Navigating the surge: How a new wave of industrial availability in Miami is affecting the average months on market for leasable space

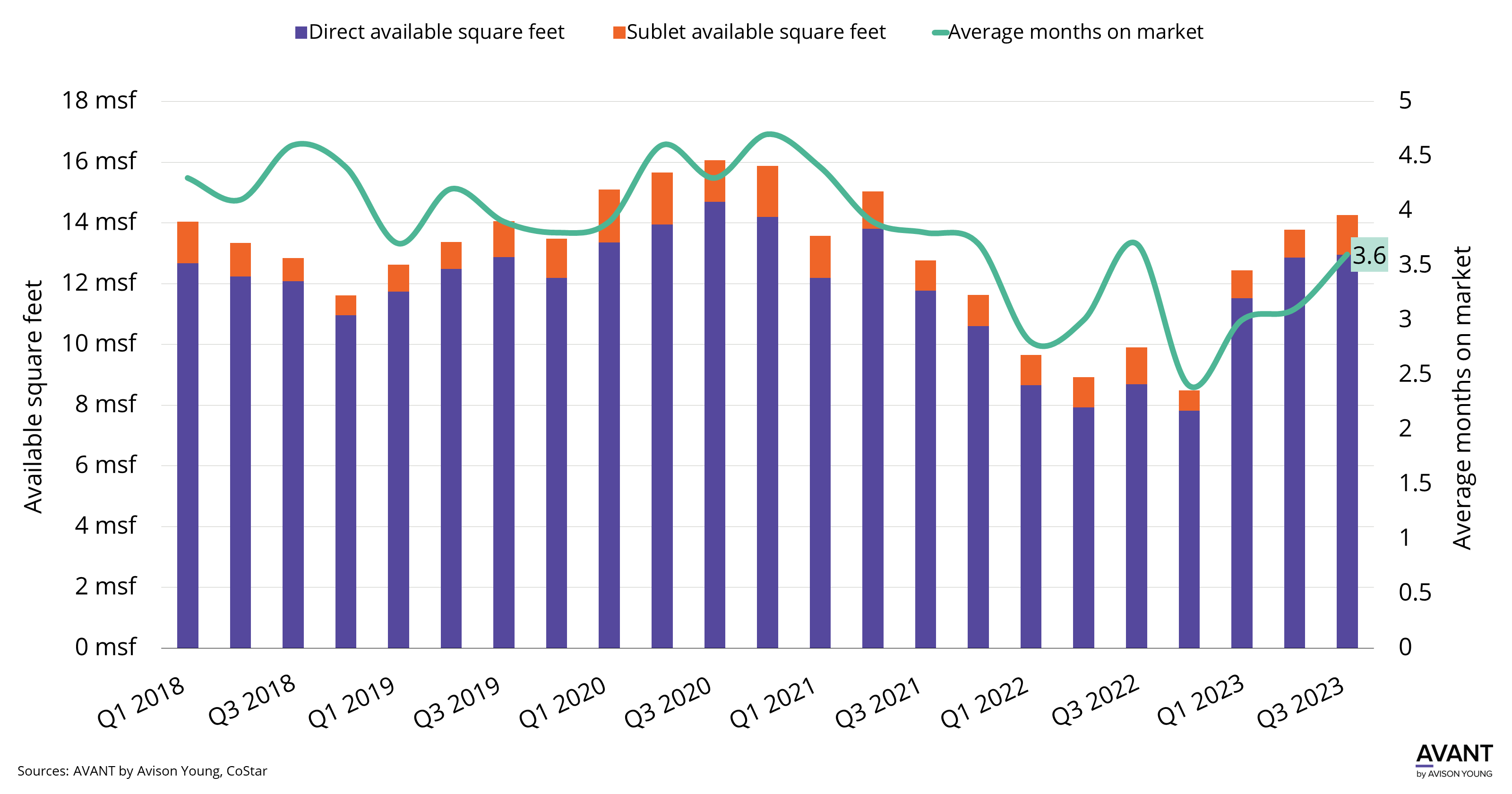

- Miami’s industrial market displayed strong fundamentals throughout 2023, with a low vacancy rate of 2.4% as of the third quarter. Total industrial availability increased each of the first three quarters, reaching a total of 14.2 million square feet and marking a 68.2% increase throughout the year as of November 2023.

- The influx of industrial availability in Miami increased the total time on market for leasable space. In the fourth quarter of 2023, the average time on market was 3.6 months, up from an average of 2.4 months one year prior. Over the past five years, the Miami market has never exceeded an average of 4.7 months to lease, indicating continued robust demand for the foreseeable future.

- The amount of available sublease space has nearly doubled since the third quarter of 2022, reaching 1.3 million square feet one year later. As supply chain issues ease, logistics and distribution tenants are beginning to shed unnecessary space that was required to fulfill inventory shortages during the pandemic.

Get market intel

US-FL-MIA Miami