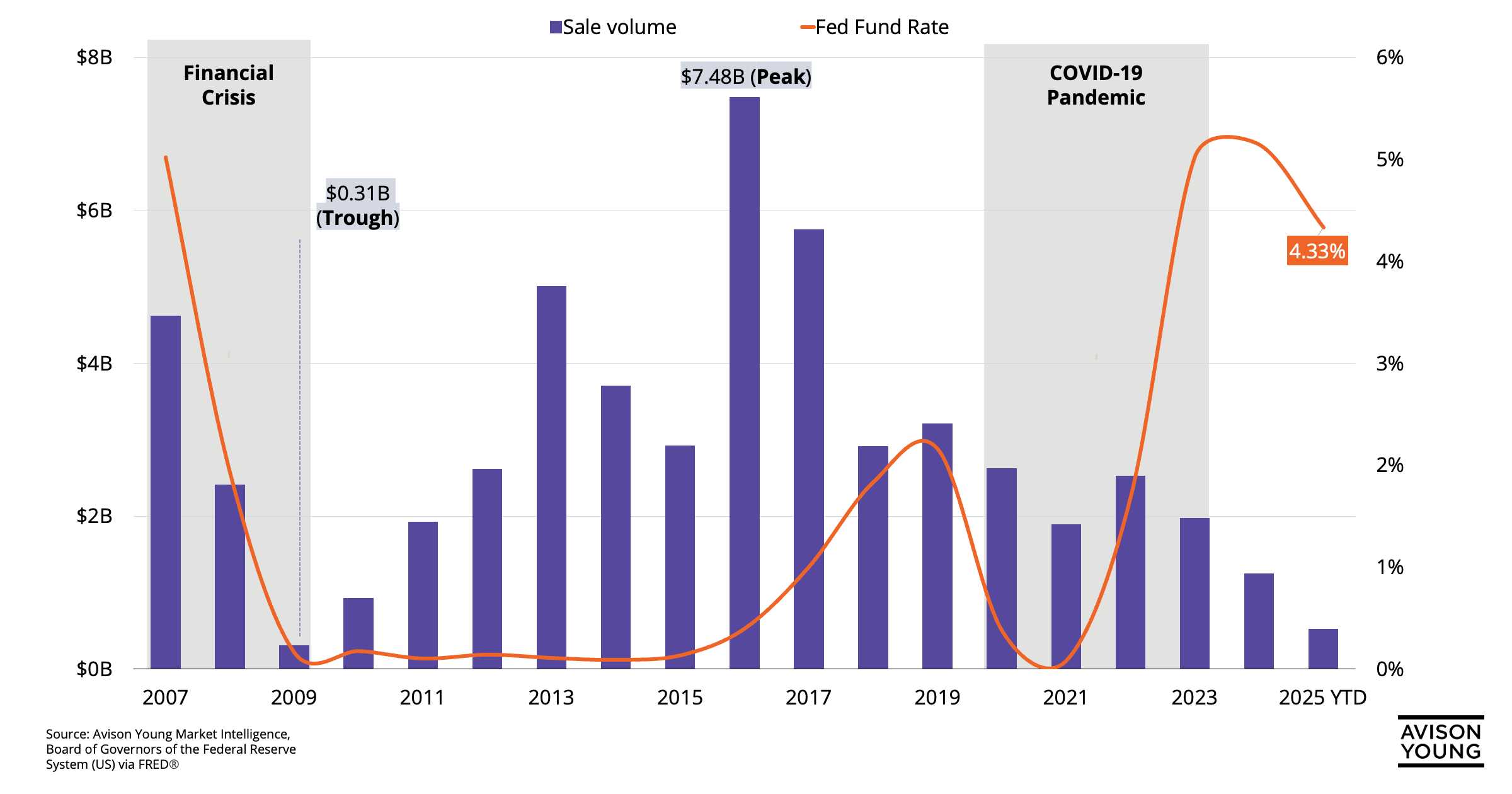

LA office investment sales: A market shaped by shifting tides

LA office investment sales: A market shaped by shifting tides -

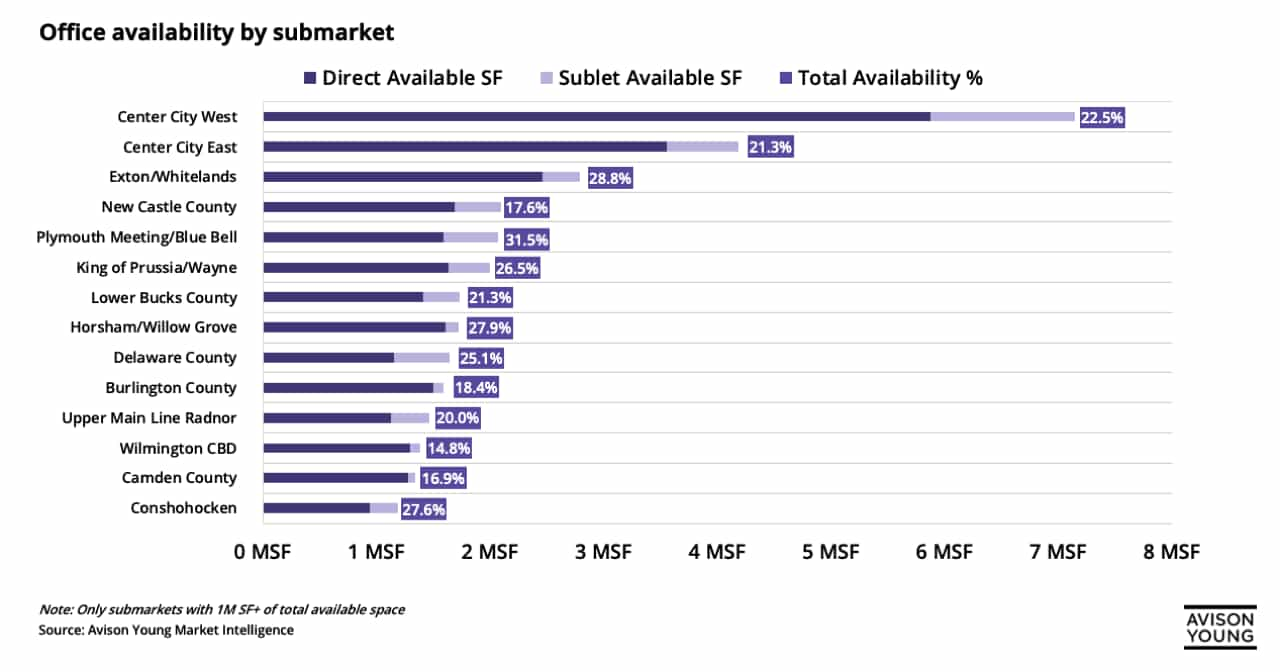

Submarket availability has yet to reach equilibrium across the Greater Philadelphia office market

Submarket availability has yet to reach equilibrium across the Greater Philadelphia office market -

