What’s ahead for industrial as tenant activity moderates?

Positive industrial outlook shaping 2024

A review of 2023 industrial real estate activity shows a market that is moderating toward a new normal after two years of surging space usage during the pandemic. Our research points to positive signs that 2024 will be a more productive year than 2023 spurred by strong tenant demand and the prospects of lower interest rates. While there are some headwinds to watch, this all bodes well for industrial capital markets activity improving and returning back to a healthier level of activity.

Principal

Head of Industrial Capital Markets

[email protected]

+1 312.273.9486

Positive industrial outlook shaping 2024

Industrial leasing activity declined significantly in 2023 as occupiers continued to moderate their space needs coming off the robust run-on-space during the pandemic. This new era is seen as a return to normalcy as metrics are reset back to near pre-pandemic levels. There is plenty of optimism about where the market is heading in 2024, given strong pre-leasing activity to start the year and the potential for interest rate cuts coming around mid-year.

On a national level, industrial leasing declined to 560 million square feet (msf) in 2023, a nearly 20% decline compared with the previous five years. This activity was just 0.6% above the pre-pandemic 10-year average, according to Avison Young research.

A review of key industrial markets showed that leasing activity declined by 20% to 40% in 2023 as businesses scaled back on space expansions or delayed moving due to economic concerns. Last year was also a sign of resiliency for the industrial sector, however, as it retained positive net absorption each quarter and ended the year only slightly below pre-pandemic averages.

These tenant demand and supply dynamics were consistent in many markets across the country, as noted in Avison Young research. Chicago recorded a 38% drop in leasing in 2023 compared with the highs attained during the previous two years. Net absorption spiked in 2021 and 2022, reaching record-breaking levels. Levels gradually decreased in 2023 and returned to align with the average of 19 msf seen in 2016 to 2020.

In Dallas-Fort Worth (DFW), demand is still extremely robust even though the industrial sector has slowed slightly from its historic highs of the last few years. During 2023, DFW recorded more than 28 msf of net absorption and close to 52 msf of leasing activity, which are in line with the region’s solid past performance. Underscoring DFW’s resilience and strength as a U.S. logistics hub, the region continues to expand. Since late 2019, 100,000 net new industrial jobs were added, with 25,000 in the last year alone. This translates into annual growth of 3.1%, compared to 0.2% for the U.S.

In Atlanta, demand levels were consistent in 2023, but more tenants were searching for smaller square footages compared to previous years. Deals signed for spaces less than 50,000 square feet accounted for 64% of leasing activity in 2023. Atlanta experienced an influx of development deliveries the last couple of years, totaling over 32.7 msf in 2022 alone.

Conversely, leasing volume reached just 7.6 msf in the Inland Empire industrial market in the fourth quarter of 2023, with only 62 newly leases signed. This represents the lowest quarterly amount of leases signed over the last seven years. The slowdown comes after the leasing boom that occurred in 2020 in which occupiers adopted a “just-in-case” model, propelling the need for warehouse space. Since then, many occupiers have put a pause on expansion efforts and leasing fundamentals have begun to stabilize.

Industrial construction drives up vacancy

Industrial absorption figures are noteworthy given record levels of new construction delivering to the market over the past few years. Nationally, new groundbreakings topped out in the third quarter of 2022, with limited replacement in the pipeline in 2023 and into 2024. Construction levels are expected to reach around 120 msf by the second half of 2024, setting the pipeline back below 10-year averages.

The Chicago market has seen a substantial decline in industrial construction due to rising interest rates and economic uncertainty. Currently, there is 20 msf under development, down 46% from 2022 and, of that, 70% is being built on a speculative basis. This decrease is projected to lead to a noticeable shortage of new inventory over the next 18-24 months.

Rents grow as landlords maintain advantage

Market conditions continue to favor landlords and are helping to push rents upward across the county. The Chicago industrial market recorded an 11.9% increasing from 2022, with average starting rents at $7.90 NNN at the end of 2023. In Dallas, rents increased by 19% from 2022 and 66% over the last five years. In Atlanta, the increase from 2022 was 13.8%.

As leasing activity resets in the industrial sector, there are positive signs in the economy, as well as metrics to watch. The economy has proven to be more resilient than many economists predicted, with strong consumer spending and record job growth seen as positive indicators. Consumer spending, which drives much of the industrial and retail sectors, is now tipping into higher debt levels that could create credit issues and a slowdown in spending.

According to the Federal Reserve’s Q4 2023 report on household debt and credit, U.S. household debt balances increased by $212 billion, a 1.2% rise from the third quarter. Credit card balances total $17.5 trillion and have increased by $3.4 trillion since the end of 2019. Balances on consumer credit reports increased by $112 billion during the fourth quarter of 2023 to reach $12.25 trillion by the end of December. Home equity loan balances increased by $11 billion to reach $360 billion in outstanding balances. This marked the seventh consecutive quarterly increase.

The resilient economy and prospects for interest rate cuts are key factors driving discussions of an expected uptick in leasing and capital market activity during the second half of 2024. In the months ahead, there should be more clarity around if and when those cuts take place – and whether consumer spending creates any headwinds that could impact industrial activity.

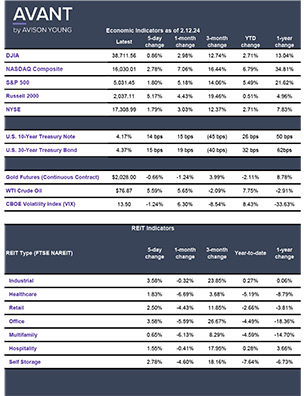

Please click on the chart below for real estate and economic indicators: