Predicting San Francisco’s Financial District asking rent recovery based on historical downturns

Predicting San Francisco’s Financial District asking rent recovery based on historical downturns.

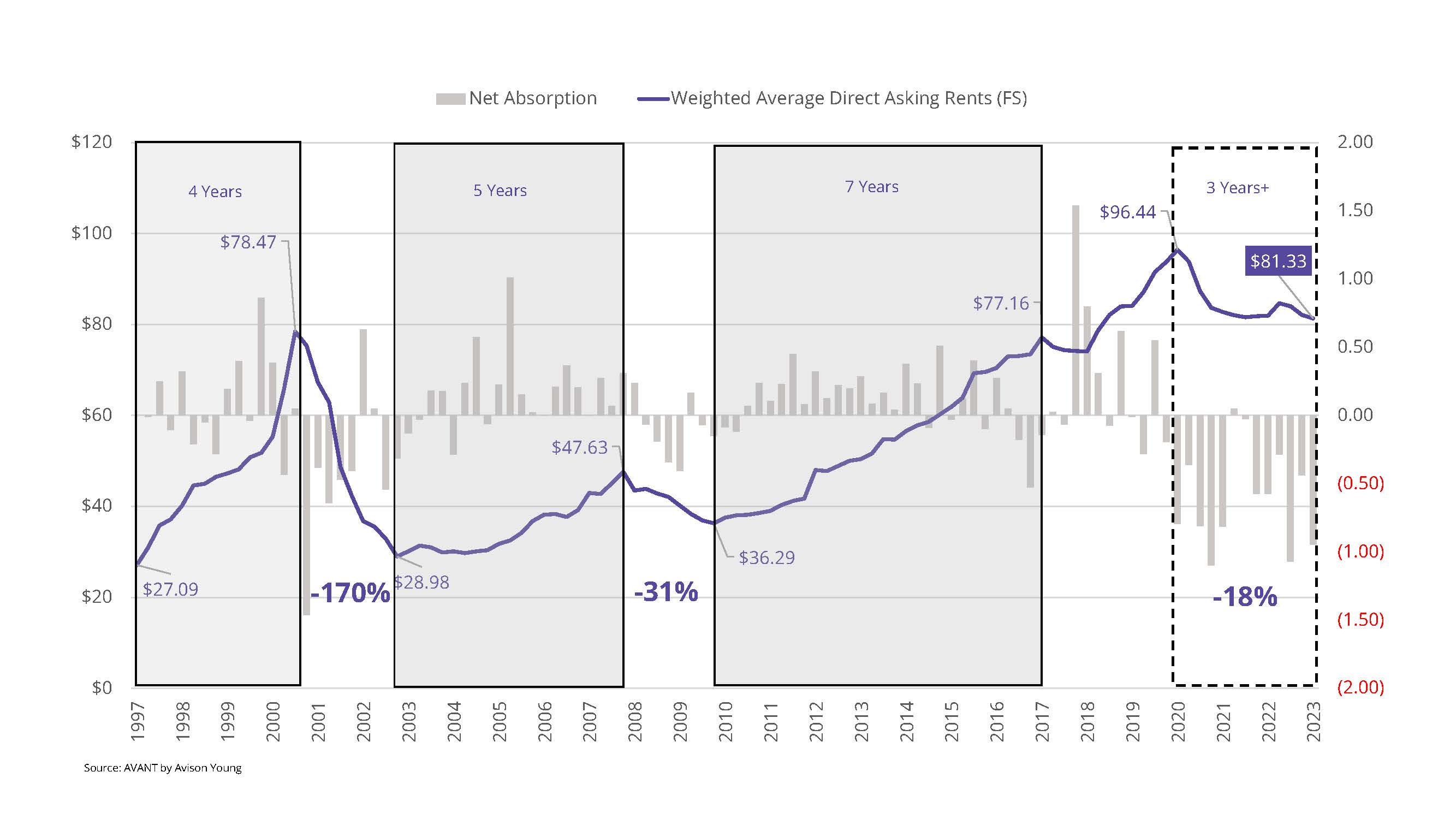

- As San Francisco witnesses new vacancy heights, landlords look for predictions on market rents. Historical class A asking rents in the Financial District shows that the last three downturns have varied in recovery time and drop in rents due to market size, economic effects, and tenant make-up.

- During the dot-com bust where the Silicon Valley tech was the epicenter, San Francisco Financial District asking rents dropped by a whopping 63% from peak to trough. While this dramatic decrease was alarming, it was also representative of a smaller office market building inventory in 2001.

- The Financial District class A asking rents remained tepid through the next several years, recovering just 38% from the dot-com crash through 2007, preceding the Great Recession. Asking rents finally recovered to 2001 peaks more than 16 years later during the beginning of the tech expansion in 2017.

- Between 2015 and 2020 more than 4.3 million square feet of new inventory was added to the Financial District’s market, a large portion being the delivery of Salesforce Tower. While the recent flooding of vacancy has dampened the San Francisco market, asking rent decreases are happening at a slower pace than in previous downturns.

Get market intel

US-CA-SFO San Francisco