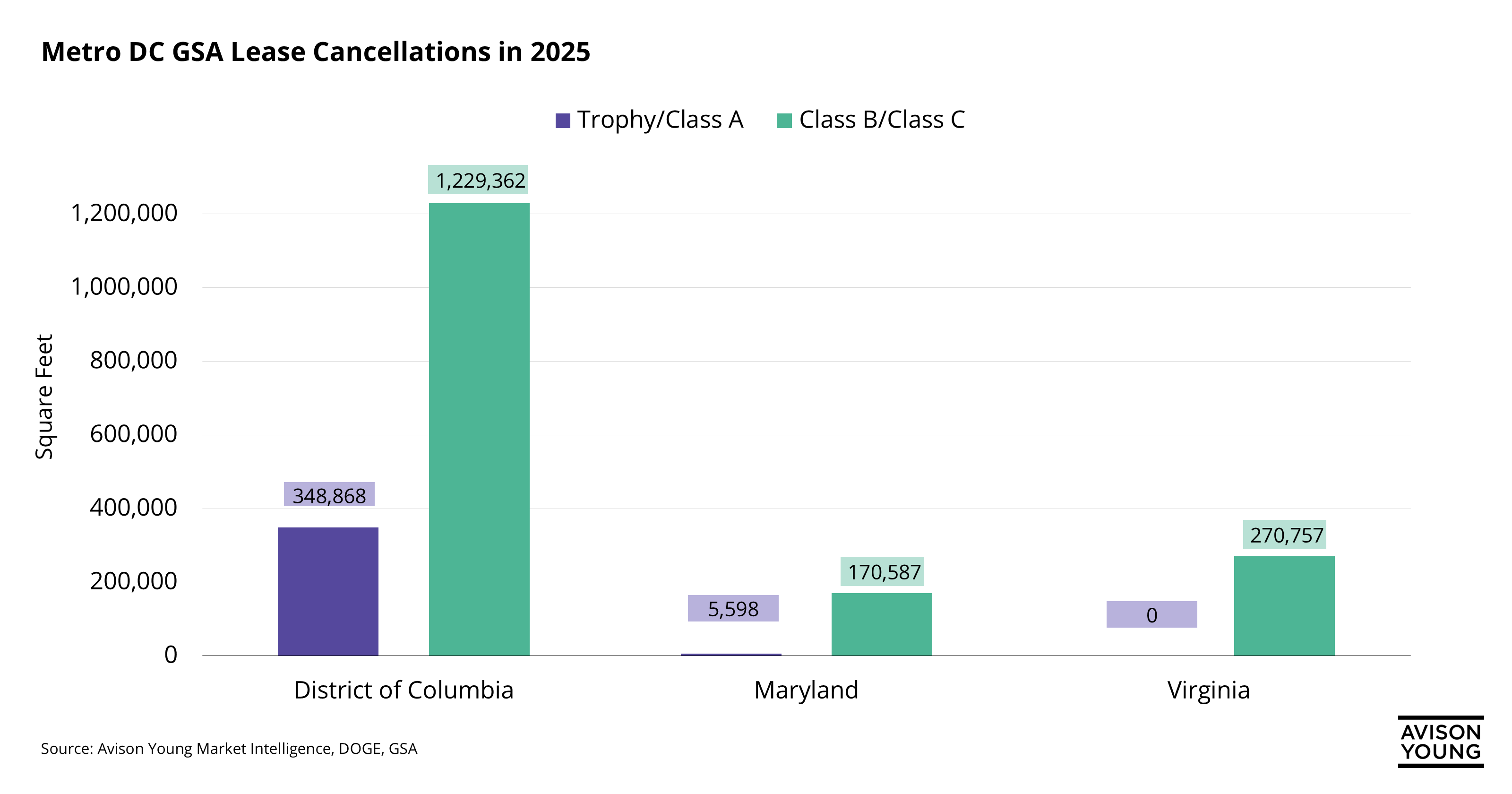

GSA lease cancellations drive further wedge between top and bottom quality of the DC, Maryland, and Virginia office market

GSA lease cancellations drive further wedge between top and bottom quality of the DC, Maryland, and Virginia office market -

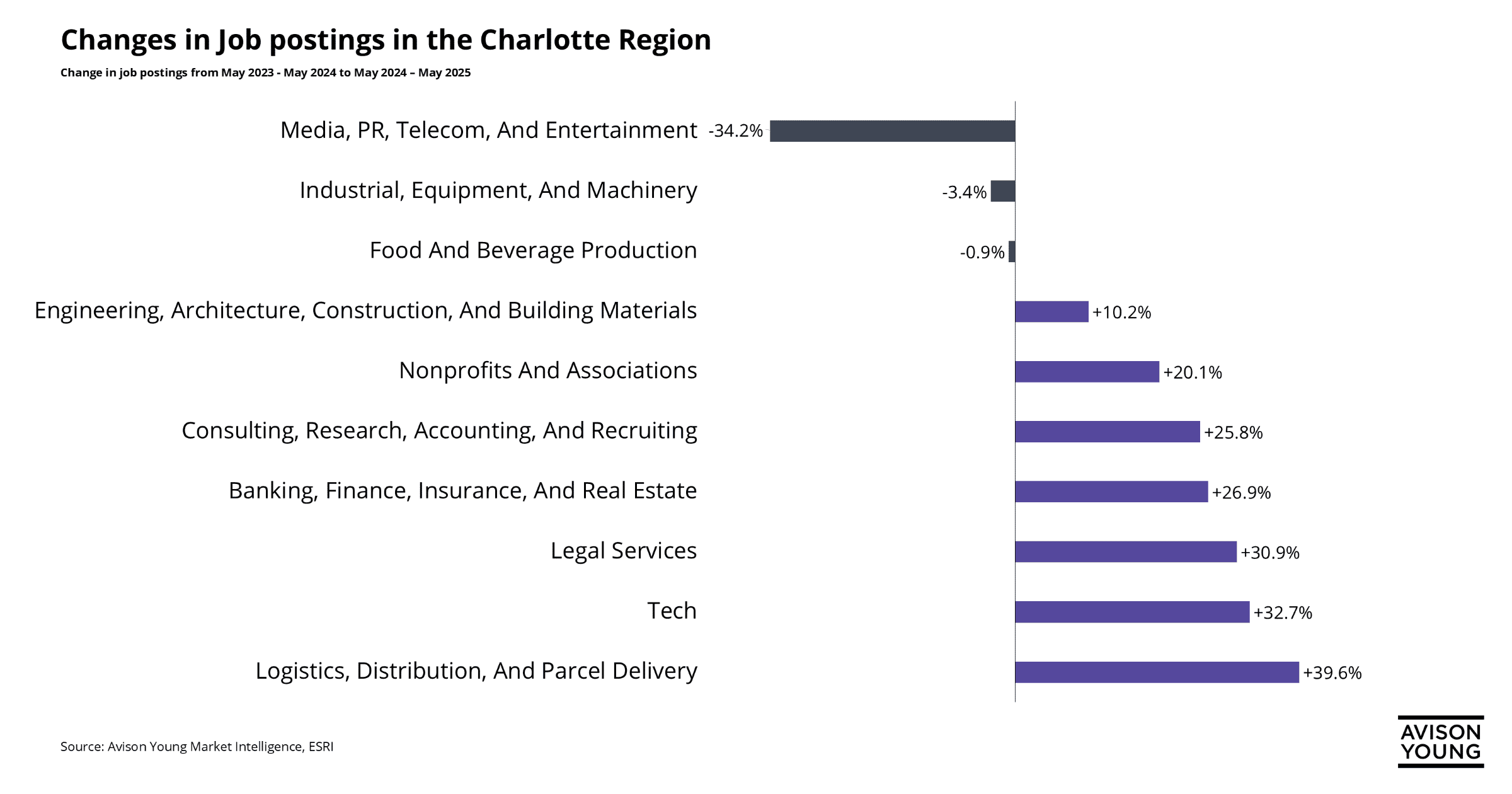

Why are job postings in Charlotte seeing significant shifts heading into 2025?

