Commercial real estate advisor providing services for investment sales, leasing, and property management in Greater Phoenix

Avison Young’s Phoenix office has become one of the area’s premier providers of commercial real estate services. From our strategically located office we offer full-service real estate solutions across office, industrial, retail, and healthcare classes. In utilizing our company’s no-silo approach to partnership, we provide reliable, efficient services for owners and investors alike, as well as for users and occupants.

Avison Young is grounded on a unique foundation of partnership. Our Principals are both the owners and configure and re-shape our team and expertise around your business demands, ensuring that your commercial real estate needs will always be met. Pair our commercial real estate experts’ critical market knowledge with industry-leading technology and gain solutions carefully tailored to create your unique competitive advantage.

We work on behalf of tenants, landlords, investors, and buyers alike, including many large national and international corporate clients. Avison Young’s Phoenix office frequently partners with the company’s brokerage operations throughout the United States, Canada and Mexico - and across the globe.

Subscribe to the Connect Arizona Newsletter

Avison Young Connect Arizona is a weekday newsletter highlighting the best local, regional, national and even international commercial real estate news. Join 1,500+ people who are already subscribed.

Phoenix commercial real estate services

Avison Young’s Phoenix brokerage team has consistently completed major leasing and investment sales transactions across all asset types. Whether you are an owner, investor, occupier or developer, we deliver results aligned with your strategic business objectives. Our Phoenix commercial real estate advisors are here to support your initiatives, add value, and build a competitive advantage for your organization.

Find properties for sale or lease in the Greater Phoenix area

Search Avison Young’s Phoenix commercial real estate listings for sale and lease to find the right commercial property for you. Our investment and leasing opportunities include office, retail, industrial, warehouse, and healthcare properties.

-

Glendale Palms PAD

SEC 67th Avenue & Bell RoadGlendale, AZ 85308For Lease

Retail

-

Camelback Lakes

2850 E Camelback Rd | Suite 315Phoenix, AZ 85018For Lease

Office

-

Arbor

310 S Mill AveTempe, AZ 85281For Lease

Retail

-

Fry’s Shops at Stapley & McKellips

1863 N. Stapley DriveMesa, AZ 85203For Lease

Retail

Phoenix and North America commercial real estate news

-

Avison Young celebrates Women of Influence, class of 2024April 18, 2024

Avison Young celebrates Women of Influence, class of 2024April 18, 2024 -

.jpg/ef28df96-d38d-5ba8-8fcb-5a9aa6753ebf?t=1713375377600) Avison Young announces $44.5 million sale of Natomas Corporate Center, a Class A Office Property in SacramentoApril 17, 2024

Avison Young announces $44.5 million sale of Natomas Corporate Center, a Class A Office Property in SacramentoApril 17, 2024 -

.jpg/ac6d921e-9452-94f1-4434-7ece99f74e17?t=1713220226805) Avison Young releases its First Quarter 2024 Industrial Market Report for PhoenixApril 15, 2024

Avison Young releases its First Quarter 2024 Industrial Market Report for PhoenixApril 15, 2024 -

.jpg/01915c6a-a21f-c2cb-7778-ec42f7782da1?t=1712855033245) Avison Young releases its First Quarter 2024 Office Market Report for PhoenixApril 11, 2024

Avison Young releases its First Quarter 2024 Office Market Report for PhoenixApril 11, 2024

