From blueprint to boom: Unleashing the easing marvel of a next-generation Metro DC office building

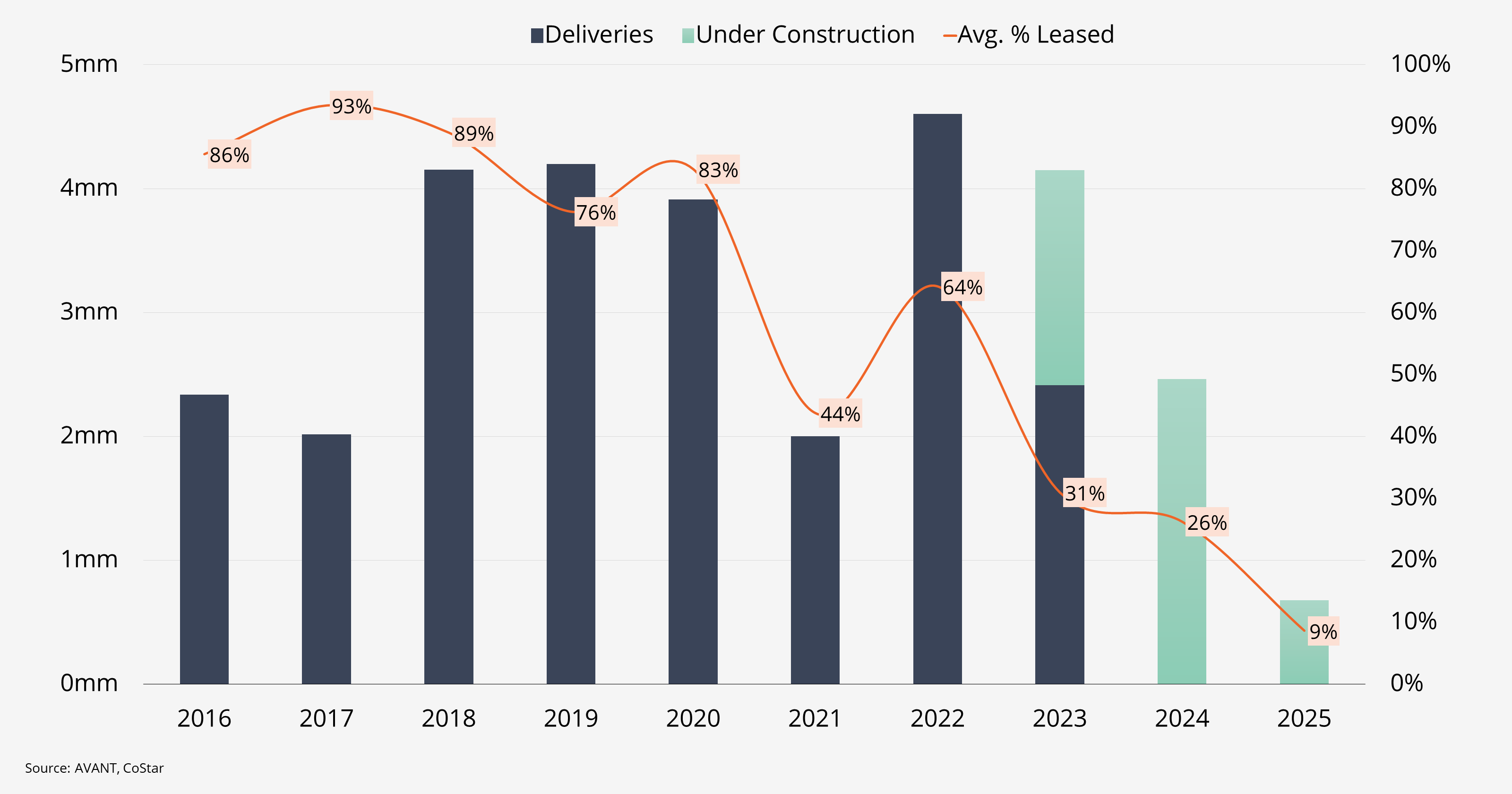

Since the pandemic structurally shifted office demand fundamentals, investors have been generally perplexed at how to underwrite office transactions, and rightfully so given the uncertain nature, and the unwillingness of tenants to commit to a permanent office utilization strategy Tenants that are transacting, have generally preferred higher quality space that offers more copious amenities, something that is generally synonymous with new construction That said, new construction has generally outperformed the rest of the market, until recently. It can be observed that across the region, the newest of construction has struggled to lease at the velocity of its predecessors, beginning in 2021. However, financing struggles have for all intents and purposes sidelined new construction, resulting in a severely limited construction pipeline, which in theory should result in supply constraints at the top of the market, a phenomenon that is already beginning to be observed in places like Downtown DC, where trophy options for 50k+ sf tenants are virtually non-existent.