Why are job postings in Charlotte seeing significant shifts heading into 2025? -

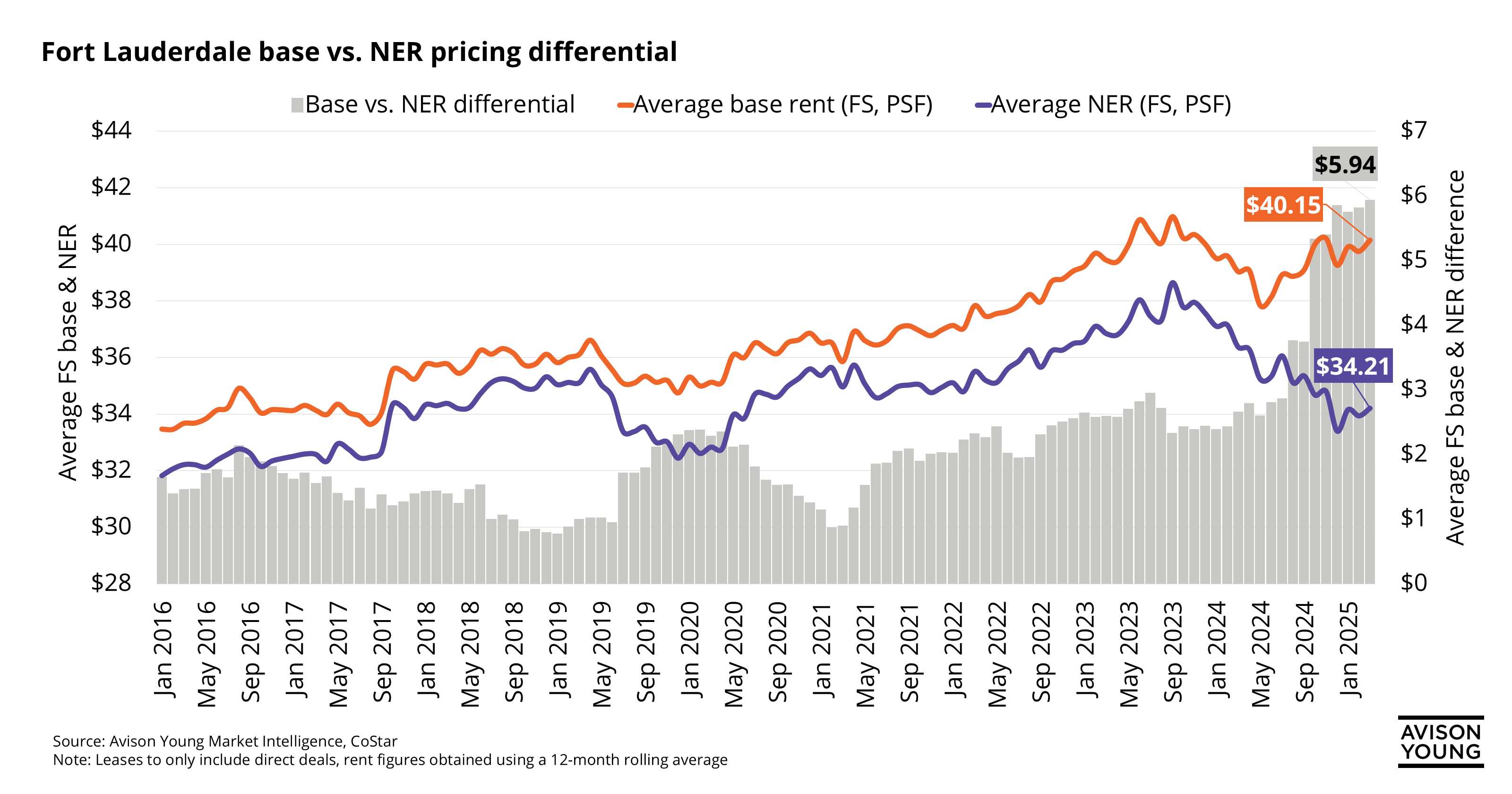

Fort Lauderdale base vs. NER pricing difference sees significant growth in the past 12 months

Fort Lauderdale base vs. NER pricing difference sees significant growth in the past 12 months -