Phoenix commercial real estate insights

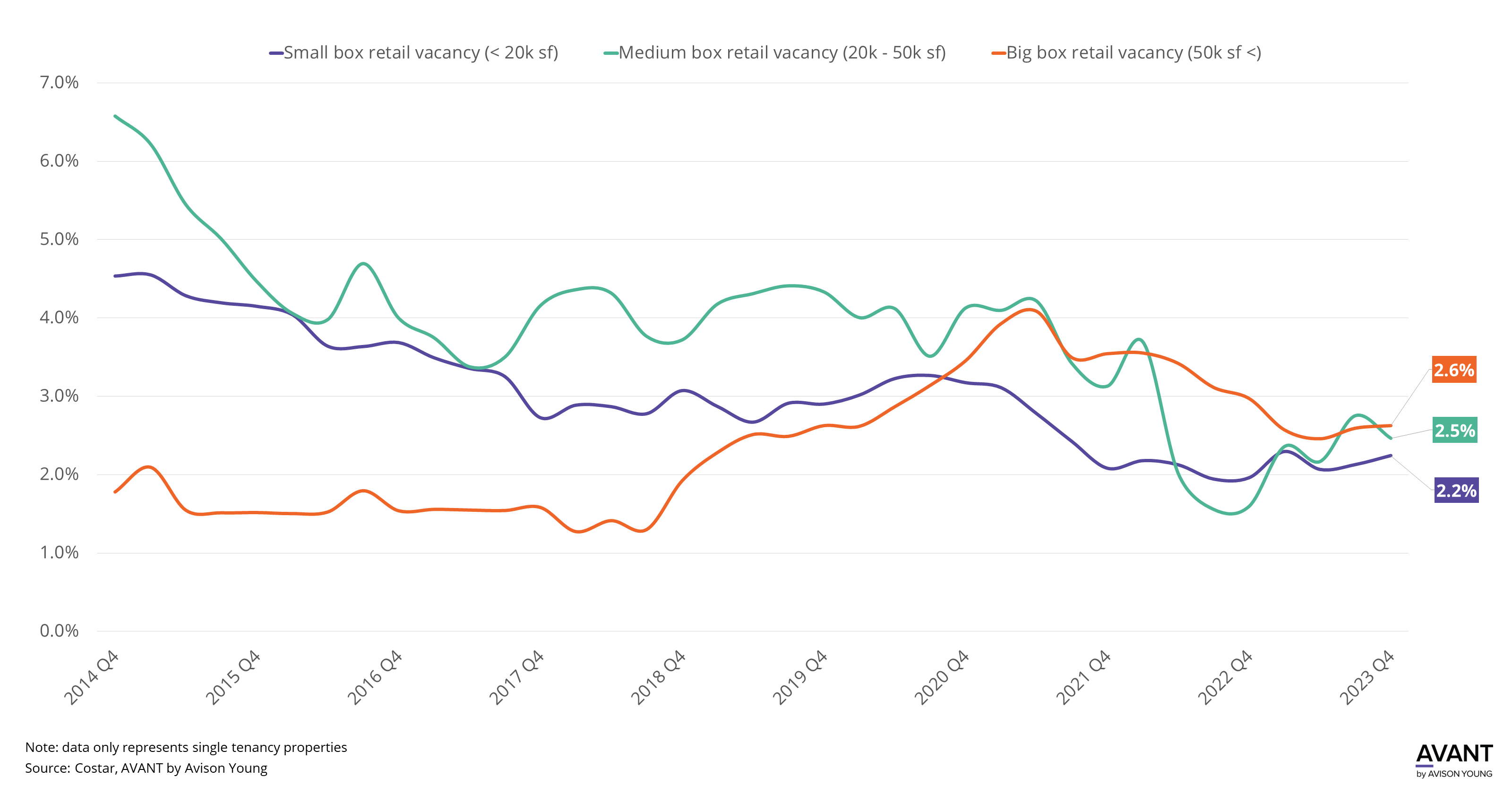

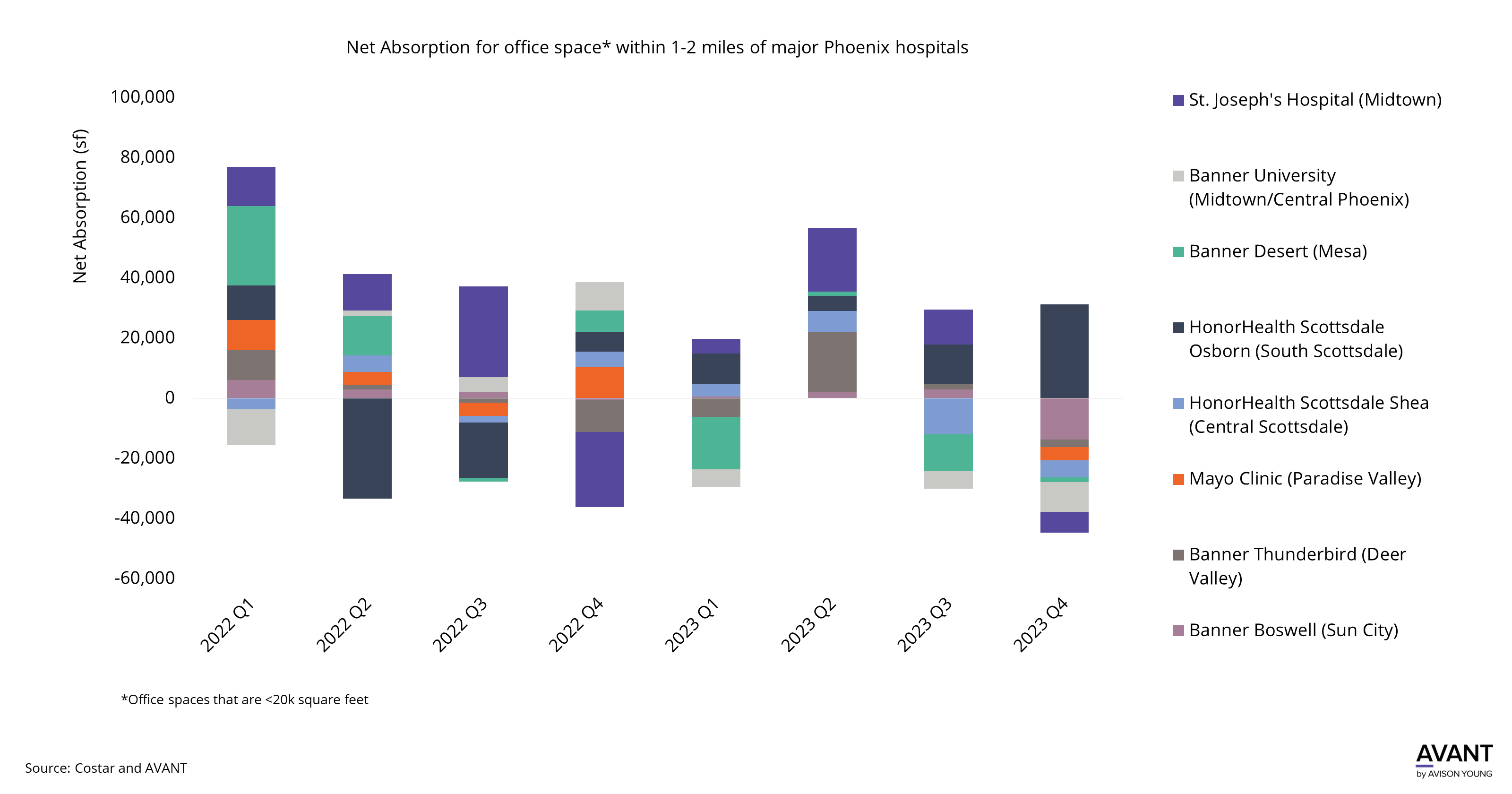

Reopening efforts, higher vaccination rates, and additional market dynamics show a promising future for the Phoenix office, retail and industrial market.

Phoenix midyear market overview 2023

View Phoenix office market report (Q1 2024)

Phoenix commercial real estate consultants

Phoenix office

Principal, Managing Director

Phoenix property management solutions

Regional Director, Real Estate Management Services

Contact a commercial real estate broker in Phoenix

Please leave your details and an advisor will contact you.