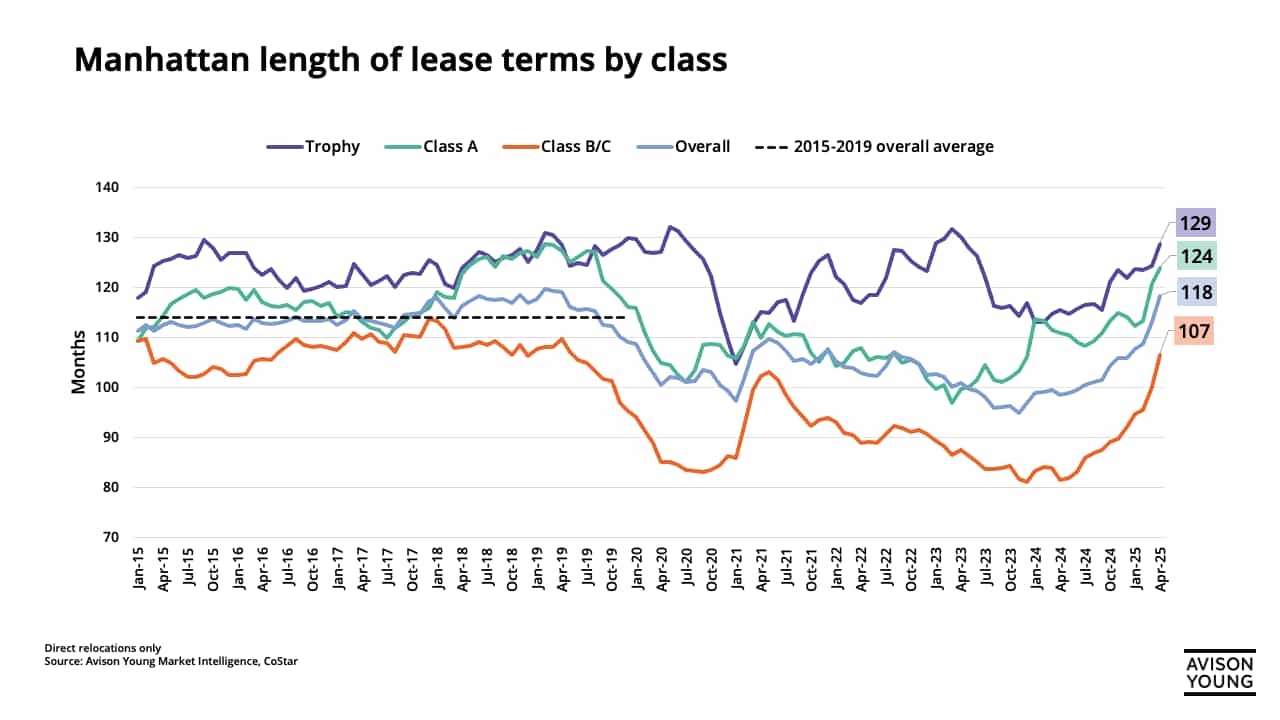

Manhattan lease terms surpass pre-pandemic averages

Manhattan lease terms surpass pre-pandemic averages -

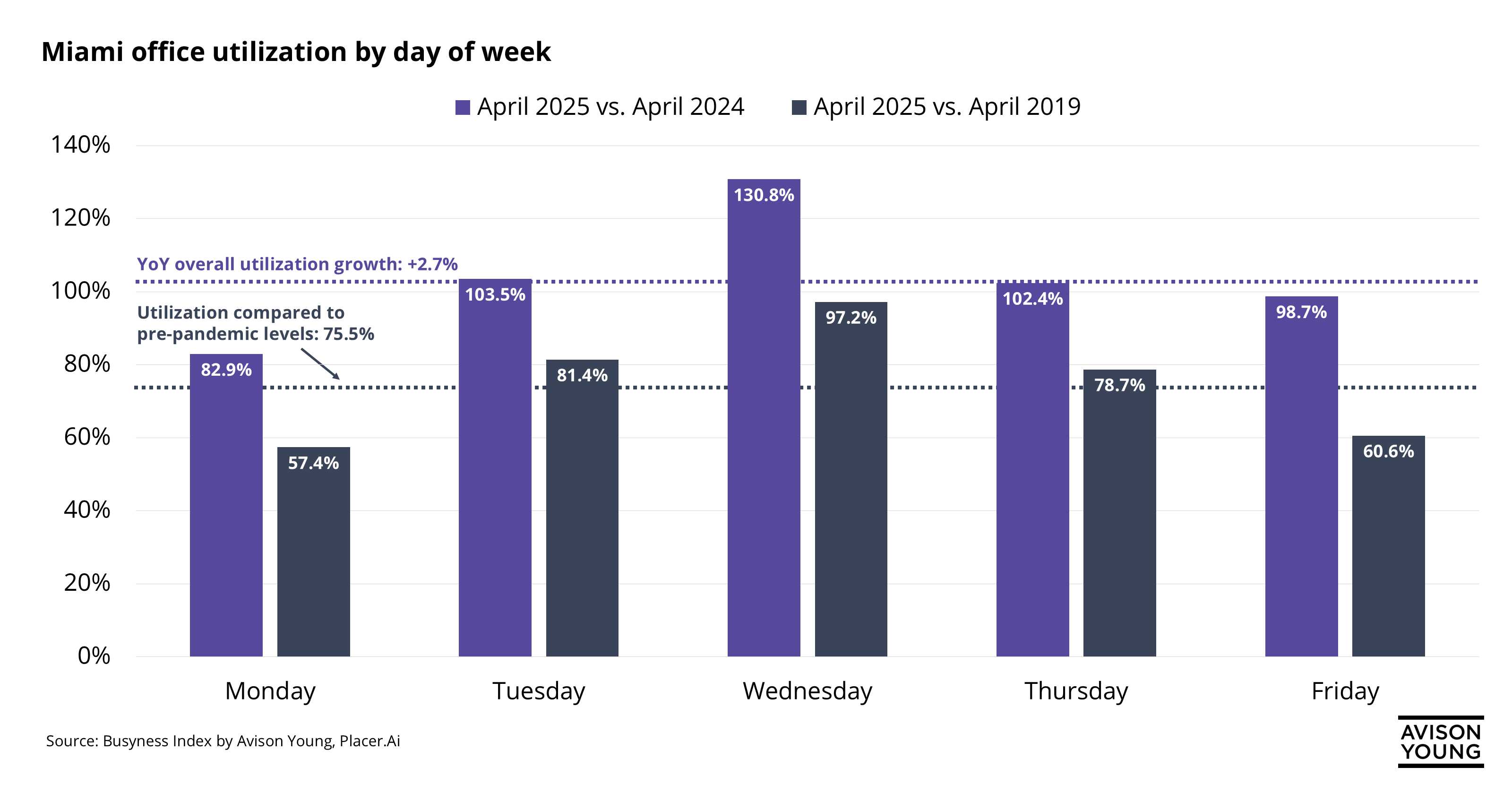

Miami sees strong mid-week office utilization growth

Miami sees strong mid-week office utilization growth -

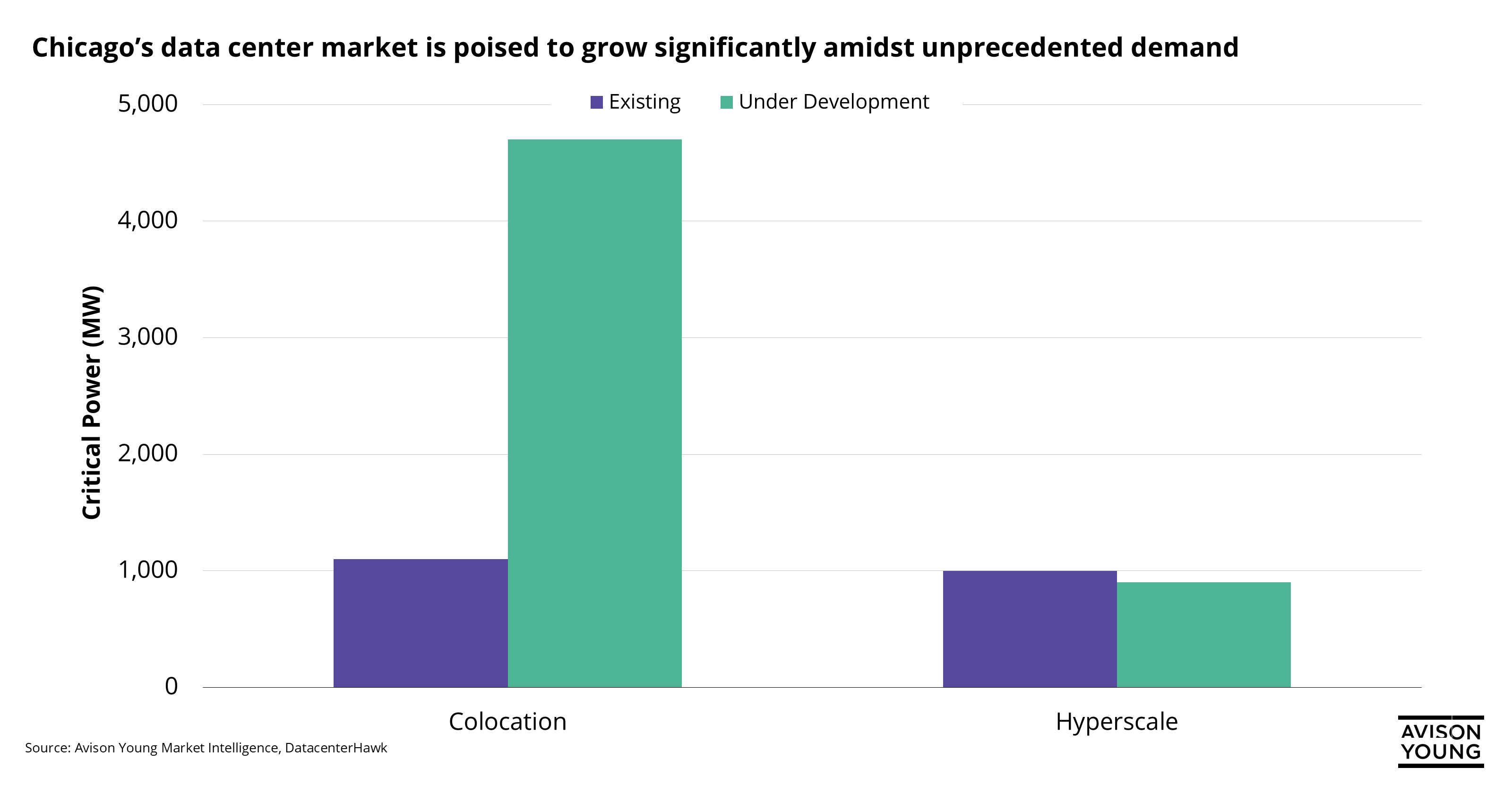

Windy city wired: Chicago’s data centers in bloom

Windy city wired: Chicago’s data centers in bloom -

Industrial buildings in Greenville-Spartanburg are getting smaller

Industrial buildings in Greenville-Spartanburg are getting smaller -

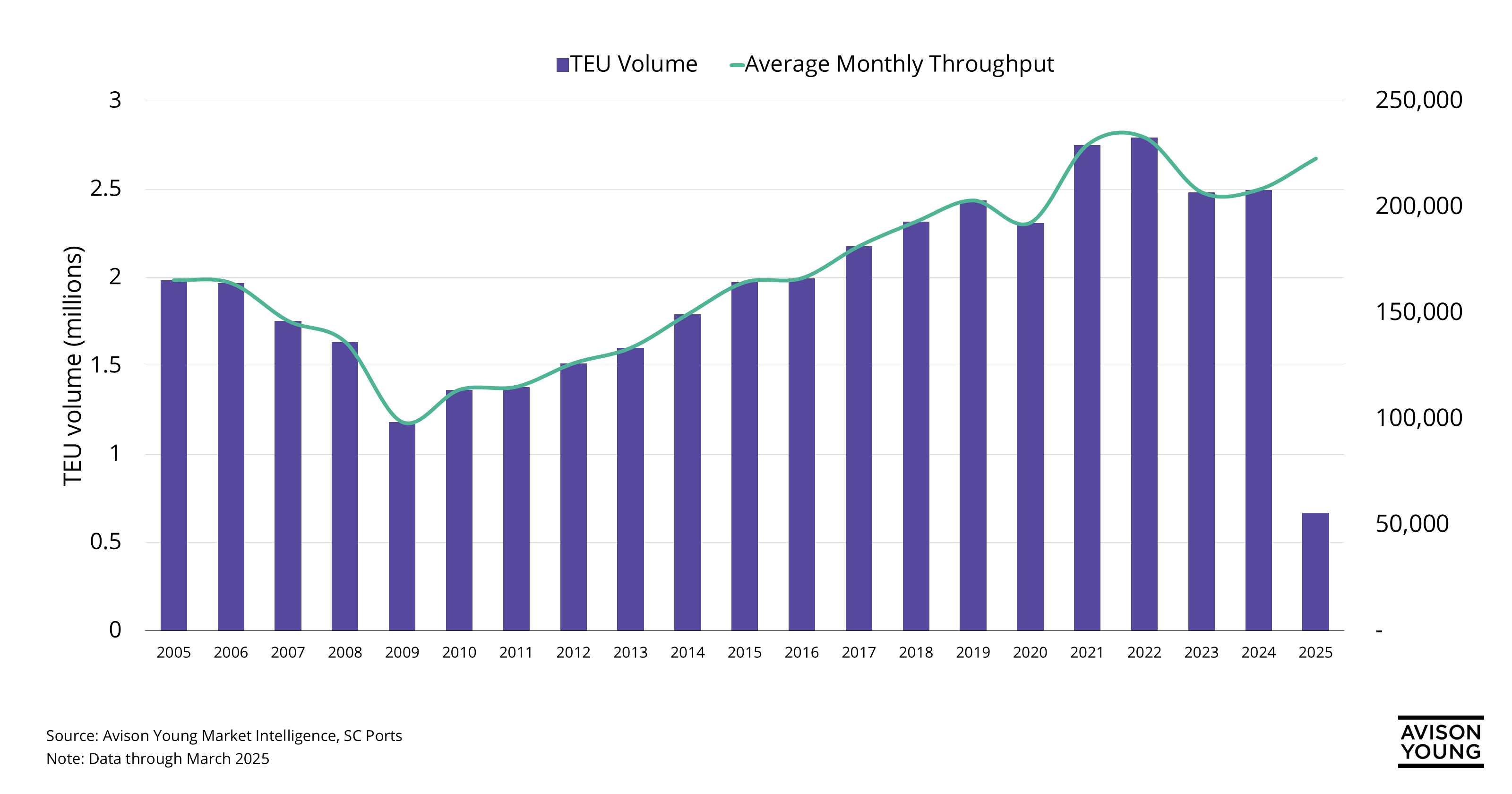

Charleston's port activity rises amid shifting trade dynamics

Charleston's port activity rises amid shifting trade dynamics -

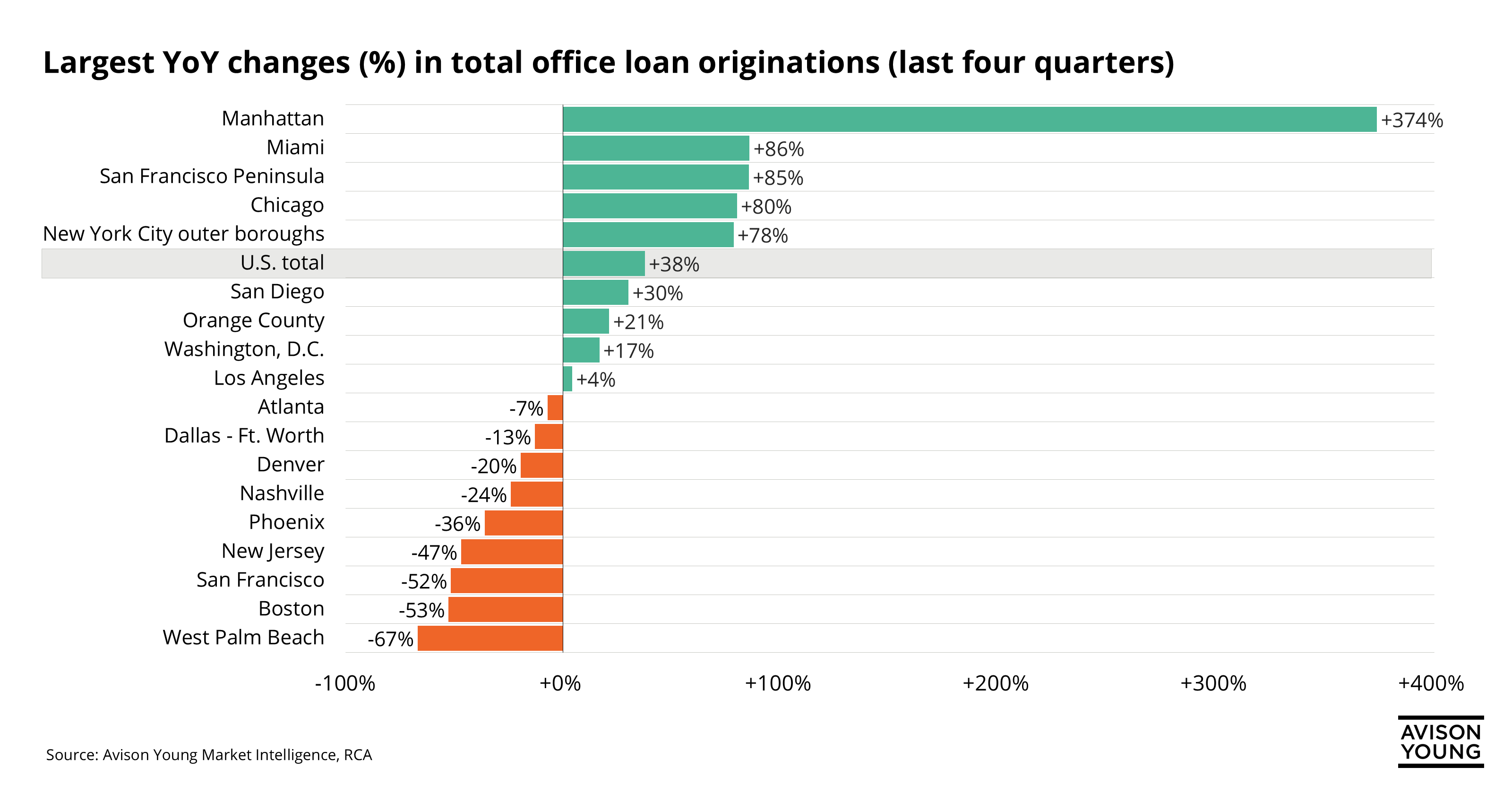

Selective confidence: U.S. office lending’s uneven rebound

Selective confidence: U.S. office lending’s uneven rebound -

Active smaller space users drive DFW’s first quarter office activity

Active smaller space users drive DFW’s first quarter office activity -

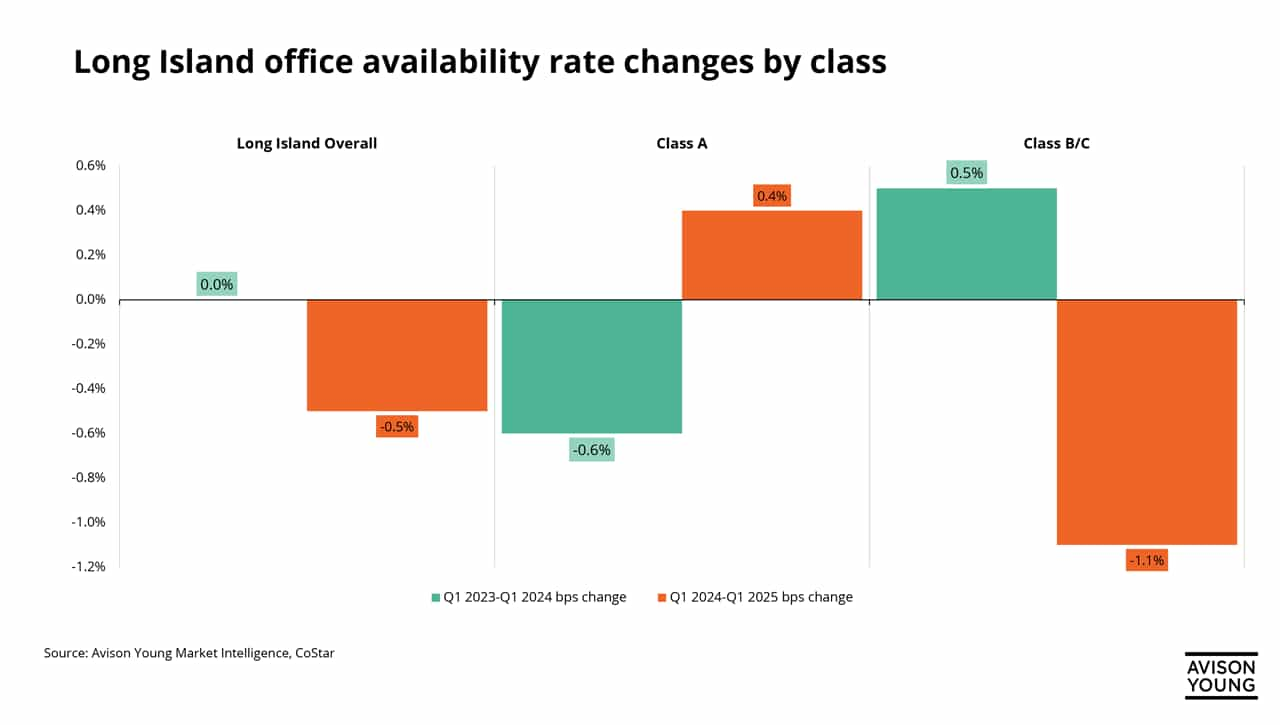

Class B/C office properties in Long Island lead the decline in availability rates

Class B/C office properties in Long Island lead the decline in availability rates -

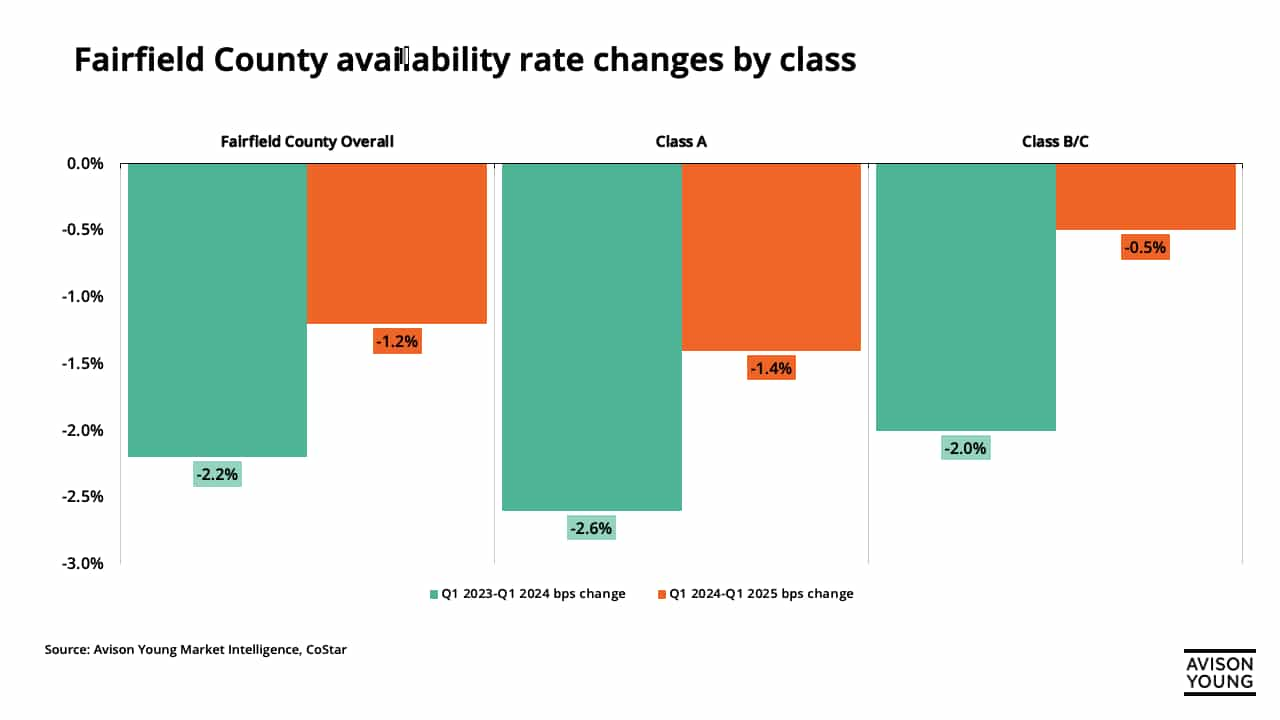

Fairfield County office properties see continued decreases in availability rate

Fairfield County office properties see continued decreases in availability rate -

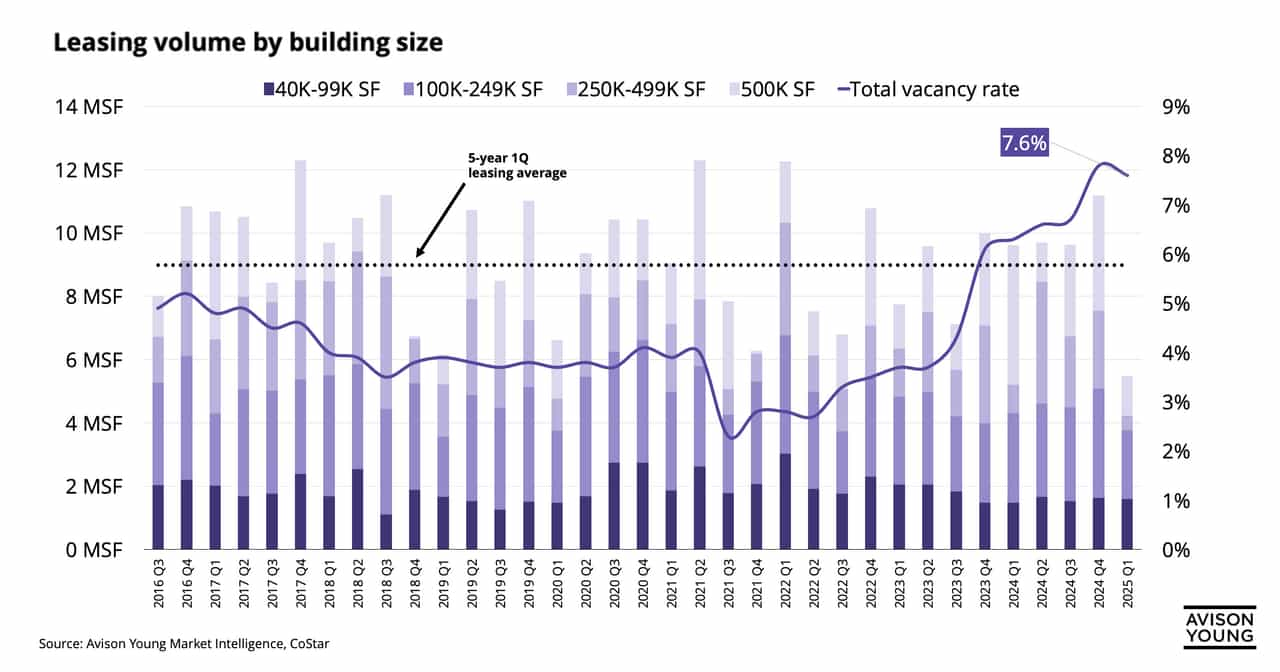

Leasing demand remains strong for small-to-mid sized industrial properties in New Jersey

Leasing demand remains strong for small-to-mid sized industrial properties in New Jersey -

.png/a4ae25fa-df6d-e748-9757-8a47e616b61b?t=1747063963869) Nashville industrial vacancy remains lowest among Southeastern peer cities despite high rents

Nashville industrial vacancy remains lowest among Southeastern peer cities despite high rents -

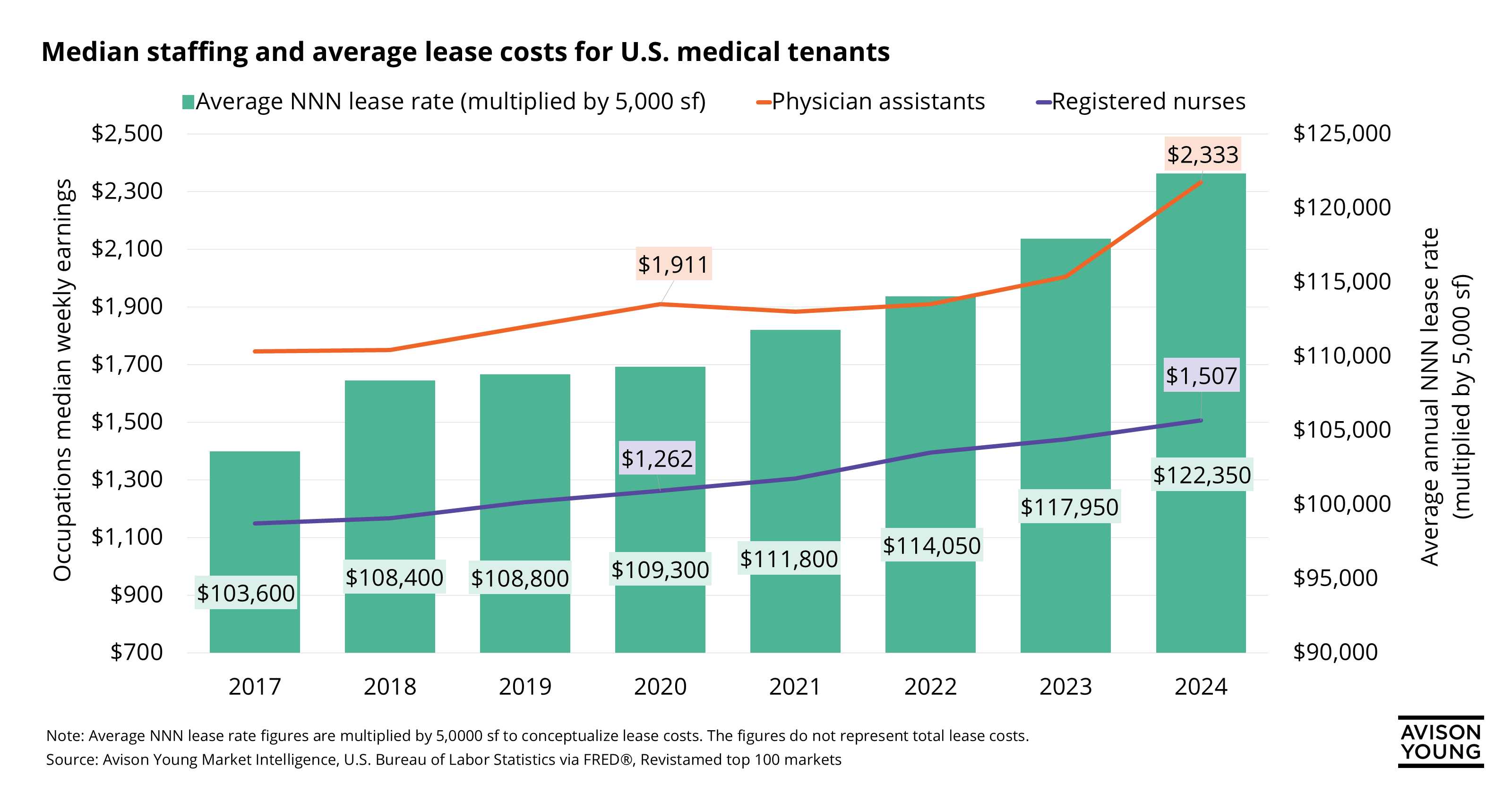

Rising rents and wages: The cost of a thriving U.S. medical occupier

Rising rents and wages: The cost of a thriving U.S. medical occupier -

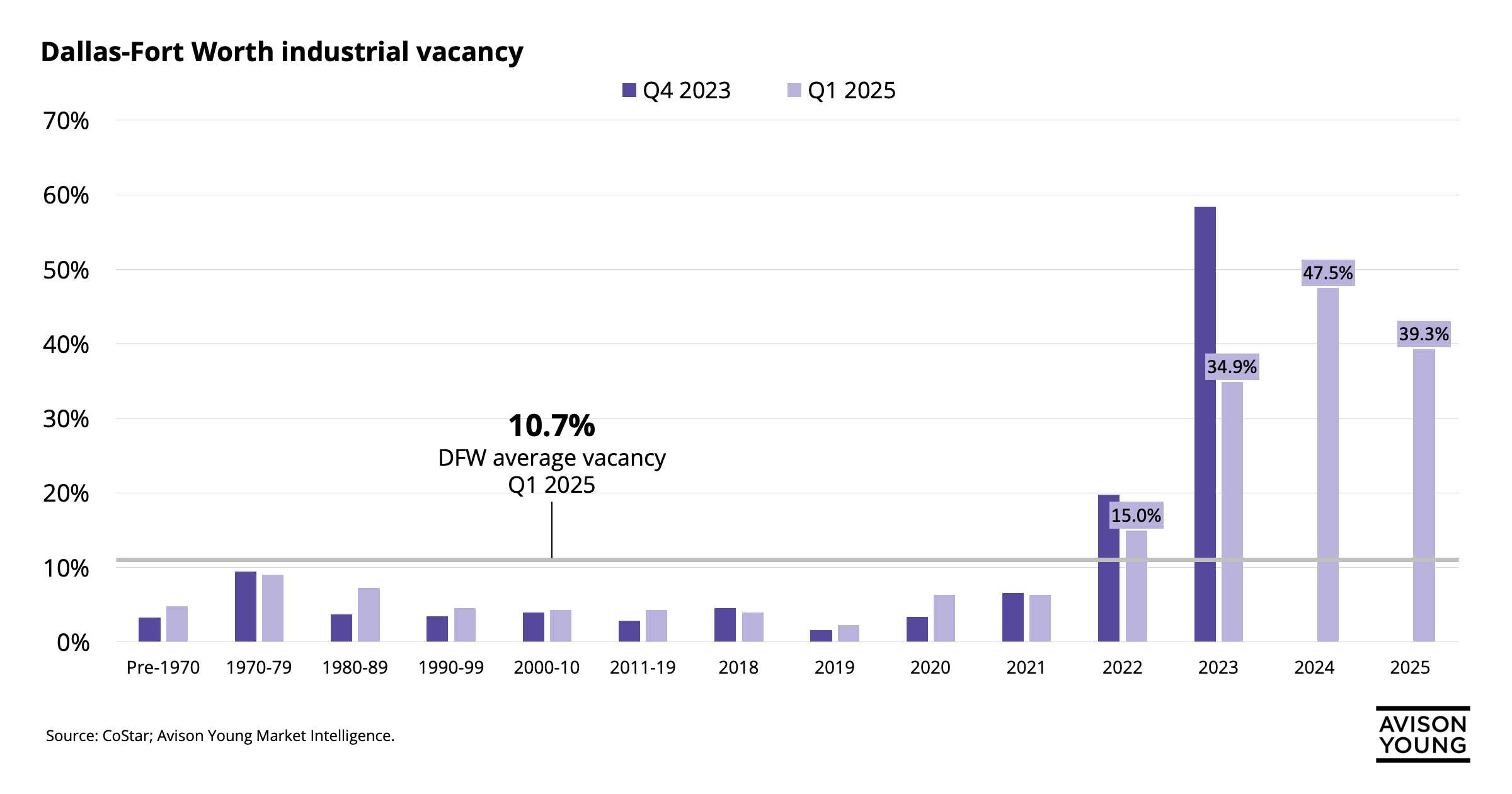

DFW’s industrial vacancy is much tighter than the averages suggest

-

Construction timelines and development costs continue to hinder the viability of the Denver construction pipeline

Construction timelines and development costs continue to hinder the viability of the Denver construction pipeline -

Shifting tides: How class B and C office availability reflects U.S. market recovery

Shifting tides: How class B and C office availability reflects U.S. market recovery -

DFW’s office vacancy has improved, but it’s a mixed bag with newer assets

DFW’s office vacancy has improved, but it’s a mixed bag with newer assets

—

60 Items per Page